Introduction

It is a known fact that crude oil has been an important component in how our societies function for quite some time now.

Hence, it is a valuable resource.

But do you also know?

You could participate in profiting from its value by trading crude oil in the world market?

That makes it more interesting, right?

If you agree to this statement, then this article is for you!

Commodities are oftentimes raw materials which are traded back and forth in the world market. These particular raw materials are being used as components in themselves to create further goods (end-products).

And because of the fact that these raw materials are being widely used, trading commodities is a constant activity.

This continuous trading process then tends to produce price fluctuations because of the ever changing dynamics of supply and demand.

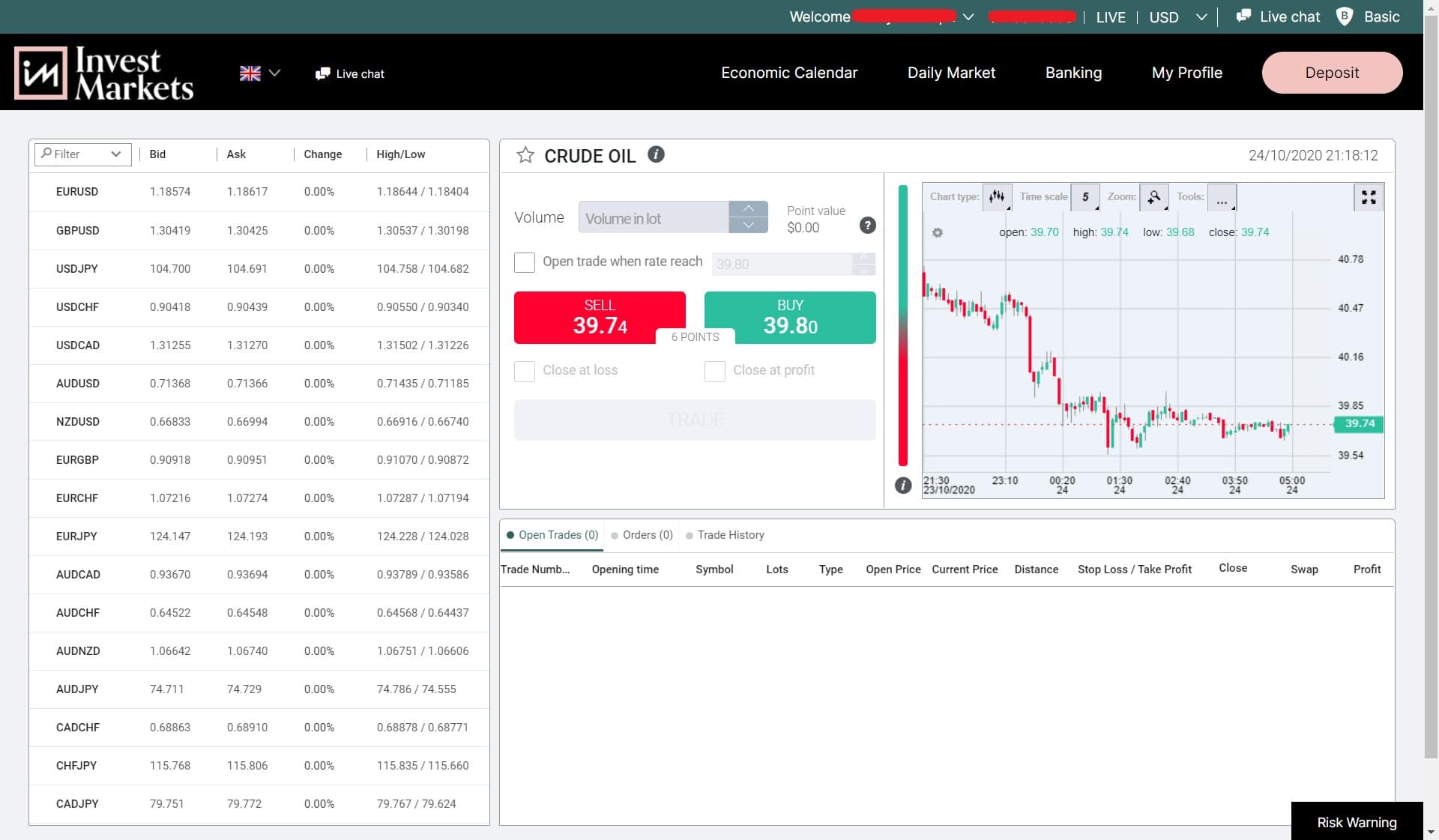

Here’s the latest graph showing how volatile the crude oil market can be:

Crude oil is one of the types of fossil fuel, and in turn could be further manufactured into more end-products (such as diesel, gasoline, etc.) which could then be distributed and sold to consumers.

It is a non-renewable resource; hence its supply has limits.

That characteristic then signifies that the market price is in a continuous ebb and flow depending on the changing supply and demand behavior shown by the market participants.

This constant volatility and extent of participation makes it a favorite among traders.

Why is it so?

The reason being is that it creates ample profit opportunities for profit, notwithstanding the general direction of the market. Crude oil traders can participate in this market activity by either trading spot contracts or futures contracts.

The difference between the two types of contracts is that:

The price of a spot contract is crude oil’s current market price, whereas the price of a futures contract is the price wherein the buyer is willing to pay for that crude oil contract for a delivery date that is set sometime in the future.

Although…

It is necessary to keep in mind that the contract’s price is NOT an assurance that crude oil will reach that price once the agreed-upon date has arrived. Trading futures contracts, is instead being used as a hedge (a tool to manage risk), or as a manner in which to speculate on.

Crude oil CFDs

Contracts for Differences (CFD) are kinds of derivatives.

In a nutshell:

Derivatives are also financial instruments, but their prices are being derived or based on the prices of their individual assets (crude oil is the individual asset referred to in this particular case).

The execution of a CFD transaction is a process wherein the difference of the opening and closing prices of the contract are to be settled in cash. It is a transaction to exchange the difference in valuation between the opening and closing prices of the said contract.

CFDs are considered to be more efficient (time-wise and cost-wise), because they do not involve transfers. In stock trading, there is a transfer of shares; and in some commodities trading processes, there is an actual transfer of physical stock.

Those do not occur in CFD trading, hence transactions are expedited.

Furthermore…

CFDs also allow crude oil traders to make informed speculations on whether the price of crude oil will rise or fall in the future – and to profit if their analysis would be proven to be correct.

These CFD products also benefit crude oil traders because they are provided enough profit opportunities regardless of what the market general direction looks like (whether the general trend is up or down).

These derivatives enable crude oil traders to go long (be able to profit if the trend is up as it allows them to sell at a higher price), or go short (be able to profit if the trend is down as it allows them to buy back at lower prices what they earlier sold short).

Furthermore, traders could be able to manage their risk better by diversifying their crude oil holdings via CFDs, and thus being provided with even more opportunities.

Why does this matter?

If you’re still reading this part, then surely we have caught your attention.

Time is of the essence if you want to participate in the challenging and fulfilling world of CFD trading, do check out our InvestMarkets review or you can immediately open an account by following this link: www.investmarkets.com.

What is InvestMarkets?

InvestMarkets is one of the leading brokers for CFDs and it has been operating since 2010.

Their competitive advantage in this market is in their integrity and drive for providing you a tailor-fit solution for your trading objective.

InvestMarkets is a fully-regulated broker as it is approved by – and is following the rules that have been set by the International Financial Services Commission of Belize with license number 000307/19.

They are one of the industry leaders by constantly providing dedicated service, commitment to excellence, integrity, and providing a specific solution for your trading needs.

Let us delve into what their platform could offer you – in more detail.

Summary

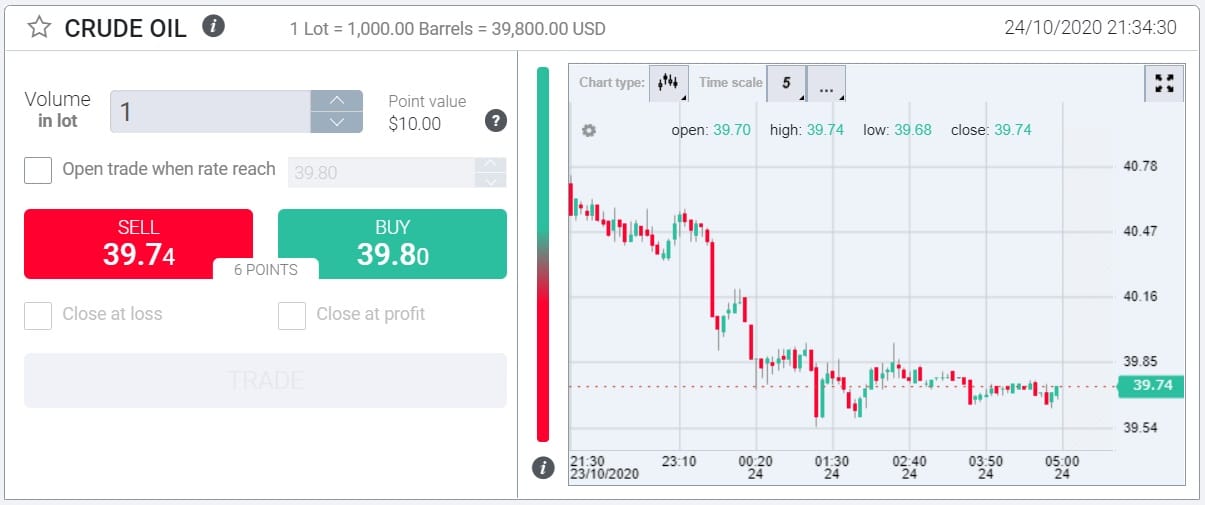

The InvestMarkets platform is pretty straightforward and shows efficiency with its features.

Its uncomplicated layout design will allow you to focus on the most important part – trade execution.

The end-to-end process (account creation, funds deposit, trade execution, and funds withdrawal) is fairly simple to do.

However, unlike other brokers who offer the option of registering or logging in via your Facebook or your Google account, InvestMarkets does not offer that feature.

But…

That could also be seen as advantageous if you are looking at it from a security perspective, as it differentiates your trading account log-in from your social media accounts. They are not getting connected.

The platform’s layout is pretty much straightforward and simple.

- Your account information (verification center, account details, and change password option) could be found on the top menu.

- The different tradable financial instruments that InvestMarkets offer could be found on the left side.

- The window for trading execution is allocated the biggest area in the platform’s layout. When you select the asset of your choice, the trading screen (main/right pane) will change to feature that asset.

Pros and Cons

Pros

- Intuitive and advanced platforms

- Comprehensive educational materials for crude oil trading

- Scheduled live webinars for trading oil

- Low floating bid-ask spreads

- Risk-management tools

Cons

- Price charts not automatically displayed in platform’s main page

- No price alerts

Let’s first talk about the pros:

InvestMarkets has your best interests in mind shown by its dedication in providing the necessary educational materials to guide you on how to make educated trading decisions before you’d start to risk your hard-earned money.

The platform offers you lessons on several essential topics ranging from:

- Technical analysis (studying information that are based on past price movements)

- Fundamental analysis (studying information that are based on macro-economic data)

- Trading psychology

- …and much more

But wait, there’s more:

The company understands that you also prefer to learn via videos; hence not only do they provide stored video lessons on different trading topics (or VOD), but they also offer scheduled webinars.

The platform also offers you one of the lowest floating bid-ask spreads in the industry; for you to not be much affected by slippages when the markets turn volatile – which they often do.

And they also offer risk-management tools such as stop-loss orders.

How can you actually use these?

These orders, acting as safety nets, will be triggered to close your position to limit your losses – if ever the trade goes against you.

Now let’s talk about the cons:

Price charts are not automatically displayed in the platform’s main page. These charts contain information that might be used for immediate analysis – especially by technical analysts.

The added action to access the price charts might prove to be a disadvantage for those who frequently use them.

It also does not offer price alerts.

There are also some regional restrictions; where this broker does not offer its services to. These areas include, but are not limited to Canada and the USA.

Education

InvestMarkets offers several tutorial videos to help you be prepared in your analysis and trade execution.

Aside from that…

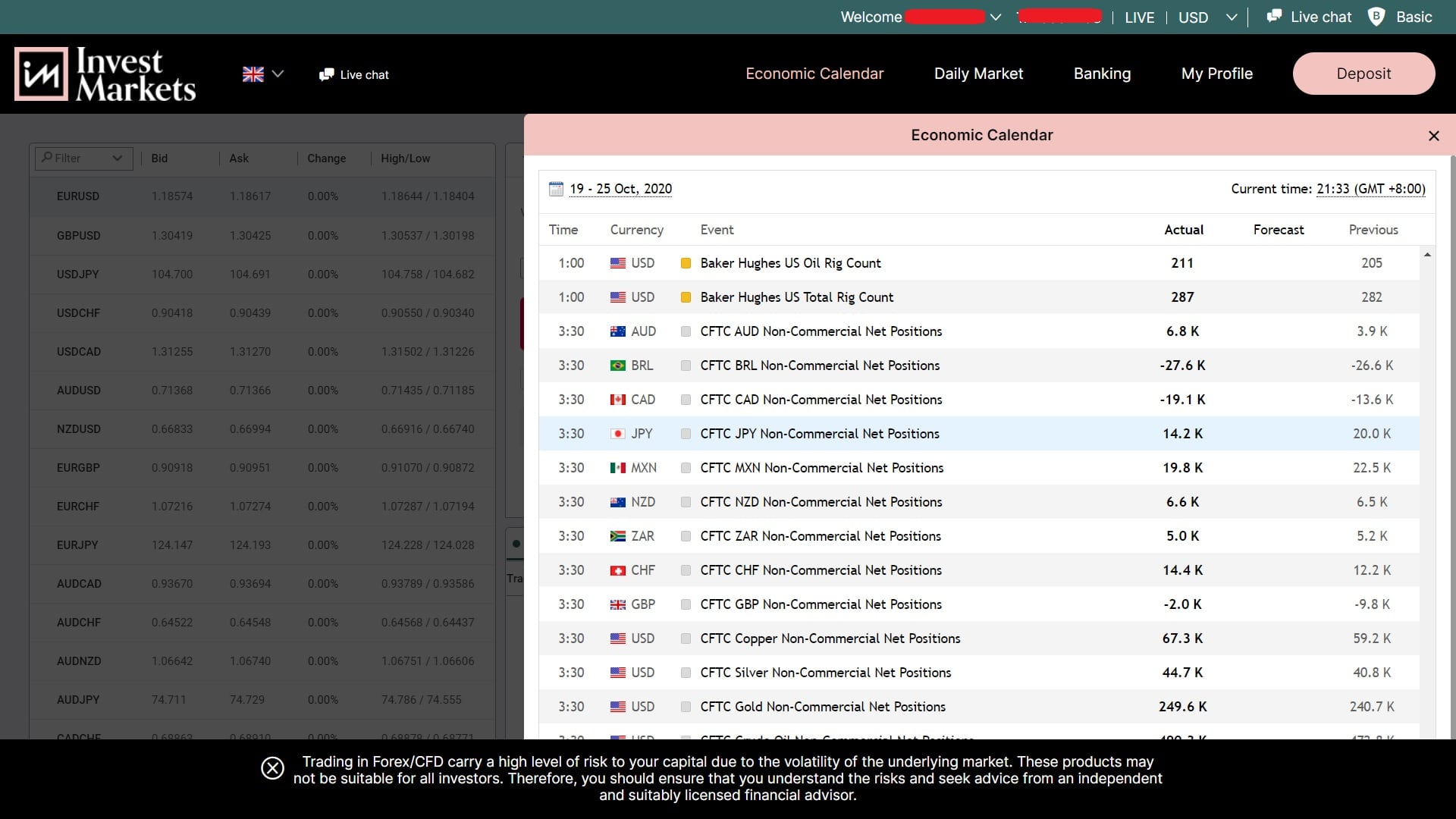

The platform also features daily market analysis, lessons on technical analysis, fundamental analysis, and trading psychology.

And believe it or not:

That’s not all as it also has an interactive e-book!

How to trade crude oil CFDs using InvestMarkets

InvestMarkets has a no-frills approach in its design. You will find its straightforward and efficient platform helpful as you start trading crude oil CFDs.

Please note that you need to do the necessary analysis before you execute your trade.

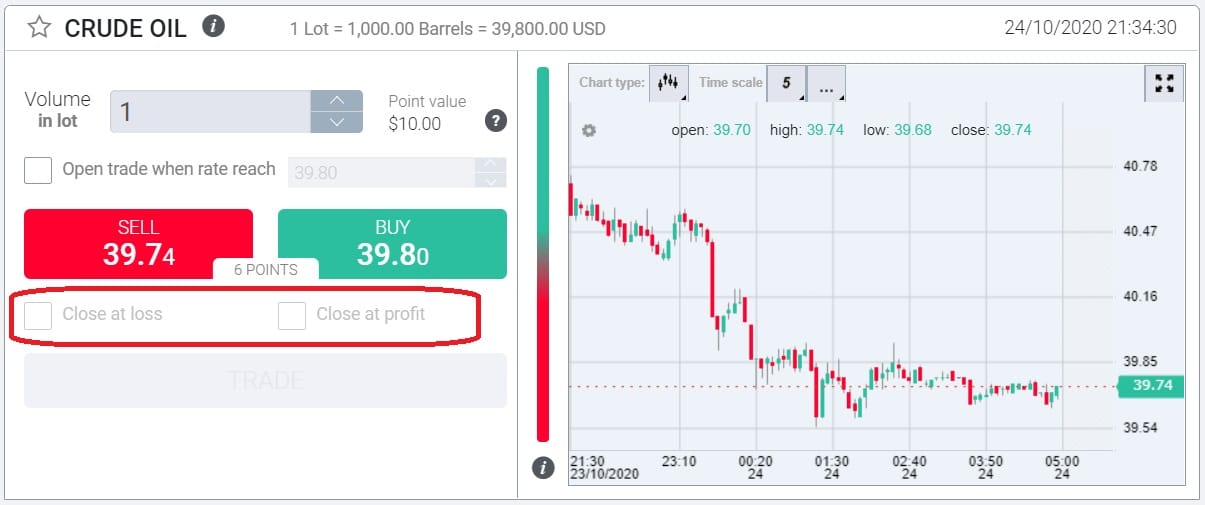

Select Crude Oil from the list of instruments located on the left pane. Then on the main pane, you need to enter:

- The volume (in lot/s) of your order. The point value is also shown there.

- For market orders: Just click whether you will want to buy or sell.

- For limit orders: Click the Open trade when rate reach. Then place the value that you would want for your trade to be executed. Afterwards, select whether you will want to buy or sell.

- For your stop loss order: Click the close at loss. Then place the value.

- For your take profit order: Click the close at profit. Then place the value.

|

Interested to Trade Crude Oil?Bottom line? Take advantage of the features that InvestMarkets provides you to gain that much needed competitive advantage over fellow crude oil traders. Sign up now and be part of the ever-growing community of crude oil traders all around the world. Please be reminded that it is very important to always manage your risk.

|