Introduction or Skip Content and Read the Bottom Line!

Forex.com is a very popular brand is the retail FX markets and is considered to be one of the current largest brokers in the world having assets of over $10.9 billion and more than 200,000 clients across the globe.

What’s also notable about this brokerage firm is that it is licensed and regulated in the USA and Canada which means that their forex trading services are allowed and are legal to operate.

There are also other additional perks and benefits when trading with this broker but the question is:

Is Forex.com reliable?

Our team of experienced financial experts have done a thorough evaluation of this broker based on all the essential and critical categories in order to answer this question fairly and equitably.

And when we say that it’s a thorough evaluation, trust us that it’s not going to be a review that’s too technical or boring.

We shall be delving on the important facts and will deliver the results in a simple and no-nonsense way.

And remember:

This is an unbiased review so expect to see some advantages and disadvantages of this broker and weigh in all of these facts before making a decision.

If you’re ready then let’s get the ball rolling!

| Founded | 1999 |

| Platform | Forex.com (Web Trading, Mobile Trading, Desktop Platform), MetaTrader4 (MetaTrader Web, MetaTrader Mobile), MetaTrader5 (MetaTrader Web, MetaTrader Mobile) |

| Minimum account size | $100 |

| Minimum lot size | 0.01 |

| Tradable assets | 4,500+ |

| Maximum margin | 1:50 |

| Spread on EUR/USD | 0.1 pips |

| Payment methods | Credit/Debit Card, Wire Transfer |

| Demo account | Yes |

| Accepts US and Canadian traders | Yes |

| Regulated | NFA (USA), CFTC (USA), IIROC (Canada), FCA (UK), ASIC (Australia), JFSA (Japan), CIMA (Cayman Islands), SFC (Hong Kong), MAS (Singapore) |

| Support | Phone, Email, Live Chat |

| Website | www.forex.com |

Registration 9.2/10

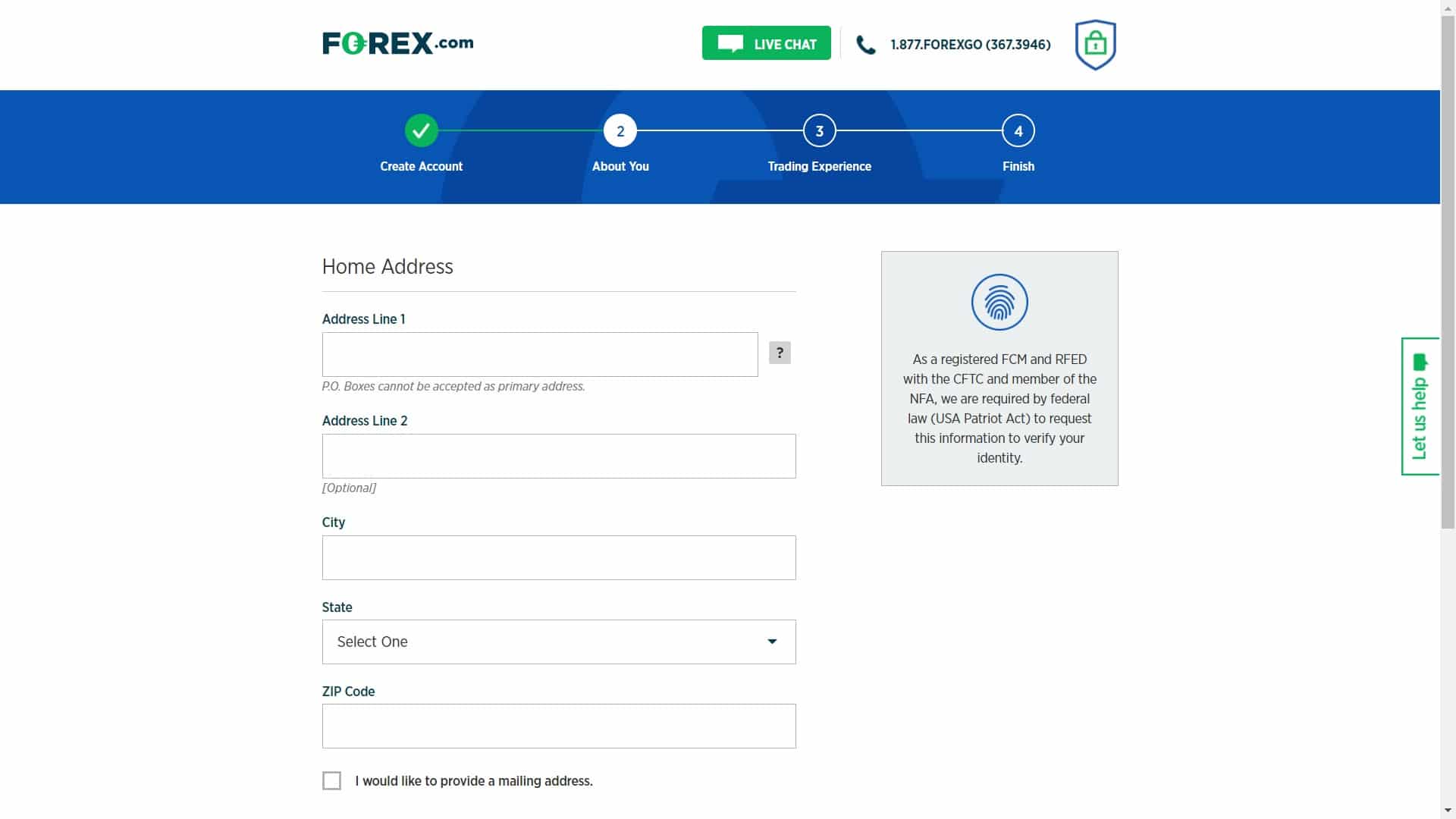

During registration, their website will take you to 4 pages in total and each page will ask for a few information about you. Don’t worry because this really won’t take long.

For the first part of the registration on their website, you will need to provide the following details:

- Country of residence

- Title (Mr., Mrs., Miss, Ms. or Dr.)

- First name

- Middle initial

- Last name

- Date of birth

- Email address

- Primary phone number (mobile number is preferred)

- Preferred username

- Preferred password

The next part will require you to provide your complete home address including your city, state, country and zip code.

You will also be asked if you would like to provide a mailing address and specify your identification and citizenship country or region of citizenship.

On the last part of this page, you need to declare if you are a US citizen or not and enter your social security number (SSN) or ITIN.

For the third part of the registration, you will be asked about your trading experience and this will include the following:

- Employment status

- Total annual income

- Net worth

- Source of funds

- The amount you would like to deposit (their minimum deposit is $100 and they recommend an account balance of $2500)

- Your affiliations

- Your experience in trading stocks/equities, options, futures and forex.

Forex.com registration page (3rd part)

The fourth page is the last step and this will display a summary of the information that you just provided to them.

Ensure that all details are correct and click on Continue to finalize the sign-up process.

Look:

You need to complete these steps to complete the registration and although it’s composed of 4 pages, the whole sign-up process from start to finish is not really that time-consuming and can be done in around 5 minutes or so.

You might have noticed that they ask for quite a bit of info as if you are talking with a bank, as it is a very serious broker (which is actually a good thing).

If you want to register with now with Forex.com, you can instantly go to the sign-up page right away via the button below. If you’re ready, it’s just a click away:

Account Types 10/10

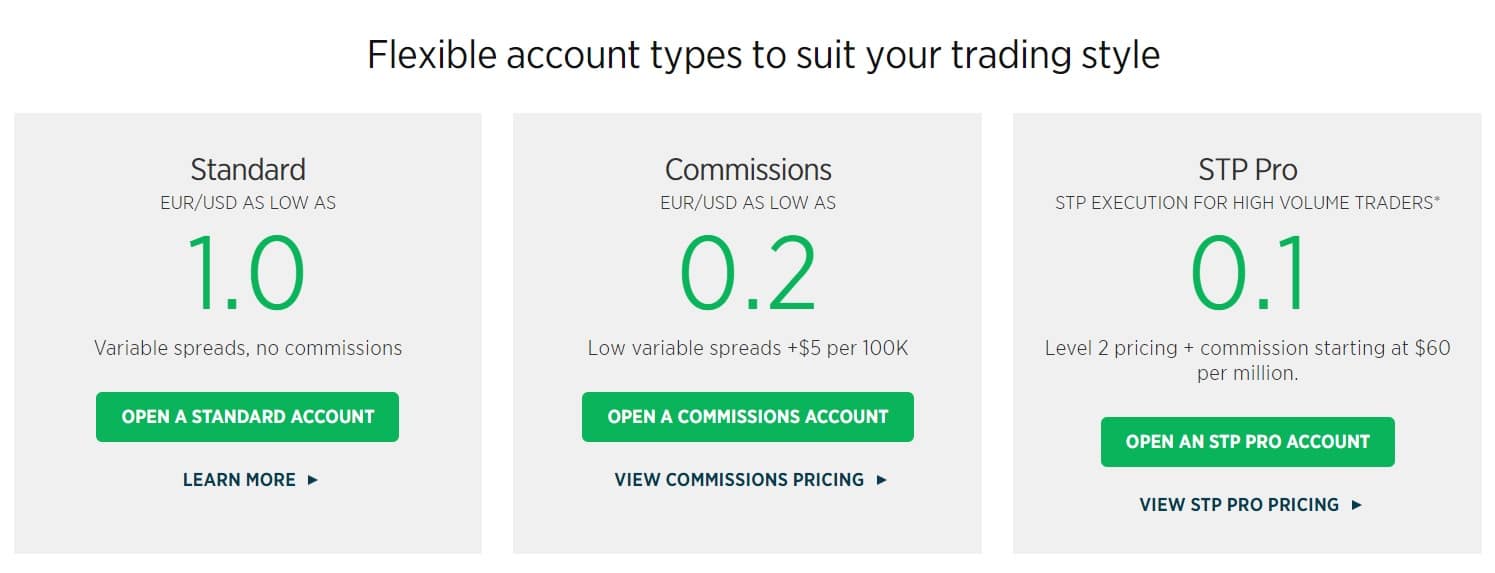

The advantage of Forex.com is that they offer flexible account types so you’ll be able to match your trading style and strategies with a specific pricing model.

These are currently the types of accounts that you can open with this broker:

- Standard – As the name implies, this is the best option if you want the traditional forex trading experience and don’t like commissions. Specifically, you can choose to open a Standard account based on the platform that you’re going to use:

- Forex.com account

- MetaTrader account

- Commission – If you prefer fixed commissions and are looking for ultra-low spreads then this is the best option for you.

- STP – This is ideal if you’re used to trading in high volumes as it has features that you can use to properly manage your trades.

Do take note:

Commission and STP accounts are not available on the MetaTrader platforms so better take this into consideration.

So which Forex.com account is best for you?

That would really depend on your trading preference so be sure to evaluate first your trading style so that you’d be able choose the most suitable account for you.

Here’s a tip:

If you’re having a hard time deciding, you can get in touch with their customer support team and ask for assistance so they could explain it to you further in detail.

Demo Account 9/10

Let us not forget:

You can utilize the free demo account if you want to test drive their trading platforms and familiarize yourself with the interface without the need to risk the real funds from your live trading account.

In general, this has all the same features from that of a live account so you’d get the feel of real market conditions but of course, your access is limited to virtual mode.

Additionally…

You may access any of their trading platforms using the credentials that they will specifically provide to you.

Here’s the thing:

The risk-free demo account will be loaded with a $50,000 virtual balance and this will be active for 90 days.

The minor downside is the 3-month validity but we think that such period is long enough for you to maximize the demo account such as exploring the platform, executing practice trades and trying out different strategies.

In comparison…

Most of the demo accounts that are provided by other popular brokers are also valid for a certain period but it’s usually shorter at around 30 days so Forex.com’s demo account offering is a lot more graceful by providing a longer expiry time.

But please keep in mind:

Using the demo account won’t incur you with profits or losses which is why it is recommended to use them only for testing purposes and once you’re ready, then live trading is the next step to take.

Payment Methods 8/10

Currently, Forex.com supports the following payment methods:

- Credit/Debit card (Visa)

- Wire transfer

Although the two methods listed above are the most common banking methods that traders use, more ways to fund the account such as personal or business check, Western Union or PayPal would have made it better although this is just considered as a minor disadvantage.

So how long does it take to see the funds in your Forex.com account?

For credit/debit cards, the processing time is immediate while wire transfers typically take around 1 to 2 business days only.

And some good news:

Forex.com won’t charge you with any fees when you fund your account.

It’s important to remember though that not all but some payment systems may charge commissions so be sure to check this first.

Minimum Deposit 8/10

Should you decide to fund your account, the minimum initial deposit is just $100 regardless of what account type you signed-up for.

This amount is considered to be in the lower range as there are other brokerages in the market that require much higher minimum deposits.

But keep in mind:

If you plan to explore several markets and diversify your portfolio, then you need to add more funds into your account.

For Standard and Commission accounts, the recommended balance is $1,000 while for the STP Pro, it’s $25,000 since you’ll be trading with high volumes.

Take note of this:

These are just recommended account balances so you can still fund it with a minimum of $100 in case you’re still not comfortable in shelling out such amount.

It’s also worth noting that Forex.com’s account types are designed based on trading styles which we believe is a much better offering as to basing it on the initial deposit of their clients.

Platforms 9.2/10

With Forex.com, you’ll be able to find the platform that is most suitable for your trading needs and preferences regardless if you’re already an experienced trader or just a newbie in this market.

In general, there are 3 types: the proprietary Forex.com platform, MetaTrader 4 and MetaTrader 5.

All of these platform types offer several choices including a downloadable program for desktops, a web-based version and apps for mobile devices.

Let’s take a look at some of these platforms!

MetaTrader 4

MT4 remains to be the industry standard for most forex traders including those in the USA and Canada.

The reason for is that it has a lot of the features and tools that traders utilize such as charts, indicators, automated trading, signals, real-time account data and more. They even offer free VPS hosting so trades are hosted via a secure server for qualified clients.

Take note that on MT4, you can only trade currencies, equity indices, metals and commodities. Access on these financial instruments will also depend on your country.

MetaTrader 5

The MT5 is the latest version of MetaTrader and it comes with enhanced charting with additional timeframes, intuitive market search and plenty of improved tools that you can use to maximize your online trading experience.

This is already a multi-asset platform, which means you can choose from 500+ markets including forex, stocks, commodities and others (access would still depend on your country).

Forex.com (Proprietary)

For those who want to explore other platforms and diversify their portfolio, Forex.com has developed its own in-house platform.

And since different traders have different preferences of accessing their account, the platform has been made available for desktops and laptops, smartphones and even directly on web browsers.

It also has a lot of features with advanced charting tools, over 80 technical indicators, more than 50 drawing tools, integrated strategies and is fully customizable.

Mobile apps

Trading on the go is also possible because they also offer platforms that are designed specially for mobile devices. They support smartphones that are powered by Android and iOS.

These mobile apps practically has most of the functionalities of the desktop platforms so you will be able to execute a Buy or Sell order and do most actions straight from your device.

And since the screen is smaller, they’ve optimized the apps so that all features are still accessible without any hassles.

Design 9.5/10

Do take note that MetaTrader is a third party application and it only allows brokers like Forex.com to add a few customizations for branding such as adding the logo so this specific category only applies to their proprietary platforms.

They have done a great job in making it very user-friendly and light to use as the loading time was very fast. All the essential functions and features are easily accessible on the main trading screen including the settings and account-related options.

There’s more…

Here’s a preview of the platform when using the dark theme:

Overall…

We had a very smooth experience in exploring the interface of their proprietary platforms.

We never encountered any difficulties in accessing all the functionalities and tools that we were looking for because the menus as labelled properly.

No lags or hiccups were encountered during the entire testing period and for this reason, we are giving them a high rating for this category.

Tradable Assets 9.7/10

The more, the merrier.

It’s as simple as that and the good news is that Forex.com covers a gamut of assets that includes not just FX pairs but also other categories of financial instruments.

As of this writing, there are over 4,500+ markets to explore and that’s a lot as compared to most brokerages that can only offer around 100 to 500 tradable assets.

Here’s a rundown of the asset class that you can invest on via this online brokerage firm:

Currencies

Forex.com lives up to its name particularly in this asset class because they have over 80 FX pairs and this includes the majors (EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAR, AUD/USD and NZD/USD), minors (EUR/TRY, USD/HKD and GBP/ZAR) and others (EUR/MXN, SGD/HKD, NOK/DKK, NOK/JPY, USD/ILS, EUR/CZK and many more). Forex trading is available 24 hours a day, 5 days a week.

Commodities

You can speculate with competitive spreads and fast execution on a selection of metals ((XAU/USD, XAU/AUD, XAU/CHF, palladium and platinum), spot (spot UK crude oil, spot US crude oil, spot coffee, spot cotton no 2 and spot sugar no. 11) and futures commodities (UK crude oil, US crude oil, coffee, corn, cotton no 2, heating oil, NY cocoa, US natural gas, soybean, sugar no 11 and wheat).

Indices

The most popular American, European, Asian and Australian equity indices are available and you’ll have over 15 choices. This includes Australia 200, CBOE UK250, China 50, EU Stocks 50, France 40, Germany 30, Hong Kong 50, Italy 40, Japan 225, Netherlands 25, Singapore Index, Spain 35, Switzerland 20, UK 100, US Small Cap 2000, US SP 500, US Tech 100 and Wall Street.

Stocks

You can go long or short on the most traded international companies around the globe and the great thing about Forex.com is that there are 4,500+ choices and that’s quite a lot!

Among the included stocks are Facebook, Apple, Microsoft, PayPal, Pfizer, Starbucks, Zoom and Boeing to name a few.

Remember:

Equities are accessible on the Forex.com proprietary platforms and MetaTrader 5 as well. You won’t be able to trade on stocks via the MetaTrader 4 platform.

If you have an existing MT4 account, you have the liberty to request for an MT5 account and wait for an approval.

Cryptocurrencies

Trading crypto CFDs is also possible with Forex.com and as of press time, they offer Bitcoin, Ethereum, Litecoin, Ripple and Bitcoin Cash. It’s also interesting to know that you can trade Bitcoin not only against the USD currency but also with other fiat currencies including GBP, EUR and AUD.

But it’s important to keep in mind:

Trading cryptocurrencies via CFDs is not the same as buying or selling cryptocurrencies from a digital exchange.

Minimum Lot Size 10/10

Just like most brokerages, Forex.com follows the industry standard of offering a minimum lot size of 0.01 for specific instruments.

Such size is recommended for those who want to trade with manageable risks.

Keep in mind that:

Micro lots are ideal for novice traders since the possible profits and losses are much lower.

To keep it simple: The smaller the lot, the less risks in the event of a significant movement in the market.

It’s also important to remember that your risk management strategy must also be considered so be sure to balance it well and fully understand the basics of trading.

Spreads 9.8/10

The simplest way is to find a broker that offers low spreads.

Depending on the markets that you’ll be trading on, you will be offered with either variable or fixed spreads by Forex.com.

Here’s the deal:

The kind of spreads that you will be able to access will be based on the account type that you selected since so be sure to pick the one that matches your trading style best.

For a Standard account, you will be trading with variable spreads and no commissions.

Commission accounts offer low variable spreads and due to its name, you will only be charged with $5 commission for every 100,000 base units traded.

The STP Pro account offers level 2 pricing and commissions at $60 for every million units traded so this is most suitable for clients that plan to trade with high volumes.

Also keep in mind:

Certain market conditions such as volatility and liquidity may affect the spreads.

Quotes Accuracy 10/10

Since Forex.com has wide network of liquidity partners, they are capable of providing prices that are accurate and fast.

In fact, most of the comments that we found about this broker is that they are among the fastest in the market with consistent execution.

How can you actually use this?

That means your trades are executed based on the price you are expecting or even better as they have the technology of detecting when the market is favorable.

Additionally…

Forex.com is a market maker.

This means that trade executions are not outsourced to other service providers so they are definitely superior when it comes to providing accurate quotes.

Withdrawal Time 10/10

Withdrawals are not a problem with this broker.

For bank transfers and debit card transfers, withdrawals are processed up to 24 hours without any fees. Withdrawals via wire transfers on the other hand have a maximum processing time of 2 business days with a $25 fee for US clients, and up to 5 business days with a $40 fee for non-US clients including Canada.

So how do you withdraw the funds Forex.com?

All you have to do is access the trading platform, choose Add Funds and then Withdraw Funds from the selection.

The minimum amount that you can cash out per transaction is $100 or the available balance in your account if it’s lower.

If you’ll be using bank transfer, a maximum of $25,000 is allowed for each withdrawal while debit cards have a higher cap at $50,000.

For wire transfers, there’s no limit on the amount that you can withdraw for each transaction.

But you need to take note of this:

Your withdrawn funds and the same amount will be credited back to its original source when you previously made a deposit while the excess can be credited via bank transfer or wire transfer.

If in case you funded your account using several banking methods, you need to exhaust the entire amount that you deposited in this order:

- Bank transfer

- Debit card

- Wire transfer

Additionally, you can include another bank account if you wish to transfer the excess funds to this payment gateway but you will need to provide your bank statement and this will also be subject for approval.

Customer Support 9/10

Let’s not forget…

Good and reliable customer service is important in any type of business, online brokerages are no exception.

It is essential that they have a helpline that is available 24 hours a day for at least 5 to 6 days a week so they can cater to their clients wherever they are located since we all know that each region have their own timezones.

If you haven’t decided yet to contact them, you can simply visit their comprehensive support page.

Take note that this is not just a basic customer service page that you’d usually see with other brokers. It has an expansive FAQ page, trading hours and holidays for the markets that they support, account forms and a subpage for downloading their platforms.

And another thing:

It also has the Service Updates page where you can find the answers on common questions when the markets are high volatile and the status of their platforms, margin requirements, pricing, funding and withdrawals, inactivity fees and others.

And should you decide to contact the customer support department, you can get in touch with them via the most common ways and this includes phone, email and live chat.

Calling the phone support was not a problem and the waiting time took only less than a minute before we were assisted by one of their agents.

Next…

We tested their email support department which we contacted via the contact form. The response time was quite impressive as we were able to receive it in less than an hour. This is considered to be fast because other brokerages usually answer them the next day.

And lastly, live chat support. In general, it was also impressive and very convenient to use.

In fact, they actually recommend using this channel especially when they are experiencing high call volumes. Live chat agents are very fast in providing answers and are also very friendly.

Overall…

We were very satisfied and are giving them a high rating in the customer service category because of their availability and top-class support.

They have the capacity to handle huge volume of customer requests and have support representatives that are highly knowledgeable of their services.

Regulation and License 10/10

The Forex.com brand is operated by Gain Capital Group which has been able to get a license and registrations from various international financial regulators:

- National Futures Association (NFA) – GAIN Capital Group is registered with NFA ID #0339826.

- Commodities Futures Trading Commission (CFTC) – GAIN Capital Group is a registered futures commission merchant.

- Investment Industry Regulatory Organization of Canada (IIROC) – GAIN Capital – FOREX.com Canada Limited is a member.

- Financial Conduct Authority (FCA) – Gain Capital – Forex.Com UK Limited with reference number 190864.

- Australian Securities and Investments Commission (ASIC) – GAIN Capital Australia Pty Ltd with ACN 141 774 727, AFSL 345646.

- Financial Services Agency (FSA) – GAIN Capital Japan Co., Ltd with license # 2010401047199.

- Cayman Islands Monetary Authority (CIMA) – GAIN Global Markets Inc. is authorized and regulated with license# 25033.

- Securities and Futures Commission (SFC) – GAIN Capital-Forex.com Hong Kong, Ltd

- Monetary Authority of Singapore (MAS) – GAIN Capital Singapore Pte Ltd.

We have checked all of these licenses and registration numbers and were able to verify them all as active.

Here’s what you need to know:

Forex.com is among the very few licensed brokers in America which makes it even more reliable since their operating company in the US remains to be a member of these self-regulatory organizations which are known to be very strict regulatory authorities.

Credibility 9.2/10

Is Forex.com a scam?

In order to answer this question fairly and equitably, we’ll evaluate this broker’s credibility in the forex industry.

So let’s look at the facts about Forex.com:

Forex.com has been operational since 1999. That’s over 2 decades and this fact alone can be the basis to answer the question regarding this broker’s credibility.

Another supporting fact that Forex.com is not a scam is that it is a subsidiary of StoneX Group which is a publicly-traded Fortune 100 company.

Here’s our take: For a company as big as this, it will certainly undergo a lot of scrutiny and as we checked the background of this company, it never had any issues historically.

In addition:

Forex.com is among the pioneers in online forex exchange and is also the top choice of the majority of traders in the USA based on an extensive research and majority of comments that we saw from their clients noted about this broker’s superior execution and competitive pricing.

And there’s more:

When it comes to awards and accolades, Forex.com is among the A-listers as it has been recognized by several independent organizations for their quality of service and innovation.

Here are among the latest awards that they received:

- Best Forex Trading Platform – 2020 Shares Awards

- Best Forex Trading Platform and Best Forex Provider of the year – 2020 London Trader Show

- Best Mobile Platform/App – 2020 UK Leverage Trading Report Awards

- Best CFD FX Provider and Best Trading Analysis Provider – 2020 Online Personal Wealth Awards

So with regards to this question, no, Forex.com is definitely NOT a scam.

</table/>

|

Conclusion 9.4/10

|