The most popular coffeehouse chain in the world, Starbucks remains a solid company that keeps on brewing successful ventures and enriching consumers’ coffee drinking experience.

Interested in trading Starbucks stocks? We will tell you how.

Overview

Status: Active

Sector: Consumer Cyclical

Industry: Restaurants

Symbol: SBUX

Exchange: NMS

Employees: 346,000

Website: starbucks.com

In this article, you will learn the stock forecast of Starbucks and follow a guide on how to trade Starbucks stocks with the help of today’s highly trusted multi-asset brokerage companies.

Founded in 1971, Starbucks has grown to a major player in the coffeehouse chain industry by having more than 30,000 branches in more than 70 countries across the globe.

From its IPO in 1992, Starbucks only has less than 150 outlets and a revenue of $73.5 million. By 2019, it is already ranked number 132 on the Fortune 500 list of the most profitable corporations in the United States.

This sustained success mirrored the strong performance of its value on the stock market.

A Company synonymous to “Coffee”

Its very rare for a company to become synonymous to a product that most of the world’s population consume at least once a day.

In this case, its “coffee”.

For Starbucks to become tantamount to this all-time favorite drink, is a testament to the company’s stunning success.

A kind of sustained winning formula that is expected to continue for many more years.

Following this forecast, it is easy to predict that the stocks of Starbucks will also follow an uphill trend.

Paying dividends

Starbucks has been generous to its shareholders since it started paying dividend in 2010. Since then, they have increased these pay-outs in the succeeding years.

The earliest investors of Starbucks have been rewarded greatly.

For investors who bought $10,000 worth of shares of Starbucks at $17 when it went public, their investment came to cost more than $2.6 million in May 2020.

Before you start, bear this in mind:

Beginning a trading career ISN'T that simple.

You first need to come up with a plan. You just don’t go trading stocks without putting much thought into it.

With our help, we will lead you to craft a strategy and set a financial goal based on your current financial situation.

Second, we will recommend to you the best multi-asset brokerage companies to help you manage your stock portfolio better.

In this article:

We will let you know all the strong points of Starbucks as a company and how it will reflect to its stock value in a positive way.

We will also guide you on how to trade Starbucks stocks.

And there’s more...

To make your life easier when it comes to managing your stock portfolio, we will introduce you to eToro and Plus500.

These are two of the leading firms in online trading today and are highly-recommended multi-asset brokerage companies used by a fast-increasing number of traders because of their highly innovative trading platforms.

And to further guide you make sound financial decisions, we will also share our unbiased forecast on the future of Starbucks stock.

If you’re ready, then let’s start brewing high-yielding stocks.

Table of Contents

Why Trade Starbucks Stock?

Before you decide on trading stocks, make sure to learn about the company you’re investing on.

The best place to start is to learn its historical stock performance as well as getting an image of what the company’s future would be like.

Remember:

Other than understanding the performance of Starbucks stocks, you need to familiarize yourself on how they generate revenue and the scope of their business model.

To start with:

The 2020 global pandemic while momentarily threatened Starbucks’ presence worldwide, but it has also given the company a chance to understand a new economic model by paying attention to the untapped potential of mobile delivery.

Starbucks is closely studying where consumers will gravitate on how they want their morning cup of coffee to be delivered to them.

These qualities of learning to adapt to the ever-changing preference of consumers will result into higher revenues and will make Starbucks a more attractive stock to traders.

Not surprising...

Starbucks is expected to come out of the Covid-19 pandemic a stronger company geared to more innovation that will make the Starbucks experience more pleasant for consumers.

Not to mention...

Alibaba—China's e-commerce giant—has joined forces with Starbucks to develop a payment feature called "Starbucks Now" across different Alibaba Digital Economy platforms.

This will allow consumers to pre-order Starbucks drink and pick it up in person at the many Starbucks location in China.

Because of this, Starbucks products will become more accessible to China's almost 1 billion citizens.

eToro

Features:

- Copy investment portfolios of top Starbucks traders

- Trade stocks commission-free

- Practice with a free demo account

- No overnight fees

- Risk management tools

As one of the most trusted multi-asset brokerage platform in the world today, eToro is quickly becoming the number one choice of traders as evidenced by its more than 10 million users.

Click here to checkout our detailed review of this broker.

How to start using eToro?

eToro is a very straightforward trading application known for its user-friendly features that allows you more freedom to managing your portfolio as well as giving you an opportunity to learn more about stock trading.

After you go through a simple registration process, you will have the chance to play with a virtual money of $100,000 for you to use to harness your skill in trading strategies before you invest using your real money.

Not only that...

eToro also features a unique set of social elements such as CopyPortfolio, CopyTrader and Popular Investment Program.

- CopyPortfolio – By using the CopyPortfolio feature, you can invest in two types: Top Trader Portfolios is composed of the best performing and most successful traders on eToro. The Market Portfolios is where the CFD stocks, ETFs and other commodities are bundled together. CopyPortfolio seek to guide investors to lessen long-term risks by promoting more opportunities to succeed.

- CopyTrader – If you're new to stocks trading just starting to learn the basics and do not have the opportunity to monitor actual stock market action, you can still learn from the expertise of other traders through the CopyTrader feature. By copying top-performing traders, you can easily replicate their strategies and apply it on your own portfolio.

- Popular Investment Program - With eToro's Popular Investment Program, you can have another source of income if other traders will copy your trades. If you think you have what it takes to be a popular investor, then you must join this program to get paid when your trades are copied by other people.

eToro charges Zero commission

eToro doesn’t charge you with hidden fees and commission charges.

As a regulated multi-asset brokerage platform, eToro follows all the strict guidelines of different regulatory bodies including the following:

- CySEC – Cyprus Securities and Exchange Commission

- FCA – Financial Conduct Authority

- ASIC – Australian Securities and Investments Commission

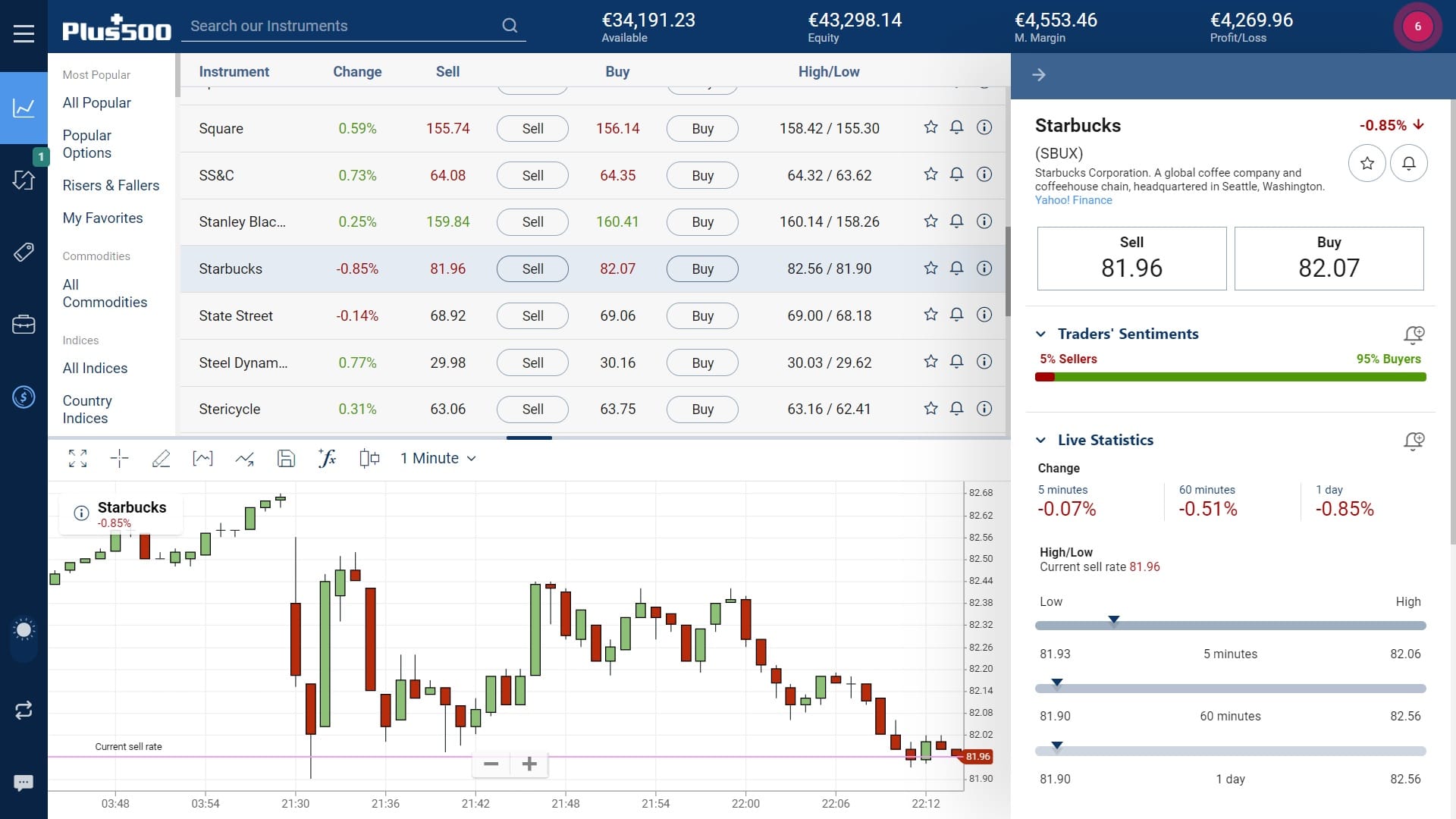

Plus500

Features:

- Competitive spreads for Starbucks

- Trading with as little as $100

- Fast and reliable order execution

- Risk management tools

- Fully regulated by the FCA, CySEC and ASIC

Trading stocks has become so much easier and more available even to beginners thanks to the innovative CFD Trading method.

While it may take a while to get accustomed to CFD Trading, thanks to the emergence of online brokerage companies, the process become accessible and doable.

Therefore...

It is vital that you select a reputable CFD platform when you decide to start investing in CFD trading. Plus500 is one such platform which you can use to invest wisely on the stock market.

What is CFD Trading?

In the world of finance, CFD refers to Contract for Differences.

This method of trading is vastly different than the traditional means of holding to an asset for long-term.

With CFD trading, you achieve more control of your investment through short and long trading, by speculating on stock movements—either rising or declining—hedging, and more leverage to make more profit based on the accuracy of your forecast.

This is a procedure in financial derivatives trading where the variances in the settlement between open and closing trade prices are settled in cash. There are no securities nor physical goods trading involved in CFDs.

The Plus500 platform easily allow you to trade Starbucks stocks in the most basic way while giving you total control on how to manage your portfolio without the complexities that are present when trading in an actual stock market floor.

Plus500 also allows you to trade or invest online in other high-earning stocks by opening the Trade or Sell features of their proprietary application.

Trading stocks online via the Plus500 platform

The Plus500 platform gives you total control of your investment while minimizing risk with the help of its integrated risk management tools.

Fully-digital and user-friendly, Plus500 caps off its bountiful benefits by charging low trading fees and requiring a low minimum deposit.

Plus500 is fully-regulated

Plus500 is also duly licensed by the following financial regulators:

- Plus500CY Ltd authorized & regulated by CySEC (#250/14).

- Plus500UK Ltd authorised & regulated by the FCA (#509909).

- Plus500SG Pte Ltd, licensed by the MAS (#CMS100648-1) and IE Singapore (#PLUS/CBL/2018).

- Plus500AU Pty Ltd (ACN 153301681), licensed by:

ASIC in Australia, AFSL #417727, FMA in New Zealand, FSP #486026; Authorised Financial Services Provider in South Africa, FSP #47546. You do not own or have any rights to the underlying assets. Please refer to the Disclosure documents available on the website.

Starbucks Stock Performance

Fact:

The stock value of Starbucks reached its all-time high on July 26, 2019 at $99.11.

The way to higher stock value

How is Starbucks stock doing?

Despite the threat of the 2020 Global Pandemic to the operations of Starbucks, the company remains as an attractive pick for investors.

If its strong historical stock performance will serve as an indicator, expect Starbucks’ value to pick up steam before 2020 ends and in the succeeding years.

Fact:

During the 1st quarter of 2020, the number of bullish hedge fund positions on Starbucks grew by 3% compared to the previous quarter.

It gets better...

Financial watchers see a robust future for Starbucks with a rating of “trade” as also backed up by many trusted brokers.

Starbucks Stock Forecast

Below is a summary of Starbucks’ future plans and followed by our forecast of the company’s stock movement in the coming years.

Take note:

Our stock prediction should only be taken as a guide to help you make a sound decision on whether to invest on the company now.

All our forecasts are based on current situation of the company, the worldwide economy and current market trends.

Certain factors brought on by unforeseen events may cause dissimilar results from what we forecasted.

2020: Bouncing Back from the Global Pandemic

2020 should be the start of Starbucks' new five-year plan.

But while the 2020 Covid-19 pandemic momentarily put the world into a grinding halt, the company set back some of its grand plans—momentarily.

Not so surprisingly…

Nevertheless, the company is managing to bounce back by slowly going back to its original plans of expanding to more countries by aiming to add 30,000 additional locations worldwide.

Brewing a bright future

Despite the hiccups brought on by the lockdowns around the world due to the pandemic, our forecast for Starbucks is starting to re-open into a promising year-end stock performance.

We expect Starbucks stock growth this year to be medium to high-yield.

2021: An Eco-friendlier Service with More Expansion

Starbucks will aim to become an eco-friendlier company by 2021.

They intend to achieve this by reducing the use of plastic cups and straws to zero throughout all their stores.

Other than this, Starbucks is also committed to adding plant-based food items on their menu.

This is expected to further lure more customers—especially the young ones who are supportive of corporations offering Earth-friendly solutions.

Starbucks is also looking to put up thousands of new stores around the world and create 100,000 additional jobs by 2021.

2022 and Beyond: Conquering Mobile App Transaction Market

Learning from the lessons of the 2020 global pandemic, Starbucks look to enhance its mobile transaction app in order to corner additional consumers who prefer ordering their coffee drink from anywhere.

By using the Starbucks mobile app, customers can easily order, customize their drink and have it deliver to their homes or while standing in line or basically everywhere they may be.

By attracting more consumers to purchase Starbucks products through their mobile phones will equate to mind-blowing additional revenue for the company AND higher stock value of its shareholders.

Based on our forecast and close analysis of Starbucks direction as a company, we peg Starbucks stock growth to range from medium to high.

How to Trade Starbucks Stock?

Simply follow the steps below and you're good to go:

-

Open an account with an online broker.

For you to trade Starbucks stock and other company shares, first you need to open an account with a brokerage which offers a platform for trading.

Signing-up for an account only takes a few minutes to accomplish and after completing this process, you need to make a deposit so you can start investing. -

Open your broker's trading platform.

Let's say you have opened an account with a specific brokerage and you have already funded it. The next step to do is to open their platform to start trading.

-

Look for the Starbucks stock (symbol: SBUX).

After opening the platform, search for the Starbucks stock by using the search bar and entering either "Starbucks" or its stock symbol "SBUX".

-

Select Trade and set the amount.

Click on "Trade" and specify the amount that you wish to invest. You may also set several specific parameters depending the features that are offered to you by your broker.

-

Execute the order.

Initiate the trade by executing the order.

Should I trade Starbucks stock?Yes. Despite taking a fall due to the 2020 Covid-19 pandemic, the stocks of Starbucks is near the “trade zone” according to financial watchers. This is due to the long history of success of the company in achieving growth. The decline in stock price can become a blessing in disguise for new tradeers as the temporary dip in Starbucks stocks is expected to only signal a major bounce back especially when the world slowly work back to normalcy.

So, are you ready to start brewing Starbucks stocks? The stock market may have entered a rough patch during the pandemic, but if there are companies that are sure to get back up on its feet and continue a sustained growth, Starbucks should be on that list of companies. A steady growth in Starbucks’ operations and stock value is anticipated in its immediate future. |

Frequently Asked Questions (FAQ)

How Much is the Starbucks Stock?

Here is the current stock market price of ( )

Who Owns the Most Shares of Starbucks?

The Vanguard Group Inc.—an investment company—currently owns the most Starbucks stock with 91,002,442 shares and an estimated value of $ 6,696,869,706.

How Many Outstanding Shares Does Starbucks Have?

Based on the last market closing, Starbucks’ outstanding shares is 1.17 billion.

Where Can I Trade Starbucks Stock?

The highly-recommended multi-asset brokerage platforms of eToro and Plus500 are great way to start trading Starbucks stocks. These are the two leading CFD (contracts for difference) trading platforms in the world today. You can trade online and learn a lot about the market everyday by using eToro or Plus500.

Best Brokers for Trading Starbucks Stocks

Based on our extensive analysis and close stock market monitoring, we recommend eToro and Plus500 as the two best brokers when trading Starbucks stocks. Alternatively, you may explore the following licensed and regulated brokerages below that offer Starbucks stock CFDs.

All you need to do is click on the Starbucks Page of your broker of choice and you'll be directed straight to their stock trading page.

| Broker | Features | Rating | Official Site |

|---|---|---|---|

|

Min Deposit: $200 Regulation: CYSEC, FCA

|

96 |

61% of retail CFD accounts lose money.

|

|

Min Deposit: $100 Regulation: FCA, ASIC, CySEC

|

95 |

84% of retail CFD accounts lose money.

|

|

Min Deposit: $5 Regulation: IFSC, ASIC, CySEC

|

90 |

|