From blockbuster movies to theme parks to cruise ships to online streaming content, Walt Disney remains a strong player in the stock market.

Do you know how to trade Walt Disney stocks? We will explain to you how.

Overview

Status: Active

Sector: Communication Services

Industry: Entertainment

Symbol: DIS

Exchange: NYSE

Employees: 223,000

Website: thewaltdisneycompany.com

A household name since the first Mickey Mouse cartoons was shown on TV in the 1920s, The Walt Disney Company has come up with innovative products throughout the decade.

In this article, we look further into pros of investing in Disney shares and an easy-to-understand guide on how to trade Disney stocks.

Did you know?

Aside from being one of the biggest media companies in the world, it is the world's biggest family and children's entertainment brand.

And the brand is not just about theme parks and films anymore because Disney has diversified into a variety of businesses over the years.

Please take note:

It is ideal to have a financial goal or plan prior to trading in stocks or other financial instruments.

Aside from introducing to you the basics of investing in Disney shares, we'll also provide you a short review and list of the best and the safest onlnine brokerage firms where you can trade DIS stocks.

And to get things going...

This article also includes a quick forecast and outlook on how Disney could possibly perform in the stock market.

So, are you ready know more about the House of Mouse?

Then continue reading to get started!

Table of Contents

Why Trade Disney Stock?

While the stock price of Walt Disney momentarily took a slight dip during the closures of its theme parks around the world at the onset of the 2020 pandemic, analysts sees a strong recovery period for the company.

This phase of getting back to its high-earning ways can result into generous rewards for its investors.

Here's what you need to know:

One of the company’s key advantages is that it has the ability to adapt and innovate which remains to be its foundations for its continuing success.

As as it is widely known for making magic on the big screen, in terms of the company's fortitude, Disney hasn't missed a trick and is well-positioned to survive and thrive.

And one thing's for sure:

Disney is one of the most powerful entertainment companies in history and it has plenty of that staying power.

eToro

Features:

- Copy investment portfolios of top Disney traders

- Trade stocks commission-free

- Practice with a free demo account

- No overnight fees

- Risk management tools

The eToro trading platform has become a leader in the multi-asset online trading world as evidenced by its 12 million users.

Highly optimized and comes with robust features, it is the trading platform you’ll ever need to grow your portfolio. How to use eToro? We will tell you how.

How to open an account on eToro

- Create an account at the sign-up page.

- Verify your personal information for security purpose

- Make your first deposit.

- And as easy as 1,2,3, you can now start trading.

More features…

eToro’s CopyTrading tool allow users to search other investors to see and study their portfolio.

By doing this, users can copy their trading strategies and apply it on their own investments.

There's also the eToro CopyPortfolios which helps traders expand portfolios while lessening long-term risk on investments.

And another thing:

eToro’s Analyst Coverage Page features all the useful information you need to manage your way in the world of stock trading for popular companies like Disney and many more.

eToro is also regulated by different regulatory bodies including the following:

- CySEC – Cyprus Securities and Exchange Commission

- FCA – Financial Conduct Authority

- ASIC – Australian Securities and Investments Commission

Plus500

Features:

- Competitive spreads for Disney

- Trading with as little as $100

- Fast and reliable order execution

- Risk management tools

- Fully regulated by the FCA, CySEC and ASIC

Remember this:

Plus500 is a highly-trusted platform being used by CFD traders. The trademarked application of Plus500’s provides users many advantage, and features needed in properly managing and expand a portfolio.

And to make things more interesting...

The integrated risk management tools of Plus500 prevent loss by giving you a robust control your investments.

Via the Plus500 proprietary platform, you will be able to invest on Disney stocks and other financial instruments, execute orders and access all of your transactions online.

One more thing…

The companies operating Plus500 are regulated by high-level financial regulatory boards and follows strict financial protocols and guidelines:

- Plus500CY Ltd authorized & regulated by CySEC (#250/14).

- Plus500UK Ltd authorised & regulated by the FCA (#509909).

- Plus500SG Pte Ltd, licensed by the MAS (#CMS100648-1) and IE Singapore (#PLUS/CBL/2018).

- Plus500AU Pty Ltd (ACN 153301681), licensed by:

ASIC in Australia, AFSL #417727, FMA in New Zealand, FSP #486026; Authorised Financial Services Provider in South Africa, FSP #47546. You do not own or have any rights to the underlying assets. Please refer to the Disclosure documents available on the website.

Disney Stock Performance

A story of consistency:

Walt Disney's stock performance has seen steady growth since its IPO in 1957.

It has gone through major world conflicts that affected its business but each time, it managed to rebound powerfully and continued its stock growth.

From its IPO to present time, Walt Disney has achieved a 14% compound yearly growth rate.

Disney Stock Forecast

Below is Walt Disney’s forecast for the next year based their corporate plans and market trends and other analysis of their business model.

Take note:

Our prediction for Walt Disney’s stock performance should only serve as a guide to help you decide whether to trade Walt Disney stocks or not.

The final decision should remain yours only.

2020: Better Months Ahead After a Sharp Fall

Why did Disney stock go down?

A lot of businesses have been affected by the COVID-19 pandemic and Disney is no exception as it was forced to suspend majority of its operations including its retail stores, theme parks and resorts and cruise ships.

Its movie studio also decided to move the release of some of its biggest blockbusters that were expected to be bring additional revenue for the company such as Mulan, Star Wars and Avatar.

Notably, its quarterly loss for 2020 was a first since 2001 for the diversified conglomerate.

But here's the silver lining:

The economic effects of the COVID-19 pandemic won't last forever.

And as billions of people are ordered to stay at home to help curb the spread of the pandemic, the company's combined portfolio of streaming services such as ESPN+, Disney+ and Hulu have the potential to be a huge revenue generator as the company gives priority to its direct-to-consumer business.

It's also worth noting that...

Disney remains to be the class act among media stocks and with its strong balance sheet, it has a solid footing despite the effects of the pandemic.

Eventually, its parks are going to reopen and other sectors will resume operations so it's likely for Disney to make a dramatic recovery.

2021: Expanding Disney World + More Revenue Source

Apart from ambitious but doable plans to add more attractions and rides in various Disney World destinations all over the world, Disney is also looking to focus more on its Disney + streaming service.

From its launch in early 2020, Disney+ has gained more than 30 million subscribers.

Expect that figures to double or triple in the coming year or two.

The future is bright for Walt Disney despite suffering a dim period during the onset of the 2020 Covid-19 pandemic.

And so, we recommend…

We are forecasting Walt Disney’s stocks as a safe trade with a big chance of achieving long-term high yielding returns for the investors.

How to Trade Disney Stock?

Simply follow the steps below and you're good to go:

-

Open an account with an online broker.

For you to trade Disney stock and other company shares, first you need to open an account with a brokerage which offers a platform for trading.

Signing-up for an account only takes a few minutes to accomplish and after completing this process, you need to make a deposit so you can start investing. -

Open your broker's trading platform.

Let's say you have opened an account with a specific brokerage and you have already funded it. The next step to do is to open their platform to start trading.

-

Look for the Disney stock (symbol: DIS).

After opening the platform, search for the Disney stock by using the search bar and entering either "Walt Disney", "Disney" or its stock symbol "DIS".

-

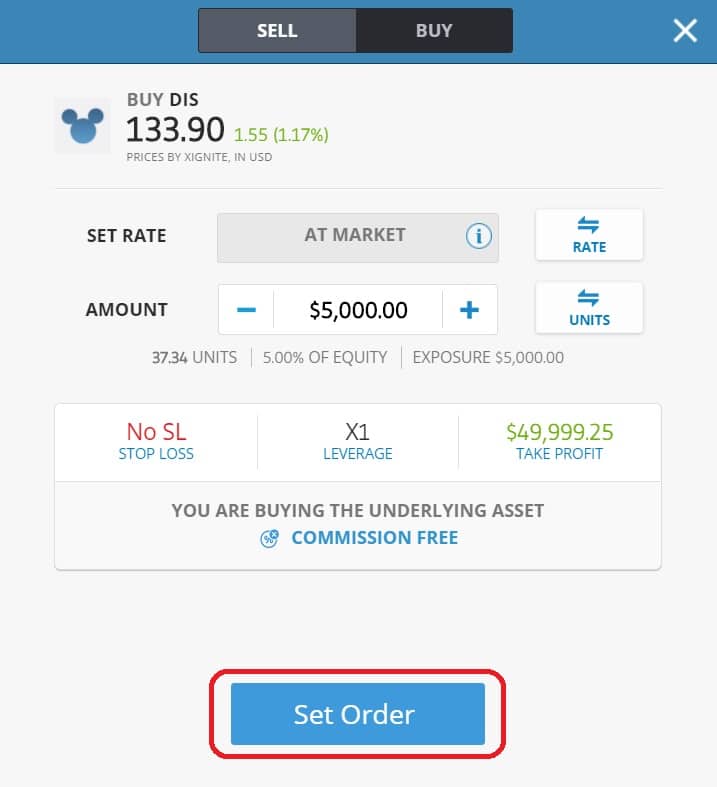

Select Trade and set the amount.

Click on "Trade" and specify the amount that you wish to invest. You may also set several specific parameters depending the features that are offered to you by your broker.

-

Execute the order.

Initiate the trade by executing the order.

|

Should I trade Disney stock?Despite the closures of Walt Disney Theme parks during the 2020 Covid-19 pandemic, Walt Disney stands to regain lost ground—thanks to slow reopening and its strong portfolio of profitable brands such as Disney+, ESPN+ and Hulu—all of which combining for more than 100 million paying subscribers all over the world. Coupled with Walt Disney's favorable balance sheet and cash in hand and holdings, expect the company to bounce back high in the coming years. Thus, making it a good choice to trade a Walt Disney stock right now. |

Frequently Asked Questions (FAQ)

How Much is the Disney Stock?

Here is the current stock market price of ( )

Who Owns the Most Shares of Disney?

The Vanguard Group owns the largest number of Walt Disney shares with 148,574,900 shares worth $16,567,587,099.

How Many Outstanding Shares Does Disney Have?

Based on latest figures, Disney’s outstanding shares is 1.81 billion.

Where Can I Trade Disney Stock?

There are several online brokerage firms selling and trading Disney stocks for you to choose from. However, there are also online brokers that offer CFD (contracts for difference) platforms–such as Plus500 and eToro which you can use to trade, manage and trade your Walt Disney shares.

Best Brokers for Trading Disney Stocks

Below is table of the most trusted and reliable licensed brokers that offer Disney stock CFDs. All you haved to do is click on the Disney Page of your broker of choice and you'll be directed straight to their stock trading page.

| Broker | Features | Rating | Official Site |

|---|---|---|---|

|

|

Min Deposit: $200 Regulation: CYSEC, FCA

|

96 |

|

|

|

Min Deposit: $100 Regulation: FCA, ASIC, CySEC

|

95 |

|

|

|

Min Deposit: $100 Regulation: CBI, ASIC, FSC, FSA, FSB

|

94 |

|

|

|

Min Deposit: $5 Regulation: IFSC, ASIC, CySEC

|

90 |