We highly recommend that you sign-up with much more stable brands such as eToro or Plus500 as alternatives so you can continue with your trading activities.

| Founded | 1996 |

| Platform | FxTrade Desktop, MetaTrader 4, Mobile Forex Trading |

| Minimum account size | AU$0 |

| Minimum lot size | 0.01 |

| Tradable assets | more than 120 tradable instruments |

| Maximum margin | 1:100 |

| Spread on EUR/USD | 1.2 pips |

| Payment methods | Credit/Debit Card, PayPal, Internet Banking, BACS, CHAPS Wire Transfer, SWIFT Wire Transfer |

| Demo account | Yes |

| Accepts Australian traders | Yes |

| Regulated | IIROC (Canada), FCA (Europe), International Enterprise Singapore, Monetary Authority of Singapore, ASIC (Australia), Institute Financial Futures Association (Japan), Financial Instruments Business Director of the Kanto Local Financial Bureau (Kin-sho) (Japan) |

| Support | Email, Phone, & Live Chat |

Pros

- AU$0 minimum account size

- Tight spreads

Cons

- Occasional platform lags and requotes

- Below average support

- Plagued by a lot of unsatisfactory reviews

Oanda was founded in 1996 and is regulated and registered with a number of financial regulators. Does this mean that this broker is safe to trade with? Let’s find out in this review.

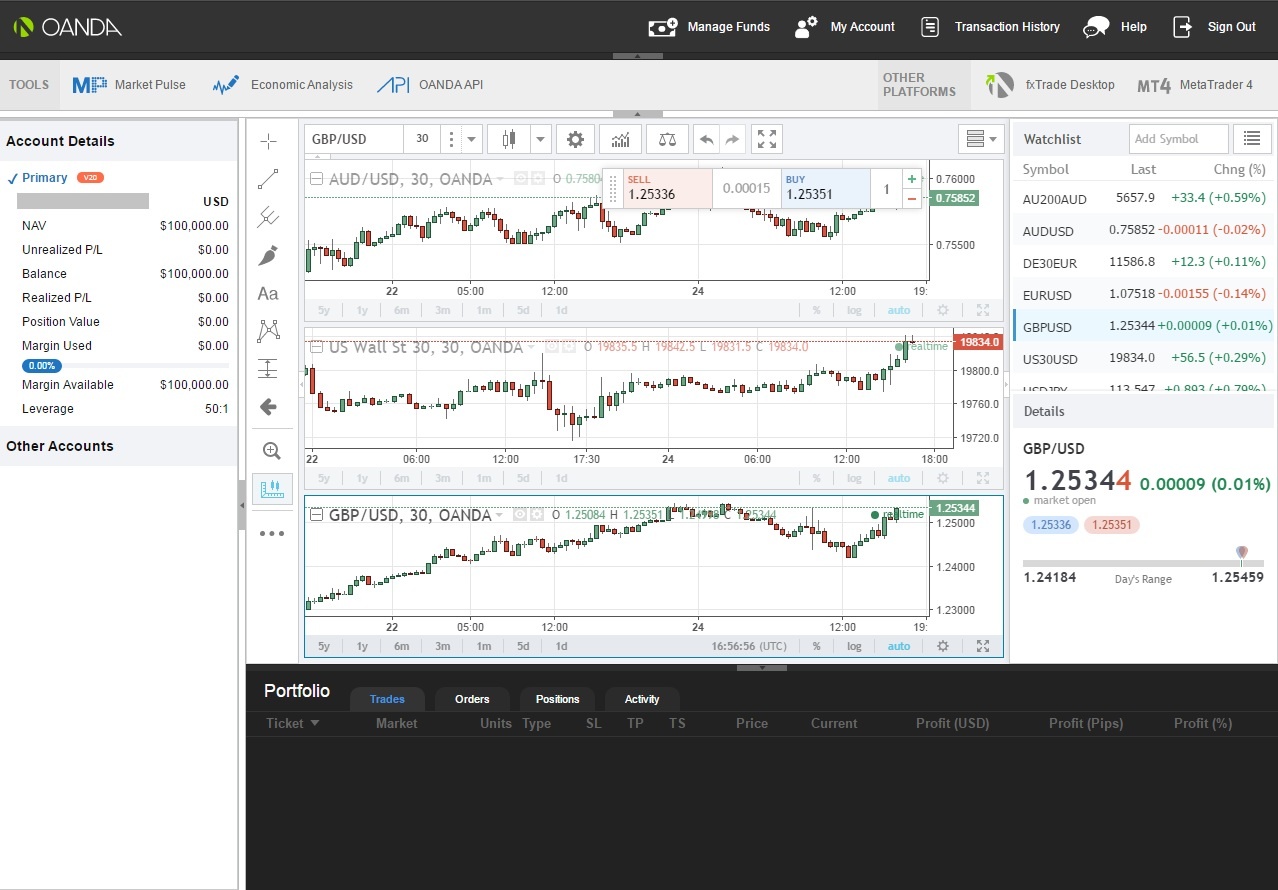

Platform

They have 3 platforms available: FxTrade Desktop, MetaTrader 4 and Mobile Forex Trading. Although generally these platforms run well, I’ve experienced a occasional lags while testing it. Such disadvantage warrants a low Platform score of 8/10.

Design

The design is basically the same as the rest of the brokers out there. It’s simple and easy to use so I am giving it a Design score of 4/5.

Minimum Deposit

The minimum account size is AU$0 so you are free to deposit whatever amount you want. This earns a Minimum Deposit score of 5/5.

Minimum Lot Size

With Oanda you can place minimum lot size of 0.01 similar to the standard size and for this they deserve a Minimum Trade Score of 4/5.

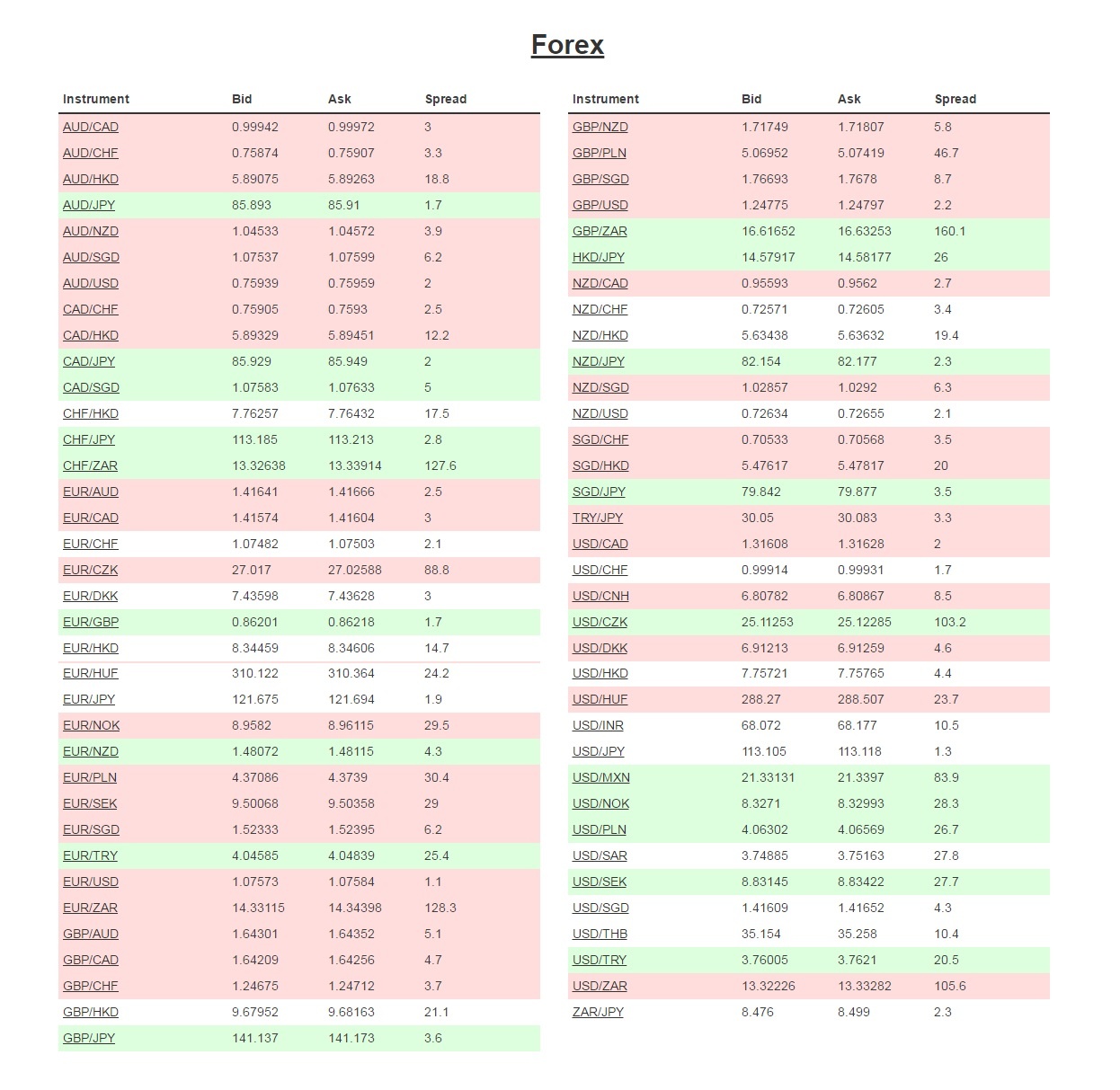

Tradable Assets

Currently they have over 120 instruments available so there are plenty of choices. Such diversity of choices warrants a Tradable assets score of 4/5.

Payouts

The spread of 1.2 pips on the EUR/USD currency pair can match what other brokers can offer. This warrants a Payouts score of 9/10.

Withdrawal Time

It may take up to 5 business days to get your withdrawal request processed with this broker. This is the reason why I am giving them a Withdrawal Time score of 8/10.

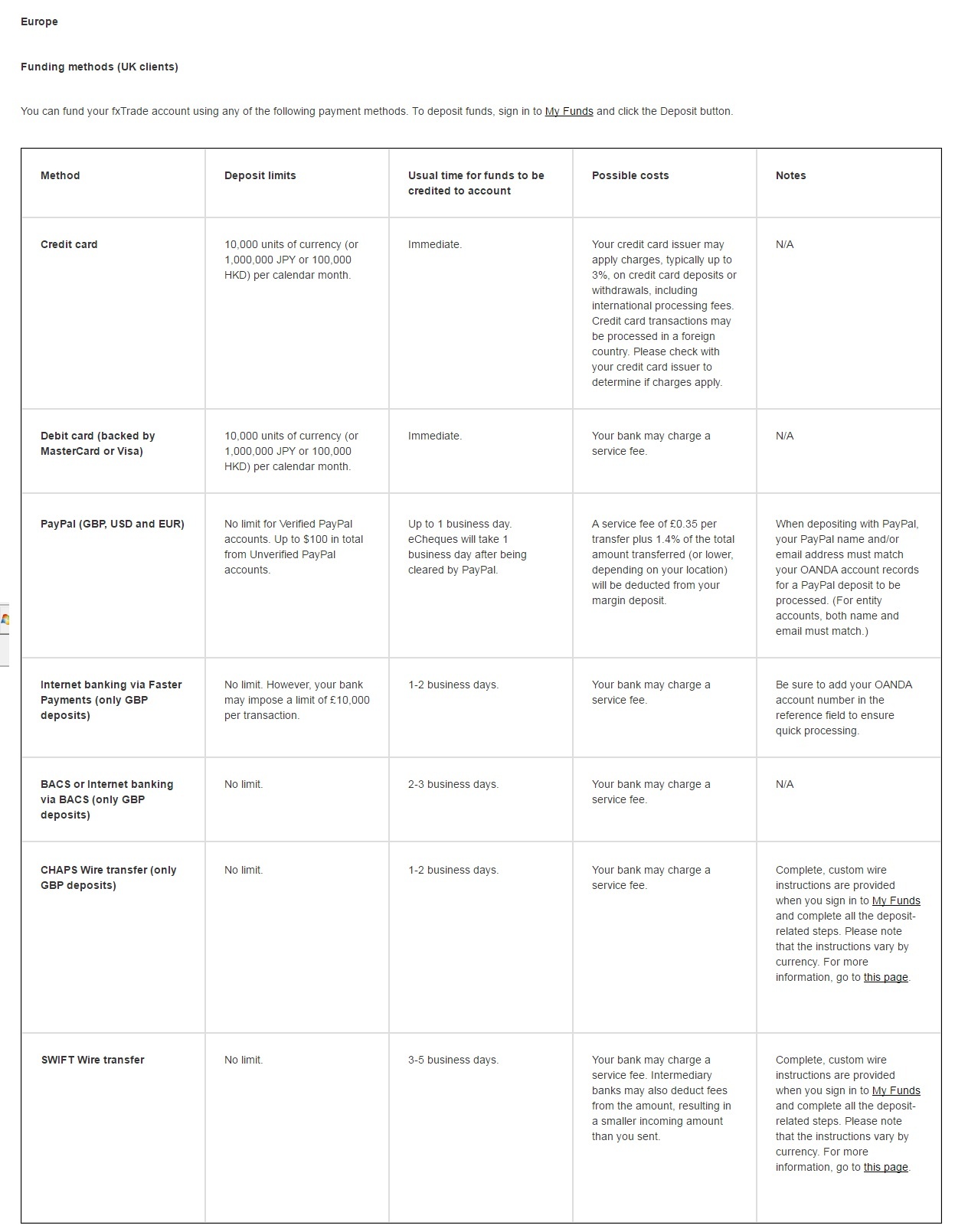

Deposit and Withdrawal Methods

Among the banking methods they accept include credit and debit cards, PayPal, Internet Banking, BACS, CHAPS Wire Transfer and SWIFT Wire Transfer. Since they almost covered all the major payment options, they received a Deposit and Withdrawal Methods score of 5/5.

Customer Support

It takes a lot of patience for you to be able to get in touch with their support. Most of the time, the lines are busy or queuing plus their agents are hard to understand. This deserves a Support score of 8/15.

Oanda customer support

Quoting Accuracy

The prices that they display on the platform are mostly in real-time but there are some instances when the numbers don’t match the actual live market data. It’s the reason why they got a Quote Accuracy Score of 4/10.

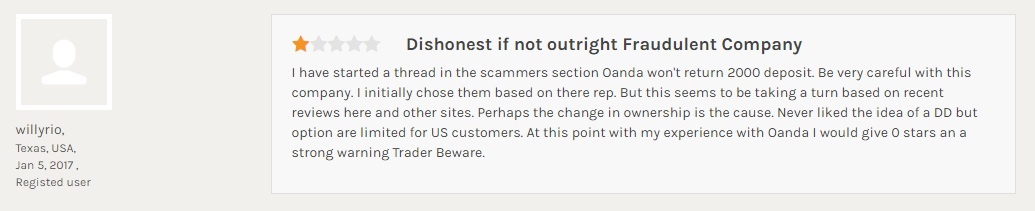

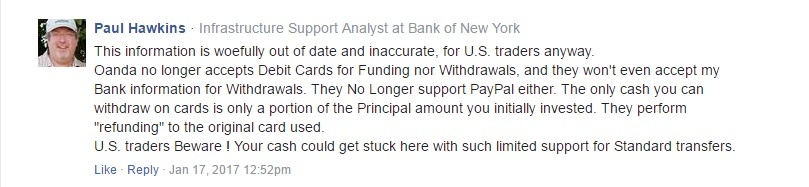

Reputation

Oanda has been in the business for more than 20 years but this broker seems to be plagued with a lot of unsatisfactory user comments and reviews including those from Australia. This is based on the extensive research that was done to know their standing in the market. Based on our grading system, they were able to get a Reputation score of 12/20.

Conclusion 7.1/10

Just because Oanda has been operating for years already doesn’t mean that they are your best option. Based on the tests that were done, it seems that they haven’t been able to maintain the quality of service that they provide to their clients. If you’re planning to trade currencies and are looking for a trusted broker to sign-up with then it would be better to find a more reputable brand that truly delivers. We highly recommend that you sign-up with much more stable brands such as eToro or Plus500 as alternatives so you can continue with your trading activities. |