If you’re looking for a solid company to invest on stocks, there are more than 280 reasons that would suggest that Twitter is a great choice.

Do you know how to buy Twitter stocks? We will explain to you how.

Overview Status: Active Sector: Communication Services Industry: Internet Content & Information Symbol: TWTR Exchange: NMS Employees: 5200 Website: twitter.com

Table of Contents

Why Buy Twitter Stock?

Financial indicators suggest Twitter isn’t only a place online to read tweets of famous personalities such as US President Donald Trump. Twitter also occupies a safe space in the stock market for you to invest and earn from. There are at least three big reasons why you should buy Twitter stocks. First, the platform keeps on growing in popularity. Second, Twitter as a company, provides more room for revenue increase and thirdly, Twitter is known for making intelligent use of its resources by investing wisely. But remember: It is important to know that before you decide on purchasing Twitter stocks, we give you a peace of mind by helping you understand the company more and be informed about the many factors that can affect its current and future market value. As an upcoming investor, we hope to guide you all throughout your stock trading journey by offering all relevant and useful information. To begin with… From a simple “SMS platform for the web”, Twitter has cemented its legacy in the world of social media by becoming a leading tool for spreading information. So enormous the role it played in shaping social, economic and governmental decisions and psychology, Twitter is credited in helping ignite the Arab Spring Revolution when users tweeted about the uprisings more than two million times a day.The potential for Twitter is spectacular and great.

-Al-Waleed bin Talal Great

Here’s the point: As Twitter became one of the leading avenues for ordinary citizens to voice out opinions, mobilize movements and promote social empowering causes, people from the government also started using Twitter to engage citizens in hopes of influencing change. The more Twitter expand its role in influencing the world, the more it grows its revenue stream by attracting more advertising from B2B companies. This massive room for progress can only equate to huge growth of its stock market value. Important: Twitter agreed on a $2 billion stock repurchase program that will guarantee to bring money back into shareholders’ pockets and lessen reduction, which in turn could minimalize descending pressure on the stock value. Currently, Twitter controls less than 1% of the $130 billion US digital advertising market, giving it more room to grow revenue in the coming years. This may appear a small figure but considering the strong performance of Twitter the last several years, many expect the company to eat up a significant number from the giant shares of the two leading companies in digital advertising: Google (%37) and Facebook (22%). But you might probably ask this question: Why is Twitter’s stock falling? Just like any equity, Twitter can also experience downtrends and among the primary causes of these are quarterly earnings reports, the stock market’s financial performance and the number of its monthly active users. Common scenarios include disappointing revenue announcements from the company or when the wider stock market is on a downturn or when there’s a significant decrease in the usage of their social media platform.eToro

Features:

- Copy investment portfolios of top Twitter traders

- Buy stocks commission-free

- Practice with a free demo account

- No overnight fees

- Risk management tools

- Sign up by providing your information.

- Safely secure your account by verifying your identity.

- Make your first deposit.

- Start trading.

- Residents of the United States can trade cryptocurrencies in registered states.

- It charges NO commissions. eToro takes the spread

- Very user-friendly with appealing interface

- Traders can follow, copy and learn from the trades of successful traders.

- Top Trader Portfolios – is built upon a trader-only portfolio, where traders being copied as part of a portfolio, are chosen based on the CopyPortfolio’s strategy. For instance, a CopyPortfolio that targets only high yielding and long-term stock investors, will select those investors based on performance, with substantial stock allocation included in their portfolio.

- Market Portfolios – this is composed of financial assets only and doesn’t include any traders. The portfolio here consists of ETFs, stocks, currencies, indices and commodities.

- CySEC – Cyprus Securities and Exchange Commission

- FCA – Financial Conduct Authority

- ASIC – Australian Securities and Investments Commission

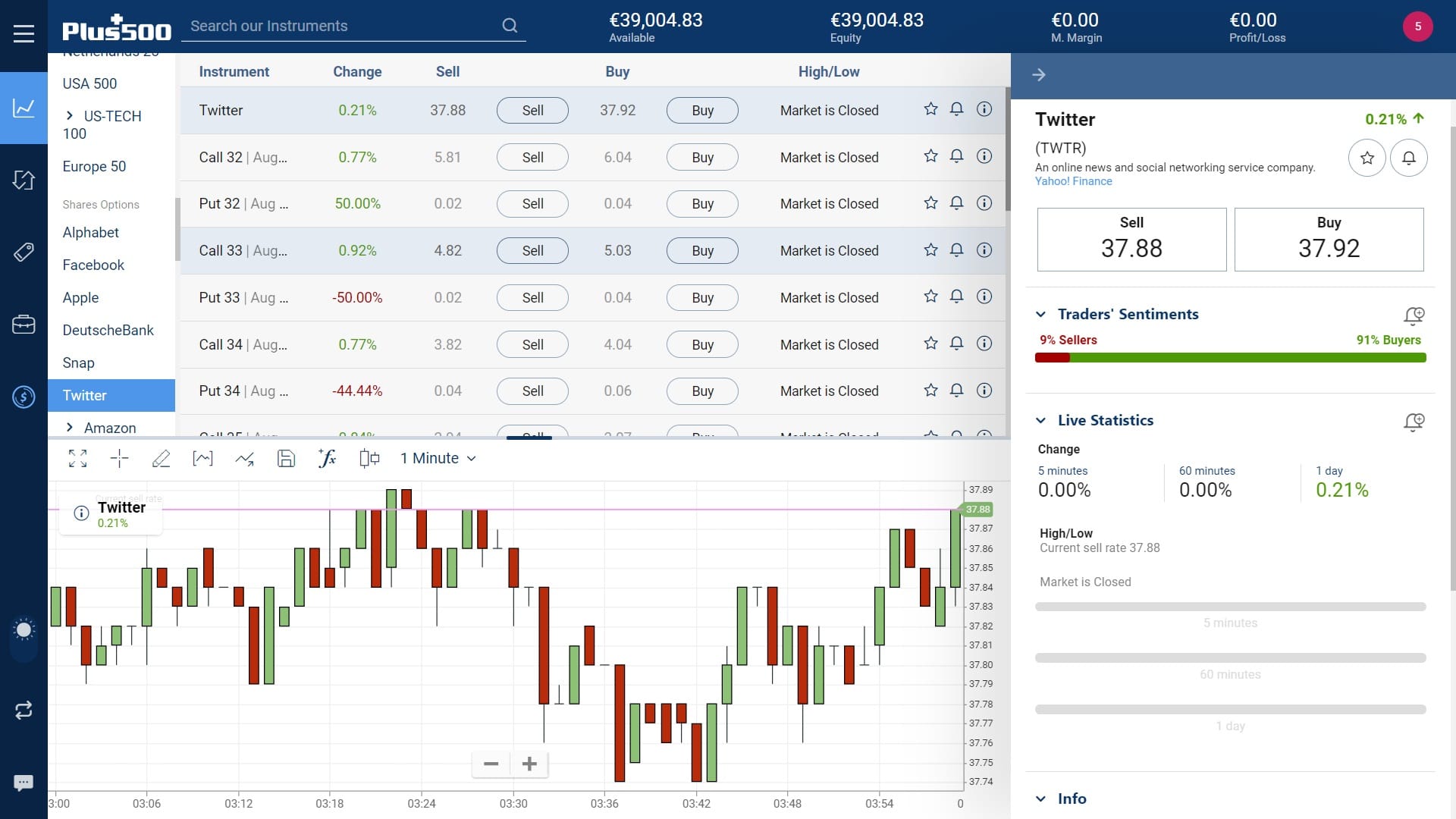

Plus500

Features:

- Competitive spreads for Twitter

- Trading with as little as $100

- Fast and reliable order execution

- Risk management tools

- Fully regulated by the FCA, CySEC and ASIC

A handy financial tool

Plus500 is Europe’s number 1 CFD trading platform and is also quickly becoming a popular investment tool globally. It features an intuitive user-friendly interface perfect for transacting CFD stock trading anytime and anywhere you may be in the world. Imagine trading CFD stocks just by using your phone and paying zero commissions.Achieve maximum leverage with Plus500

Plus500 gives traders a chance to qualify for a “professional” account. This will give traders a high chance of gaining maximum leverage for the same cost. For example, an investor with a professional account status can increase their maximum leverage ten times from 1:30 to 1:3000. Get real-time updates of:- Live quotes for Twitter and other company shares

- Stock exchange charts and even a live stream of Plus500 quotes

- Popular stock market quotes

- Plus500CY Ltd authorized & regulated by CySEC (#250/14).

- Plus500UK Ltd authorised & regulated by the FCA (#509909).

- Plus500SG Pte Ltd, licensed by the MAS (#CMS100648-1) and IE Singapore (#PLUS/CBL/2018).

- Plus500AU Pty Ltd (ACN 153301681), licensed by: ASIC in Australia, AFSL #417727, FMA in New Zealand, FSP #486026; Authorised Financial Services Provider in South Africa, FSP #47546. You do not own or have any rights to the underlying assets. Please refer to the Disclosure documents available on the website.

Twitter Stock Performance

To begin with, if you’re going to ask: When is Twitter going on the stock market? The answer is that it’s already listed on the New York Stock Exchange (NYSE) under the ticker symbol TWTR. How is Twitter stock doing? Just like any company, social media giant Twitter had its share of ups and downs. After its much-hyped IPO back in 2013, it faced a lot of struggles to increase its market value but over the past few years, it managed to keep within a good price range amid several challenges to its business. And here’s some good news: Twitter has agreed on a partnership with Elliott Management and Silver Lake. Some of the key highlights from this deal includes:- Silver Lake will invest $1 billion on Twitter.

- The board approving a $2 billion “share repurchase program”.

- Twitter promised to reach its goal of achieving a +20% yoy growth in mDAUs with major improvement in the years after 2020 to bag a higher percentage of the digital advertising market.

Twitter Stock Forecast

Below are additional information detailing our expert forecast about the future of Twitter in the coming couple of years. This are all based on current market data, analysis and expectations.

Please remember:

Our forecasts are based on current events in the company and stock market movements.

We cannot give assurance about the future performance of a company’s stock price as actual market outcomes and results may produce a different result from what was forecasted due to numerous factors and circumstances.

2020: Audience Growth Amidst the Pandemic

With the stay-at-home order is being implemented in many countries, Twitter is generating additional users and audience in the new normal. The platform is expected to breach the 200 million daily users by the end of 2020 and the company also expects a significant increase from its 330 million monthly users. In addition… Other than expanding their audience, Twitter is also planning to roll out features that will give users more control on their contents. The platform is also clamping down on fake news contents. These developments excite analysts as this is sure to attract more users who are growing tired of the information overload—both factual and fake contents—from other social media platforms. Need proof? Take a look at this updated graph and notice how Twitter’s stock has performed for a span of 1 year:2021: A Year of Strategic Acquisitions

After acquiring Vimeo and Periscope in the past, Twitter has showed it is serious to make a push in the video streaming platform. In fact… Many financial watchers expect Twitter to ramp up its acquisition in the next year by making smart moves to expand the audience and revenue of the company. This is only one of the many promising developments that makes investors bullish about the future of Twitter stocks. For these reasons, the outlook for Twitter’s stock growth ranges from medium to high.How to Buy Twitter Stock?

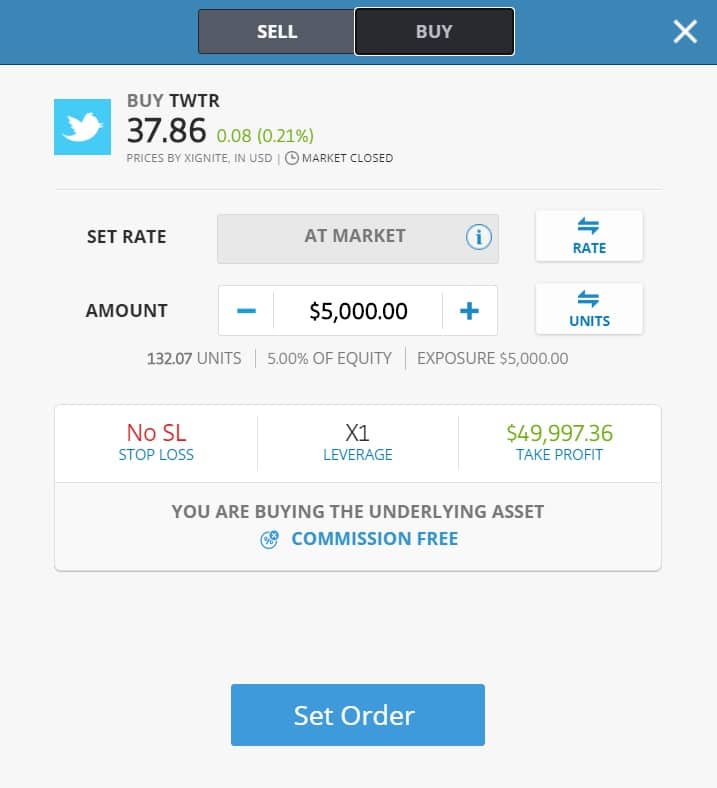

So how do you buy Twitter stocks? It’s a very common question especially for those who are interested to invest on this tech giant’s shares. Simply follow the steps below and you’re good to go:Open an account with an online broker.

For you to buy Twitter stock and other company shares, first you need to open an account with a brokerage which offers a platform for trading. Signing-up for an account only takes a few minutes to accomplish and after completing this process, you need to make a deposit so you can start investing.Open your broker’s trading platform.

Let’s say you have opened an account with a specific brokerage and you have already funded it. The next step to do is to open their platform to start trading.Look for the Twitter stock (symbol: TWTR).

After opening the platform, search for the Twitter stock by using the search bar and entering either “Twitter” or its stock symbol “TWTR”.Select Buy and set the amount.

Click on “Buy” and specify the amount that you wish to invest. You may also set several specific parameters depending the features that are offered to you by your broker.Execute the order.

Initiate the trade by executing the order.

Should I buy Twitter stock?Your answer should come in a short tweet of “Yes” Doubters will argue that Twitter’s current stock price ( ) may lag compared to the current price of other web companies like Google ( ) and Facebook ( ). However, this is where they miss the point completely. By having a lower stock price, the chances of earning higher returns from Twitter stocks is significantly larger. As we’ve mentioned on this article, analysts consider Twitter stocks as a “multi-bagger” in the making. |

Frequently Asked Questions (FAQ)

How Much is the Twitter Stock?

Here is the current stock market price of ( )Who Owns the Most Shares of Twitter?

Investment management company Vanguard Group Inc. owns the largest number of Twitter shares with more than 83 million shares estimated to value more than $2.0 billion.How Many Outstanding Shares Does Twitter Have?

Based on the first quarter of 2020, Twitter’s outstanding shares is 784.63 million.Where Can I Buy Twitter Stock?

Below are the most trusted and regulated brokers that we recommend for you to trade Twitter stock CFDs. Simply click on the Twitter Page button of your chosen broker and we’ll take you straight to their stock trading page.Got a Question?

Post it here and get an answer from one of our experts! [anspress]Best Brokers for Buying Twitter Stocks

Below are the most trusted and regulated brokers that we recommend for you to trade Twitter stock CFDs. Simply click on the Twitter Page button of your chosen broker and we’ll take you straight to their stock trading page.| Broker | Features | Rating | Official Site |

|---|---|---|---|

|

Min Deposit: $200 Regulation: CYSEC, FCA |

96 |

|

|

Min Deposit: $100 Regulation: FCA, ASIC, CySEC |

95 |

|

|

Min Deposit: $100 Regulation: CBI, ASIC, FSC, FSA, FSB |

94 |

|

|

Min Deposit: $5 Regulation: FCA, ASIC, CySEC |

90 |

|