Introduction

Let’s see…

You’ve probably heard about cryptocurrencies, Bitcoin, Ethereum, Ripple and the like but there’s a new coin in the crypto-sphere that’s getting a lot of buzz lately which is called Libra.

Here’s the deal:

This 2020, Facebook along with 27 other partners plans to launch its very own cryptocurrency which is going to be easily accessible for those who don’t have the following:

- Credit cards

- Bank accounts

How does Libra work?

Ever heard of Bitcoin?

How about PayPal?

Well, it’s going to be somewhat the best of both worlds.

Here’s the picture:

Basically, this will be a digital cash which you can use for the following:

- Purchasing items

- Sending money to other users

Now in order to send and receive Libra, you will need a digital wallet where the coin will be stored.

This wallet will be an app that can be integrated into other apps that are already existing in the market today.

What makes Libra different from Bitcoin?

To start with…

The edge of Libra is that it’s going to be the digital version of fiat currencies like the US dollar, Euro, British Pound, etc.

And the point is?

It’s fast money that’s tied to traditional currencies.

Libra’s value will be tied to a market-value basket of several trusted currencies as opposed to Bitcoin which is tied to how difficult it is to produce.

The bottom line is this:

It’s lot closer to converting a US dollar to Euros.

It’s not going to have the same wild price swings like Bitcoin and other popular cryptocurrencies out there.

Many want to pit Libra vs. Bitcoin. In my mind these two are not in the same category. BTC is a decorrelated (investment) asset. Libra is designed to be a stable medium-of-exchange. I have been, and remain a fan of BTC, but for very different purposes.

— David Marcus (@davidmarcus) June 19, 2019

Availability of Libra

As of this writing, the coin is expected to be launched this 2020 as per the latest announcement of the Libra Association.

Once the Libra coin is launched, it will be accessible via these platforms:

- Facebook Messenger

- Other Libra partners

History of Libra

The concept of Libra started in early 2018 with David A. Marcus, Facebook vice president, transferred from the Facebook Messenger division to the new blockchain division.

There were reports of the social media giant having plans to develop its own cryptocurrency called “GlobalCoin” or “Facebook Coin” and that Marcus will be heading this project and working with over 50 engineers.

Everything however was still unclear until Libra was formally announced on June 18, 2019 and a white paper was released which to reflect its mission, vision and purview.

The Libra Association

The new coin and its underlying code are controlled by a 28-partner consortium of companies and foundation with Facebook leading the pack.

The association is expecting to have 100 members by 2020.

Here is the current list of notable partners are governing this so-called stablecoin:

- Payments

- Visa

- MasterCard

- PayPal

- PayU

- Stripe

- Blockchain

- Coinbase

- Bison Trails

- Anchorage

- Xapo

- Telecommunications

- Vodafone

- Iliad

- Technology and marketplaces

- eBay

- Uber

- Lyft

- Spotify

- Booking Holdings

- Farfetch

- MercadoPago

- Venture Capital

- Andreessen Horowitz

- Breakthrough Initiatives

- Ribbit Capital

- Thrive Capital

- Union Square Ventures

- Nonprofit and multilateral organizations, and academic institutions

- Creative Destruction Lab

- Kiva

- Mercy Corps

- Women’s World Banking

Why does this matter?

if you’re familiar with frequent flyer programs or Disney Dollars, these are controlled by a single or a few entities which makes them centralized.

Now…

With this number of partners, Libra is not controlled by one entity and over time, the association plans bring in more partners for the purpose of making the digital coin more decentralized.

And it gets more interesting…

Every member has a minimum investment of $10 million and can vote on group decisions.

You might ask: what’s the $10 million investment for?

A portion of this investment will be used to have a reserve of funds in exchange for the cryptocurrency.

Here’s what you need to know:

Cryptocurrencies have undergone significant growth in the past 2 years but the market is still struggling to gain widespread acceptance.

Why is it so?

First of all, blockchain technology is hard to grasp and understand particularly for the average Joe.

What’s more…

Crypto coins are mostly popular among gamers and those who want to remain anonymous with their online transactions.

The point is?

Majority of internet users are still not jumping on the cryptocurrency bandwagon

But…

With such big names on board as members pushing for Libra, this could be the catalyst of the blockchain mass adoption that the market has long been waiting for.

Novi: the Libra wallet

Let’s set things straight before we go on further:

Facebook is one partner.

Novi Financial on the other hand is a new subsidiary that Facebook entirely owns.

Novi’s role is to build and maintain the digital wallet which is what you need to use to store and exchange Libra.

This will then be integrated into Facebook’s apps like Messenger and WhatsApp where you can transfer the cryptocurrency via texting.

Does it ring a bell?

This technology and process is not really new as it is similar how you can use Apple Pay.

Here’s another interesting detail:

Novi’s financial data won’t be shared with Facebook since it will be stored on separate servers.

Who needs to use Libra?

Based on its main stated mission, Libra is primarily targeting to service the world’s poor and unbanked.

Picture this:

If you’re planning to send money aboard, there’s an average of 7% fee that you need to pay for international transfers.

International payment systems like PayPal or Venmo can be a solution for this problem.

The downside?

You’ll need a bank account.

And this is where Libra comes to the picture because with this new digital cash, you won’t need to have an existing bank account.

Fact:

Most of those who have no access to banks have mobile phones and can access the internet.

These are the only requirements for you to have access to Libra.

It’s that simple.

You will be able to receive Libra and use that money as well to spend it simply by using your mobile phone.

To top it off…

Compared to other non-banking options, Libra transactions are set to be a lot more reasonable since the fees are expected to be cheaper.

Funding your Libra account

You will be able to fund your Libra account via the following payment options:

- Bank transfers

- PayPal

- Stripe

There are no exact details yet on how to do this but most likely, the steps are quite similar as how you would usually fund an account via these common payment methods.

But what if you don’t need to send money abroad?

You might still find Libra to be useful to your advantage.

First of all, there could be some incentives and promotions which you can avail by using this digital cash instead of using your credit card.

And another thing…

Partner companies like eBay, Spotify, Lyft and Uber are most likely to encourage you to use Libra as payments for using their services by offering discounts or promos.

And while these are not yet announced, analysts are expecting such scenarios to happen.

Will companies support Libra?

Below are some of the notable reasons why companies are expected to support this new cryptocurrency:

Cost-effective: Companies will be able to save a lot on the transaction costs when their clients are using Libra.

Imagine this:

If you’re going to fund your account or pay them via credit cards, these companies are subjected to they pay hefty transaction fees.

With Libra, the fees are going to be a lot cheaper than traditional credit card transactions.

To sell you more services: Aside from Libra, Novi will be developing and supporting other financial services such as credit lines.

And while Facebook will provide the default app in order for users to access this currency, it will not have full control of this currency.

Customer retention: Companies are targeting potential customers who are interested with their services but don’t have credit cards.

They will also be able to keep existing customers by using Libra and encourage them avail of promotions by joining their partners.

Value of Libra

So how much will 1 Libra be in fiat currencies?

It’s going to be around a dollar and it’s expected that the value won’t fluctuate significantly.

And when it comes to the transaction fees, these are projected to be a small fraction of a cent.

Compared to other services offering money transfer or remittance, it is going to be a lot more affordable.

And if that’s not enough

Compared to credit cards, businesses that will support Libra will have much lower transaction fees.

Investing in Libra

Planning to invest in Libra?

If you have $10 million to spare, yes you could and you can even be a partner.

But what if you’re just the average Joe?

Your next best option is investing in companies that will support Libra.

Think about this for a moment…

The coin has already started picking up some steam so expect the number businesses and companies that will have support for this cryptocurrency.

Question:

Do you have this plan to invest in Libra for the purpose of believing that its value will skyrocket and give you substantial profits in the future?

Unfortunately, this is not the case for Libra.

Here’s why:

Since this digital currency will be backed by government currencies and securities, its value is expected not to fluctuate that much.

So it’s more like exchanging a dollar for a Euro.

In short:

Libra’s value is NOT expected to rise or fall dramatically.

There will always be some risk but the upside is that it’s not as risky as Bitcoin, Ethereum or Ripple which is susceptible to wild price fluctuations.

Here’s what you need to know:

Libra is not yet available but once it gets launched, most exchanges and brokers will likely offer them to their clients’ portfolio.

And since this will be Facebook’s cryptocurrency, it’s most likely to be hyped and a lot of traders are sure to ride the bandwagon due to the so-called FOMO or fear of missing out.

So what are your options right now?

Since Libra is not yet in circulation, your best bet right now are the companies behind Libra and this ambitious project which obviously includes Facebook and other known brands like:

- eBay

- Vodafone

- Uber

- Spotify

But wait, there’s more…

Since many experts are already convinced that Libra is the validation for the rise of cryptocurrencies, it would be wise to invest on the biggest ones currently circulating on the market:

- Bitcoin

- Ethereum

- Ripple

- Litecoin

- And more…

Trading Libra-related assets via CFDs

If you want to trade on any of the company shares that supports Libra or other rising cryptocurrencies brought about by the introduction of this new coin, then it would be wiser to trade them via CFDs or contract for difference.

With CFDs, you actually DON’T own the underlying asset and this can be a great trading alternative.

Here’s how it works

Basically, you’re buying a contract between you and the CFD service provider to pay the difference between the current price of an asset and the final price at the end of the contract time.

Bottom line?

CFDs are only based price movements and the contract is between you and your broker.

Using leverage

CFDs are leveraged product and this will allow you to increase your exposure to an underlying asset based on the leverage provided to you by your broker.

Do take note that if the market moves in your favor, the leverage might result in added gains but if the position moves against you, there’s also the risk of increased losses.

The safer way to trade

Investing in cryptocurrencies is a lot safer by trading them via CFDs instead of buying and selling them via digital exchanges where holders may suffer losses due to security issues.

With these exchanges, users are prone to malicious hacking and processing errors which is why it is better to trade them via CFDs as well.

If you’re looking for the best and the most trusted service providers which supports CFD trading on these underlying instruments, then we recommend the following brokerages.

These are licensed and authorized by trusted international regulators and are backed by powerful platforms and technology:

eToro

eToro has a unique social trading platform where you can invest in cryptocurrencies, stocks and other markets by copy leading investors.

eToro’s platform supports the following instruments that are linked with Libra:

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto investments are risky and highly volatile. Tax may apply. Understand the risks here https://etoro.tw/3PI44nZ

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

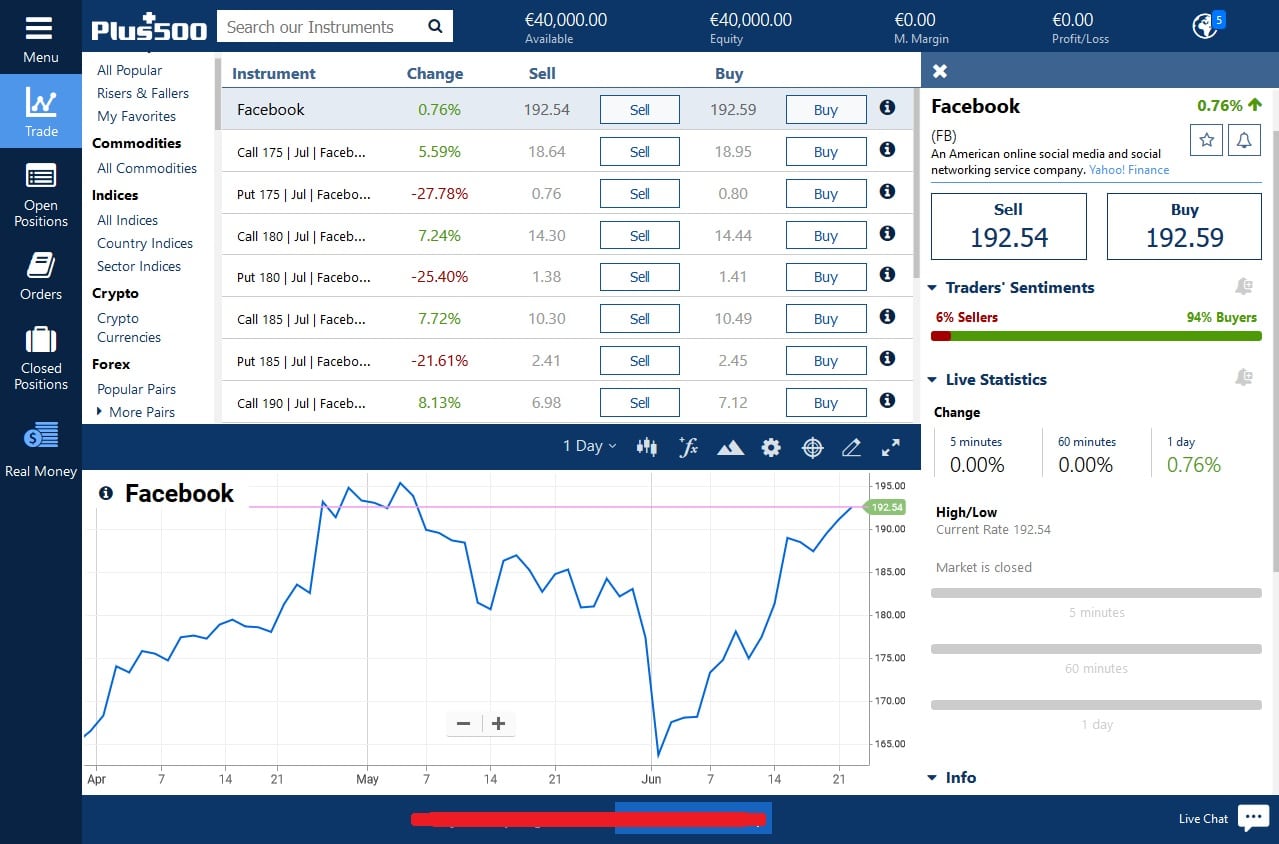

Plus500

Plus500 is an established CFD service provider that has developed a very stable and proprietary platform with all the necessary features and risk management tools for trading.

With Plus500, you can trade on the following Libra-related markets:

- Visa

- MasterCard

- PayPal

- Vodafone

- Iliad

- eBay

- Uber

- Lyft

- Spotify

- Booking Holdings

InvestMarkets

InvestMarkets has a full-feature platform with flexible trading conditions, client benefits and 24/7 support.

Via InvestMarkets, you can invest on the following assets that are partnered with Libra:

- Visa

- MasterCard

- Vodafone

- eBay

- Uber

- Lyft

- Spotify