Introduction

Crude oil is an important component in society for quite some time now.

If you’ve ridden in an automobile, then you’d most likely agree with that previous statement.

The general public is likely involved with entities or machines that are consumers of this fossil fuel.

However…

Are you also aware that you could also have the opportunity to profit from crude oil, the commodity itself?

It’s probably high time to stop being just a passive consumer and learn how you may be able to profit from the crude oil market – as an active participant by reading the rest of this article.

In majority of the cases…

Commodities are raw materials that are being bought and sold in the market around the globe. These aforementioned materials are then manufactured to create more end products for the public’s consumption.

Because of this constant demand emanating from the public, commodities are thus actively traded in the market causing regular fluctuations in the price – as the demand-supply dynamics are also changing over time.

Crude oil is a type of fossil fuel which gets further processed into products like gasoline or other of its petrochemical adaptations. This commodity is a non-renewable resource, hence has a limited supply.

This causes the balance of its supply and demand to continuously shift causing price changes. This price volatility and the liquidity that it provides makes it an attractive instrument for market participants to trade in and out of – regardless of the market’s general direction.

Check out this updated graph and see how volatile the crude oil market is:

Here’s the real deal:

Crude oil traders could also take part in this market activity by buying and selling either spot contracts or futures contracts. The difference between these two kinds lies in how the prices are being obtained.

A spot contract’s price reflects that of the crude oil’s current market price. Meanwhile, the price of a futures contract is the price that a buyer is willing to pay for a delivery that is scheduled at a future date.

Please note that:

The futures contract’s price is NEVER a guarantee that crude oil’s price will match that of the price of the futures contract once the agreed-upon date has arrived.

These types of contracts, instead, are either used as risk management tools (to hedge crude oil bets) or as means for speculation.

Crude oil CFDs

CFDs – or contracts for differences – are types of financial instruments called derivatives. Derivatives could also be traded in the market, but their prices are being derived from the prices of their underlying assets (as with crude oil in this case).

You might want to watch this informative video about CFDs. It only takes a few minutes but will give you lots of insights about this topic:

Implementing a CFD transaction involves a process where the settlement of the difference of the opening and closing prices is to be done in cash. It is an arrangement to exchange the difference of the valuation between the contract’s price once it was opened and its price upon closing.

Crude oil traders find CFD transactions advantageous for various reasons.

One is that it is more efficient in terms of time and cost.

The reason being is that apart from cash, no other entities are being involved in the trade.

Unlike when trading stocks wherein shares or certificates are involved, or in some cases of commodities trading wherein actual physical goods are being involved in the transfer as well.

Another advantage is that:

CFDs allow crude oil traders profit opportunities regardless of which direction the general market is heading, as they can go long (buy at lower prices and eventually sell once the prices are higher for a profit), or go short (sell when the prices are still relatively higher then buy them back once the prices are lower for a profit).

CFDs not only enable traders to speculate on what price action is likely to occur in the future, but also to be diversified (a form of risk management).

Here’s the deal:

If by any chance, you’re still reading up to this part, then you surely are interested.

Let us introduce to you one of the leading platforms and brands in this industry, XM.

You may register for an account by visiting this link right now: www.xm.com

What is XM?

As was mentioned earlier…

XM is recognized as one of the leaders in the industry.

This is apparent by the multitude of accolades that it has received over the years. XM was founded back in 2009 and now is serving over 2.5 million clients located all over the world (which would further increase once you have signed up).

It is also proud to say that over 2.4 billion trades have been executed on their platform without any requotes or rejected trades.

In general…

XM is all about fairness, trustworthiness and dependability.

It is regulated by different governing bodies, depending on the country where the clients are located. Regulatory bodies such as:

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Services Commission (FSC)

- Australian Securities and Investment Commission (ASIC)

All clients are ensured that they are presented fair trading conditions REGARDLESS of their account type.

XM offers several choices of financial instruments for trading CFDs on forex, stocks, commodities, equity indices, precious metals, and energies.

They also offer several platforms for you to choose which are you most comfortable with; these platforms include but are not limited to: MT4 for PC, MT4 for Mac, MT4 Multiterminal, MT4 for WebTrader, MT4 for iPad, MT4 for Android, MT5 for PC, MT5 for Mac and MT5 for WebTrader.

Moreover…

They understand the importance of human interaction, thus they offer 24×5 customer service and outstanding support. Their customer service team could be reached via live chat, phone or email.

Let us now further look into XM’s features and see what are the advantages and the disadvantages that this broker has.

Summary

A feature that sets XM apart from other broker is that it offers several platforms that you could use, which were already mentioned above.

These platforms can be classified into 2 general areas: a downloadable MetaTrader application and XM’s webplatform (also MetaTrader but incorporated).

Picture this:

Most other brokers offer only a web-based platform.

Even though, the XM’s WebTrader platform layout is not as direct and simplistic in its design as the other brokers’ platforms, because you need to download another application to execute the trades (MetaTrader) or the WebTrader platform is designed for technical analysts, it does contain a lot more data that you could use for your analysis.

What’s more…

Another feature that you might find to be advantageous of having the MetaTrader interfaced with it is that you could have the option of using ExpertAdvisor bots to automate your trading in the future – once you have already familiarized yourself with the trading process that is.

The whole process of registering an account, depositing funds, executing your trades, and the eventual withdrawal of your money is a straightforward one.

One thing noticeable though is that you can only register via the email address option, unlike other brokers who allow registration via your existing Facebook or Google account.

Although it might cause some tiny inconvenience; if you’d look at it from a security perspective however, it is actually an advantage. It separates your trading (which of course involves money) credentials from that of your social media account/s credentials.

Additionally…

You are also given the option to sign up for a demo account in order for you to practice your strategies and skills without risking your hard-earned cash immediately in the market.

After registration, you’ll be given an ID and the password that you’d be setting up. Then upon logging in to their platform using those credentials, the default member page basically lists your account details and links to the deposit, withdrawal, research, etc pages.

For trading, you have to click the link that says Platforms located at the top menu.

Here’s the thing:

For this article, we shall focus only on the web platform hence kindly click MT5 WebTrader. The WebTrader 5 window would then show up.

On that screen, you will see that the main pane contains the price chart, and on the left pane is the list of financial instruments that could be traded on their platform.

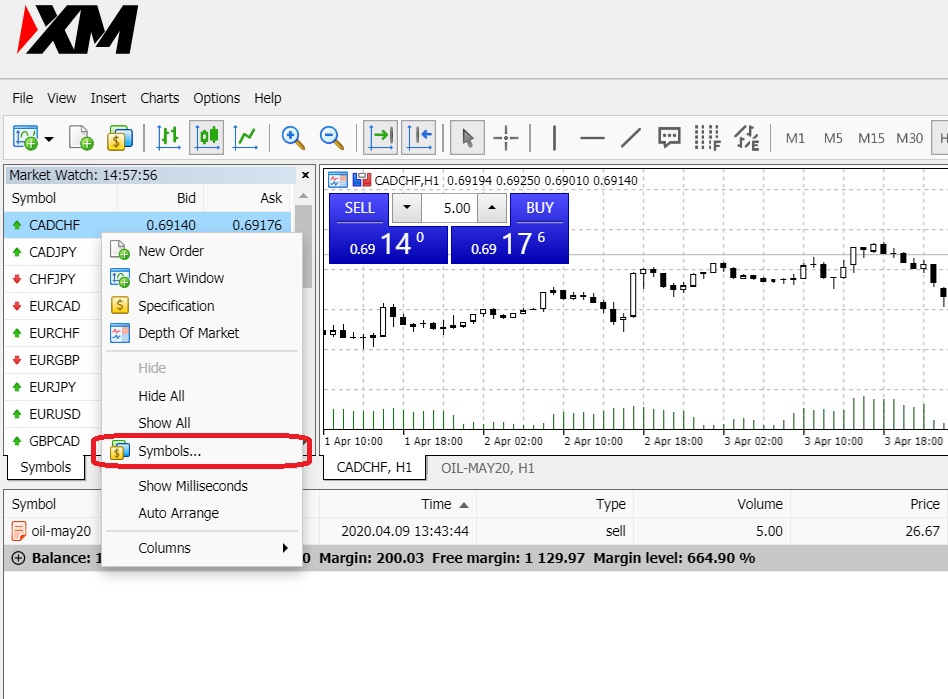

Take note that the default list only shows the forex pairs. In order for the CFD instrument to show up, you need to add it up by right-clicking the financial instruments pane then select symbols.

Under CFDs, select Futures, then select Energies. The different options will now show up, and you could select the oil contract of your choice.

There are plenty of instruments available, from forex pairs to CFD contracts on energies, commodities, metals, indices, etc.

Pros and Cons

Pros

- Advanced charting tools

- Option to use ExpertAdvisor trading bots

- Offers strategies and technical indicators

- Competitive bid-ask spreads

- Stop loss and take profit orders

Cons

- Takes a while to get familiarized navigating the interface

- Restricted in some countries

Let’s first talk about the pros:

Since XM has interfaced MetaTrader to its platform, that provides an advantage to their clients.

Reason being is that:

MetaTrader has many advanced charting tools that will definitely help you to better analyze price action and to speculate which action is likely to occur.

You also eventually have the option to use ExpertAdvisor trading bots to streamline your trading process.

But that’s not all…

XM also offers strategies and technical indicators that they have developed to provide you an advantage over fellow participants.

Moreover, they offer competitive bid-ask spreads so that your execution will not be greatly hampered by slippages if ever the market’s volatility level suddenly rises and the liquidity dries up. They also offer stop loss and take profit orders to help you manage your risk during the course of your trade.

Now let’s talk about the cons:

For starters, you probably will encounter minor difficulties in navigating around the MetaTrader interface at first, as it is designed for those who mainly use price charts as analysis tools.

But one thing’s for sure:

After a couple of sessions, you’d be much more familiarized with it.

XM also does not offer its services for residents of certain countries, like USA, Canada, and Israel.

Education

XM has your best interests in mind as they offer you extensive educational materials and webinars to help you be knowledgeable in this trading craft.

.As if that’s not enough…

They also have a research section which offers tutorial videos, news, trade ideas, an economic calendar, etc. to constantly provide you with updated data and news to help you better strategize and execute your plans.

How to trade crude oil CFDs using XM

The XM platform offers a multitude of tools and indicators to help you analyze price charts and help you execute your trades.

At first glance…

It may look a bit complicated at first, but you’ll get the hang of the features of the platform in no time.

Please note that:

You always need to do the required analysis before executing trades.

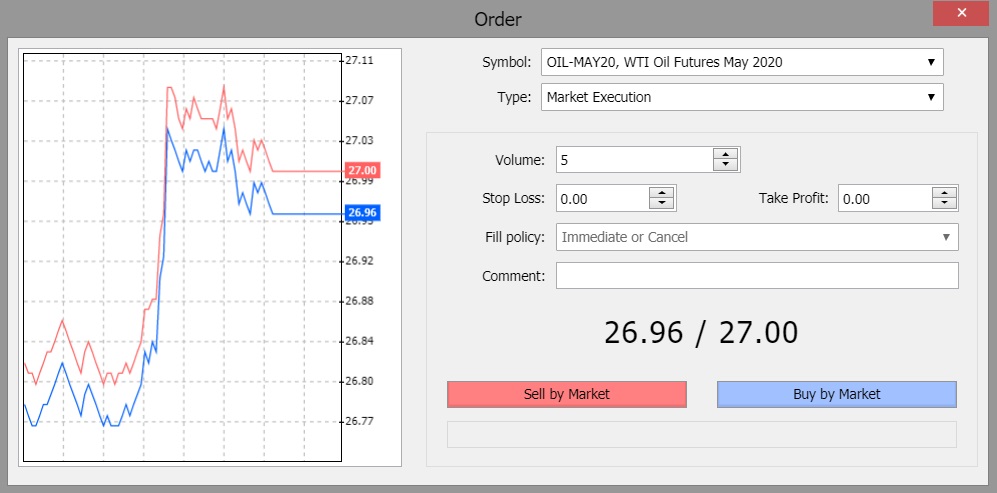

You need to doubleclick on the Oil CFD contract of your choice from the list located on the left pane. A new window will pop up and here you need to enter:

- Volume of your order.

- For market execution orders: Select if you’ll buy (by market) or sell (by market).

- For pending orders: Place the value that you would want for your trade to be triggered. Then select which type of execution it will be: will it be a buy limit or a sell limit? Then also set the order’s expiration.

- Place your stop loss order.

- Place your take profit order.

|

Interested to Trade Crude Oil?Why does this matter? Let us not waste any more of your time. The features and the research and education section offered by XM are in a totally different level. Register now in order for you to start taking advantage of those to help you analyze and properly execute on those profit opportunities presented by the market. Kindly always be reminded that it is very important to manage your risk.

|