84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Introduction

Since time immemorial…

It is still being widely accepted that gold is known as a safe-haven for traders and investors alike when the other financial markets are experiencing extreme volatility.

Even if the markets are acting like that, isn’t it interesting to note that opportunities to profit still exist?

If that caught your interest and you want to start trading gold now, then this article is definitely for you!

More often than not:

Commodities are raw materials that are being traded in the marketplace.

These are then being used as inputs and undergo further processing to create more goods (end-products). Since these end-products that are produced from commodities are being widely used in many societies today, there is a constant demand for these commodities, in this case gold.

Market prices then tend to follow the continuous ebb and flow of supply-demand dynamics.

The value of gold has remained throughout history.

Before societies adopted the use of paper currency, coins that are made of this yellow metal were the main means of exchange.

Since this commodity is being valued by many, this dynamic creates more than sufficient activity and liquidity in the gold market; hence profit opportunities for gold traders are abound – regardless of the market’s general direction.

This updated graph will give you a quick preview about gold’s market value over the past several years:

Gold traders could engage in this type of market activity by buying and selling either spot or futures contracts.

Spot contracts are the ones wherein the contract’s price reflects gold’s current market price, while the price of a futures contract reflects the price in which the buyers are willing to pay for that particular gold contract on a future delivery date.

It is important to note that:

The price of the futures contract is not a guarantee that the price of gold will be able to match that once the agreed upon date has arrived.

These types of contracts (futures), are used to manage risk instead (as hedges), or as a means for speculation.

Gold CFDs

Derivatives are financial products whose prices are being derived from their underlying assets (i.e. price of gold).

CFDs – or contracts for differences – are kinds of derivatives. CFD transactions comprise of the settling (in cash) of the difference between the contract’s opening and closing prices.

CFD transactions are efficient in terms of time and cost.

The reason being is that there’re no actual transfers of anything that are being done here.

Unlike in stocks, where there is a transfer of shares, or in some cases in commodities, where there is an exchange of physical goods that is being done.

These CFD transactions also enable gold traders to speculate (and profit from) on gold’s price action – whether the price will rise or fall.

As if that’s not enough…

CFDs are also advantageous to traders for they allow them to have profit opportunities whether the general market’s direction is up or down.

Gold traders also use CFDs, or other kinds of derivatives, as a means of diversification, or to manage their risk (hedging), and be exposed to more opportunities.

How can you actually use this?

We now have a hold of your interest and attention, haven’t we?

Then let us not waste further time, go ahead and explore the platform of Plus500. You may register and create an account right now at this link: www.plus500.com.

What is Plus500?

Plus500 is an industry leader for CFD trading.

It delivers you its utmost service, trading resources on commodities, stocks, foreign exchange, ETFs, indices, options, and the newest kid on the block: cryptocurrencies.

The company behind the Plus500 platform is Plus500UK Ltd. This publicly-listed company is based in the United Kingdom and was founded in 2008.

It is rapidly expanding its growth as a leading CFD provider not only within the European vicinity, but also in Asia.

The platform currently boasts of having over 2000 instruments, which it provides to over a million of its clients – which will soon include YOU.

Furthermore…

In 2018, Plus500UK Ltd has been included in the UK FTSE 250 index as one of the leading mid-cap companies.

This company is being regulated by the Financial Conduct Authority (FCA). The regulating body has rules and regulations in place that ensure Plus500 offers not only high quality, but also fair services to you and its other clients.

Another proof of their dedication in promoting transparency and accountability, the company has your and the other clients’ money stored in segregated bank accounts to assure that your funds are all accounted for.

The platform also provides 24/7 customer support should you have inquiries or you need immediate assistance on your trading endeavors.

Why do these things matter?

It’s an assurance that the company is looking after your best interests.

We shall now discuss in more detail the different features of the Plus500 platform.

Summary

It is a complete and rather perceptive, yet simple, platform.

The company ensures that the whole process would be user-friendly (from creating an account to depositing funds to executing trades to withdrawing money) and as effortless on your part as possible.

When signing up for an account, you are given a choice of not only registering your email address, but you could also log in via your Facebook or Google account.

It’s pretty easy right?

The platform’s overall design emanates simplicity and robustness.

The page is divided into different panes. Selected financial instruments are already grouped and displayed on the topmost pane.

They could be grouped via the following:

- Their popularity (their usage inside the platform)

- Risers and fallers (the instruments whose prices moved the most whether up or down)

- The financial instrument’s category (i.e. commodity, stocks, foreign exchange, etc.)

- You could also create your own favorite list.

How can you actually use this?

These groupings are necessary in order for you to focus on certain names for your analysis.

You could also add an instrument to your list of favorites.

Here’s all you have to do:

This could be done by selecting the instrument of your choice (in this case, gold), and on the right side of the row there’s a ✰ icon.

Kindly click on that icon, once the icon is filled, then that will be added to your favorites.

Lastly, there’s also a choice for you to directly search for a particular financial instrument’s name. Just type the name on the search field, which is located on the top of the pane.

Pros and Cons

Pros

- Simple and user-friendly platform

- Arranged and organized list of instruments including gold

- Gold price alerts

- Take profit and stop loss orders

- Competitive bid-ask spreads

Cons

- Does not have a limit order option

- Restrictions in a few countries including USA and Canada

Let’s first talk about the pros:

The features provided in the platform’s main page already have the necessary information.

The list of assets are already arranged and organized (was earlier discussed) and you could also execute a trade directly from the main page as the buy and sell icons are already shown next to the financial asset’s name.

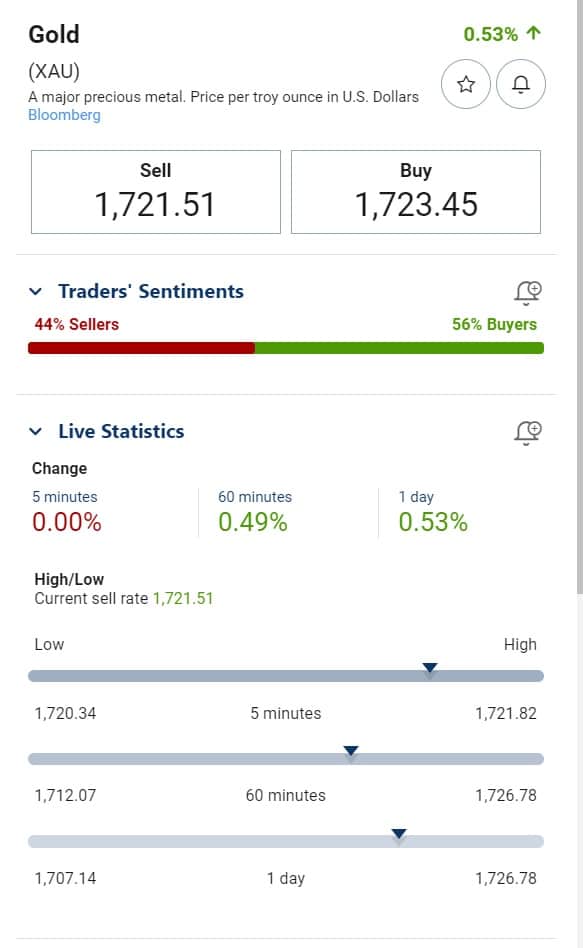

There’s also an alert icon (bell icon) at the far right side which is pretty useful so that you could be notified if the price has crossed a threshold level, without the need of actively monitoring the price action.

The charts are also shown at the lower pane, thus providing immediate information of how the behavior of the price is at that instant.

How can this benefit you?

Even if you’re not into technical analysis, it could show if there’s a general trend that you could use as information.

The charts could also be adjusted by changing the timeframe or adding your choice of technical indicators.

The platform also provides take profit and stop loss orders.

In essence:

These are risk-management tools that could help you manage your trade better, by taking some profit along the way; or by limiting your losses if the price action did not go according to your analysis.

They also offer competitive bid-ask spreads.

This ensures that your trades will not be greatly affected by slippages during times of high volatility and low liquidity – which happen every now and then.

Now let’s talk about the cons:

The platform does not have a limit order option; orders are being done at the current market price.

Furthermore, there are regional restrictions for the company as they do not offer their services to some countries including the USA and Canada.

Education

If you are the type who places an emphasis on macroeconomic affairs, then this is definitely good news for you:

The platform offers an economic calendar that not only shows country-level macroeconomic scheduled reports or announcements, but also corporate news.

What makes this significant?

Such data will assist you in preparing for potential price action catalysts that may come from macroeconomic events.

Moreover, there are also some tutorial videos that could help you better understand trading concepts and strategies to help you in your analysis and execution: www.plus500.com/TradersGuide

How to trade gold CFDs using Plus500

The platform’s efficient yet thorough features make it smooth for you to trade gold CFDs.

First, ensure that you have done the necessary analysis before executing your trades.

Then, on the list of instruments, select Gold.

At the pane located at the right-side of the screen, there are options presented to you:

- Select either the buy or sell transaction.

- Place the amount you would like to invest.

- Place a stop loss order (Close at loss).

- Place a take profit order (Close at profit).

- An added section is the advanced section. In there, you can place a trailing stop – should you choose to.

|

Interested to Trade Gold?Bottom line? You can participate in trading that precious yellow metal RIGHT NOW and be a part of one of the most actively traded markets in the world. Take advantage of the profit opportunities provided by Plus500’s easy-to-use features. Please do note that it is very important to always manage your risk.

|