If you’re looking for a solid company to invest on stocks, there are more than 280 reasons that would suggest that Twitter is a great choice.

Do you know how to trade Twitter stocks? We will explain to you how.

Overview

Status: Active

Sector: Communication Services

Industry: Internet Content & Information

Symbol: TWTR

Exchange: NMS

Employees: 5200

Website: twitter.com

As the leading microblogging social media platform that also helped shape global events, Twitter, as a company, has evolved into a consistently strong player in the stock market since filing its IPO in 2013.

So what’s it all about?

In this article, we will breakdown all the strong points of Twitter as a stock investment option especially for those starting out as a stock trader.

We also listed down a simple step-by-step procedure on how to trade Twitter stocks.

Looking back...

Since its launching in 2006, Twitter has grown rapidly in the last decade achieving more than 330 million active users a month and 150 million daily active users as of 2020.

From a simple micro-blogging platform, it also evolved into a leading e-commerce platform by attracting 75% of B2B Businesses to market their products on Twitter.

Fact:

Majority of Twitter's revenue comes from selling ads to businesses.

Since the platform has become the go-to source for everything current events such as breaking news, live shows and viral content, it attracts a high traffic and engagement that boost the advertising sales of Twitter.

And here’s the thing...

Financial and social media observers note the absence of an emerging company or platform that can pose a challenge to Twitter’s microblogging platform in the years ahead.

This fact guarantees the company’s success in the future.

And there’s more:

Twitter is one of the few companies expected to withstand even the most volatile crisis in the world.

As they say, the crazier the world goes, the more people will use Twitter to source for information and voice out sentiments.

This reinforces the longevity of Twitter as a tool not only for business use but also for various advocacies and cry for social justice.

Please bear in mind:

Before you begin your career as a stock investor, it is important to follow a concrete plan such as setting a financial goal in relation to your current financial situation.

We also advise you to spend more time learning the history of the company and to keep yourself updated on everything that is going on with the company.

This include change of management, future plans and acquisitions and so on.

Do not invest merely because of current financial trends or ride bandwagons as this can rapidly change overnight.

Otherwise, with our expert guidance, you’re all set to becoming a stocks investor and trader.

Is Twitter a trade now? Is it a good long-term investment?

In this article, we will help you familiarize with the strong industry performance of Twitter and understand where its heading in the next few years.

We will also point out certain risks if anything comes up from our analysis of the company.

And there's more...

We will also make your life easier when it comes to trading Twitter stocks by endorsing the most-trusted brokerage firms in the CFD trading market today.

These brokerages use the best technology platforms best suited to beginner traders like you. Aside from that, these service providers will supply all required information to help you come up with the best financial decisions.

As cherry on top...

We will also supply you our unbiased outlook and financial forecast about Twitter especially everything that relates to its performance in the stock market.

If this excites you already, then let’s start tweeting—and trading!

Table of Contents

Why Trade Twitter Stock?

Financial indicators suggest Twitter isn’t only a place online to read tweets of famous personalities such as US President Donald Trump.

Twitter also occupies a safe space in the stock market for you to invest and earn from.

There are at least three big reasons why you should trade Twitter stocks.

First, the platform keeps on growing in popularity.

Second, Twitter as a company, provides more room for revenue increase and thirdly, Twitter is known for making intelligent use of its resources by investing wisely.

But remember:

It is important to know that before you decide on purchasing Twitter stocks, we give you a peace of mind by helping you understand the company more and be informed about the many factors that can affect its current and future market value.

As an upcoming investor, we hope to guide you all throughout your stock trading journey by offering all relevant and useful information.

To begin with...

From a simple "SMS platform for the web", Twitter has cemented its legacy in the world of social media by becoming a leading tool for spreading information.

So enormous the role it played in shaping social, economic and governmental decisions and psychology, Twitter is credited in helping ignite the Arab Spring Revolution when users tweeted about the uprisings more than two million times a day.

The potential for Twitter is spectacular and great.

-Al-Waleed bin Talal Great

Here's the point:

As Twitter became one of the leading avenues for ordinary citizens to voice out opinions, mobilize movements and promote social empowering causes, people from the government also started using Twitter to engage citizens in hopes of influencing change.

The more Twitter expand its role in influencing the world, the more it grows its revenue stream by attracting more advertising from B2B companies.

This massive room for progress can only equate to huge growth of its stock market value.

Important:

Twitter agreed on a $2 billion stock repurchase program that will guarantee to bring money back into shareholders’ pockets and lessen reduction, which in turn could minimalize descending pressure on the stock value.

Currently, Twitter controls less than 1% of the $130 billion US digital advertising market, giving it more room to grow revenue in the coming years.

This may appear a small figure but considering the strong performance of Twitter the last several years, many expect the company to eat up a significant number from the giant shares of the two leading companies in digital advertising: Google (%37) and Facebook (22%).

But you might probably ask this question: Why is Twitter's stock falling?

Just like any equity, Twitter can also experience downtrends and among the primary causes of these are quarterly earnings reports, the stock market's financial performance and the number of its monthly active users.

Common scenarios include disappointing revenue announcements from the company or when the wider stock market is on a downturn or when there's a significant decrease in the usage of their social media platform.

eToro

Features:

- Copy investment portfolios of top Twitter traders

- Trade stocks commission-free

- Practice with a free demo account

- No overnight fees

- Risk management tools

For over a decade, eToro review)

Used by more than 10 million traders worldwide, eToro is an award winning online brokerage trading platform that started operation in 2006 (read detailed review). It features pioneering and innovative financial instruments that help balance and diversify your portfolios in the stock market.

How to start using eToro

eToro is a very user-friendly platform that provides a rich understanding and plenty of value to your trading experience. Starting on how to use it is very easy.

- Sign up by providing your information.

- Safely secure your account by verifying your identity.

- Make your first deposit.

- Start trading.

Key Highlights of eToro

- Residents of the United States can trade cryptocurrencies in registered states.

- It charges NO commissions. eToro takes the spread

- Very user-friendly with appealing interface

- Traders can follow, copy and learn from the trades of successful traders.

Yes, you read it right: Zero Commission

When we say eToro gets ZERO commission, we mean it. No broker fee will be charged to you when you open and close a position. This is a big difference from other online brokerage companies that charges numerous fees and commission charges.

eToro also have a feature called CopyPortfolios which aims of helping investors lessen long-term risk. It also promotes more opportunities for growth by bringing copy trading to farther to the next level and diversifying investments:

- Top Trader Portfolios - is built upon a trader-only portfolio, where traders being copied as part of a portfolio, are chosen based on the CopyPortfolio's strategy. For instance, a CopyPortfolio that targets only high yielding and long-term stock investors, will select those investors based on performance, with substantial stock allocation included in their portfolio.

- Market Portfolios - this is composed of financial assets only and doesn't include any traders. The portfolio here consists of ETFs, stocks, currencies, indices and commodities.

And the best thing:

eToro fully follows all the strict guidelines of different regulatory bodies such as:

- CySEC – Cyprus Securities and Exchange Commission

- FCA – Financial Conduct Authority

- ASIC – Australian Securities and Investments Commission

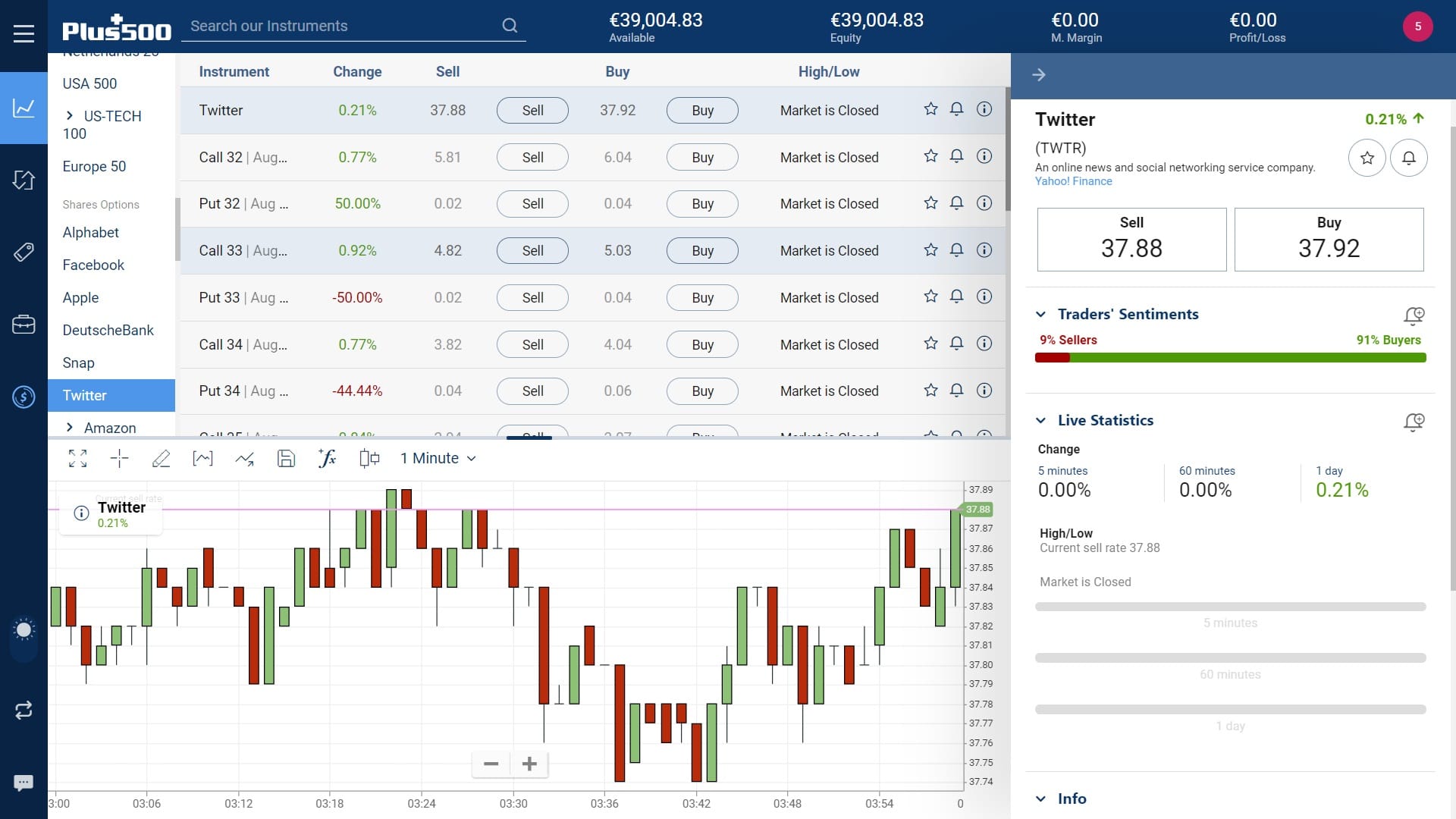

Plus500

Features:

- Competitive spreads for Twitter

- Trading with as little as $100

- Fast and reliable order execution

- Risk management tools

- Fully regulated by the FCA, CySEC and ASIC

CFD trading has made investing on stocks a lot easier and accessible to more people. Thanks to this innovative technology and to highly trusted companies such as Plus500, a highly regarded name in CFD trading — you can now easily start a career in stock trading.

A handy financial tool

Plus500 is Europe's number 1 CFD trading platform and is also quickly becoming a popular investment tool globally. It features an intuitive user-friendly interface perfect for transacting CFD stock trading anytime and anywhere you may be in the world. Imagine trading CFD stocks just by using your phone and paying zero commissions.

Achieve maximum leverage with Plus500

Plus500 gives traders a chance to qualify for a "professional" account. This will give traders a high chance of gaining maximum leverage for the same cost. For example, an investor with a professional account status can increase their maximum leverage ten times from 1:30 to 1:3000.

Get real-time updates of:

- Live quotes for Twitter and other company shares

- Stock exchange charts and even a live stream of Plus500 quotes

- Popular stock market quotes

The best part about Plus500...

Plus500 is fully licensed by the following financial regulators:

- Plus500CY Ltd authorized & regulated by CySEC (#250/14).

- Plus500UK Ltd authorised & regulated by the FCA (#509909).

- Plus500SG Pte Ltd, licensed by the MAS (#CMS100648-1) and IE Singapore (#PLUS/CBL/2018).

- Plus500AU Pty Ltd (ACN 153301681), licensed by:

ASIC in Australia, AFSL #417727, FMA in New Zealand, FSP #486026; Authorised Financial Services Provider in South Africa, FSP #47546. You do not own or have any rights to the underlying assets. Please refer to the Disclosure documents available on the website.

Twitter Stock Performance

To begin with, if you're going to ask: When is Twitter going on the stock market?

The answer is that it's already listed on the New York Stock Exchange (NYSE) under the ticker symbol TWTR.

How is Twitter stock doing?

Just like any company, social media giant Twitter had its share of ups and downs.

After its much-hyped IPO back in 2013, it faced a lot of struggles to increase its market value but over the past few years, it managed to keep within a good price range amid several challenges to its business.

And here's some good news:

Twitter has agreed on a partnership with Elliott Management and Silver Lake. Some of the key highlights from this deal includes:

- Silver Lake will invest $1 billion on Twitter.

- The board approving a $2 billion "share repurchase program".

- Twitter promised to reach its goal of achieving a +20% yoy growth in mDAUs with major improvement in the years after 2020 to bag a higher percentage of the digital advertising market.

Look whose heading into the right direction...

Twitter seem to be getting the right ingredients for growth at the right time.

After experiencing ups and downs in the stock market in the past, the company seem to be heading for a long-term shareholder value creation.

Many financial analysts believe that Twitter has the making of a "multibagger".

Did you know?

The term multibagger in stock trading means: stocks whose values have increased multiple times from their initial investment prices.

Twitter Stock Forecast

Below are additional information detailing our expert forecast about the future of Twitter in the coming couple of years. This are all based on current market data, analysis and expectations.

Please remember:

Our forecasts are based on current events in the company and stock market movements.

We cannot give assurance about the future performance of a company’s stock price as actual market outcomes and results may produce a different result from what was forecasted due to numerous factors and circumstances.

2020: Audience Growth Amidst the Pandemic

With the stay-at-home order is being implemented in many countries, Twitter is generating additional users and audience in the new normal.

The platform is expected to breach the 200 million daily users by the end of 2020 and the company also expects a significant increase from its 330 million monthly users.

In addition...

Other than expanding their audience, Twitter is also planning to roll out features that will give users more control on their contents.

The platform is also clamping down on fake news contents.

These developments excite analysts as this is sure to attract more users who are growing tired of the information overload—both factual and fake contents—from other social media platforms.

Need proof?

Take a look at this updated graph and notice how Twitter's stock has performed for a span of 1 year:

In the final analysis...

Our forecast for Twitter’s stock is on the trade now side (high) considering the many progress made by the company in creating a more appealing platform that will attract strong earning potential than ever before.

2021: A Year of Strategic Acquisitions

After acquiring Vimeo and Periscope in the past, Twitter has showed it is serious to make a push in the video streaming platform.

In fact...

Many financial watchers expect Twitter to ramp up its acquisition in the next year by making smart moves to expand the audience and revenue of the company.

This is only one of the many promising developments that makes investors bullish about the future of Twitter stocks.

For these reasons, the outlook for Twitter’s stock growth ranges from medium to high.

How to Trade Twitter Stock?

So how do you trade Twitter stocks? It's a very common question especially for those who are interested to invest on this tech giant's shares.

Simply follow the steps below and you're good to go:

-

Open an account with an online broker.

For you to trade Twitter stock and other company shares, first you need to open an account with a brokerage which offers a platform for trading.

Signing-up for an account only takes a few minutes to accomplish and after completing this process, you need to make a deposit so you can start investing. -

Open your broker's trading platform.

Let's say you have opened an account with a specific brokerage and you have already funded it. The next step to do is to open their platform to start trading.

-

Look for the Twitter stock (symbol: TWTR).

After opening the platform, search for the Twitter stock by using the search bar and entering either "Twitter" or its stock symbol "TWTR".

-

Select Trade and set the amount.

Click on "Trade" and specify the amount that you wish to invest. You may also set several specific parameters depending the features that are offered to you by your broker.

-

Execute the order.

Initiate the trade by executing the order.

Should I trade Twitter stock?Your answer should come in a short tweet of “Yes” Doubters will argue that Twitter’s current stock price ( ) may lag compared to the current price of other web companies like Google ( ) and Facebook ( ). However, this is where they miss the point completely. By having a lower stock price, the chances of earning higher returns from Twitter stocks is significantly larger. As we’ve mentioned on this article, analysts consider Twitter stocks as a “multi-bagger” in the making. |

Frequently Asked Questions (FAQ)

How Much is the Twitter Stock?

Here is the current stock market price of ( )

Who Owns the Most Shares of Twitter?

Investment management company Vanguard Group Inc. owns the largest number of Twitter shares with more than 83 million shares estimated to value more than $2.0 billion.

How Many Outstanding Shares Does Twitter Have?

Based on the first quarter of 2020, Twitter’s outstanding shares is 784.63 million.

Where Can I Trade Twitter Stock?

Below are the most trusted and regulated brokers that we recommend for you to trade Twitter stock CFDs. Simply click on the Twitter Page button of your chosen broker and we’ll take you straight to their stock trading page.

Best Brokers for Trading Twitter Stocks

Below are the most trusted and regulated brokers that we recommend for you to trade Twitter stock CFDs. Simply click on the Twitter Page button of your chosen broker and we'll take you straight to their stock trading page.

| Broker | Features | Rating | Official Site |

|---|---|---|---|

|

Min Deposit: $200 Regulation: CYSEC, FCA

|

96 |

61% of retail CFD accounts lose money.

|

|

Min Deposit: $100 Regulation: FCA, ASIC, CySEC

|

95 |

84% of retail CFD accounts lose money.

|

|

Min Deposit: $100 Regulation: CBI, ASIC, FSC, FSA, FSB

|

94 |

|

|

Min Deposit: $5 Regulation: IFSC, ASIC, CySEC

|

90 |

|