*61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Fact:

Financial markets move because of the aggregate decisions of all the market participants at any given point in time.

Whether most of the participants are optimistic or pessimistic about the outlook of their respective investments, these are reflected in the price action at that point in time.

And to say that this year is rather eventful is an understatement. And the uncertainties brought about by the pandemic and the government regulations, apparently manifested in the financial markets as well.

We’ve seen the NASDAQ Composite Index go down by around 42%, then went up by about 70% and registered to new ALL-TIME highs.

As traders went on to buy technology-related names, the SPX and the Dow Jones Industrial Average indices have seen similar behavior.

The uncertainties brought about by this year’s events have made the traders rush through the door with their pessimism (or even maybe fear), then rush back in with their optimism.

What’s next in this volatility cycle?

If we can take away one thing so far from this year’s market behavior is that the action can head in the other direction quickly – and violent.

Although we will never know today what the upcoming market action will eventually turn out to be, what we can do right now is manage risk – and protect our downside if ever the market does sell-off.

Here are 5 ways that traders can do to prepare for that possibility:

1. Lessen Market Exposure

We could only lose the money that we are currently risking in the market.

By reducing the amount of money that we are putting at risk, we are protecting our downside. And if you use leverage, then you may lessen the leverage as well.

But here’s the thing where CFDs (or contracts for difference) provide a distinct advantage:

They are advantageous for they provide profit opportunities to traders REGARDLESS of what general direction the market is heading.

Furthermore…

Brokers such as Plus500, eToro, and Avatrade provide competitive bid-ask spreads that lessen the liquidity risk in times of market volatility.

2. Decide on how much drawdown is acceptable to you

Financial markets go up and down.

That is a reality that investors and traders must accept.

Let us take the S&P 500 Index for instance, taking data from October 2016, has been on an uptrend.

It has been up by more than 70% since its October close. But there have been many downward price movements in between.

If a 5% move to the downside is not acceptable to you, then you wouldn’t be able to participate in that uptrend as you would have already sold.

Do some number-crunching and ask yourself, what percentage are you able to risk holding on to, in favor of the possibility of a bigger reward.

What’s the real story?

CFDs, aside from providing trader opportunities to profit regardless of the direction, they also serve as hedges (being derivatives) to their respective financial assets.

They also act as means of diversification to help you handle that level of drawdown that you’ve prepared yourself for.

3. Consider the cash that you need

Remember this:

The outcome of a trade is never guaranteed the moment you take it. Consider the possibility of losing your capital as well.

Or maybe at least that capital won’t be giving you returns for quite some time.

Will losing that capital affect the lifestyle that you are living?

Do you have debts that you need to pay off?

Do you have enough cash to cover any unplanned events that may occur?

Consider these questions. Build an emergency fund. Pay off any short-term debts. Liquidity is still the key.

How can you actually use this?

Aside from considering your personal liquidity, it is also important that your brokers are fully regulated by reputable financial institutions.

Rest assured that AvaTrade, eToro and Plus500 are fully regulated in the countries where they provide their service.

4. Create a portfolio that matches your risk personality

Trading involves decisions on what to do with your capital. Hence, it is a personal endeavor.

People have different personalities and financial capabilities; hence we have different risk profiles and the capacity to take risks.

There are three kinds of risks that we have to keep in mind in terms of appropriateness.

- Risk tolerance is the risk level you are able to handle.

- Risk capacity is the risk level that you can afford to consider.

- Risk appetite is your preparedness to accept that risk.

You need to consider these factors and find a balance between them, then you are in a better position whatever the market throws at you.

The best part?

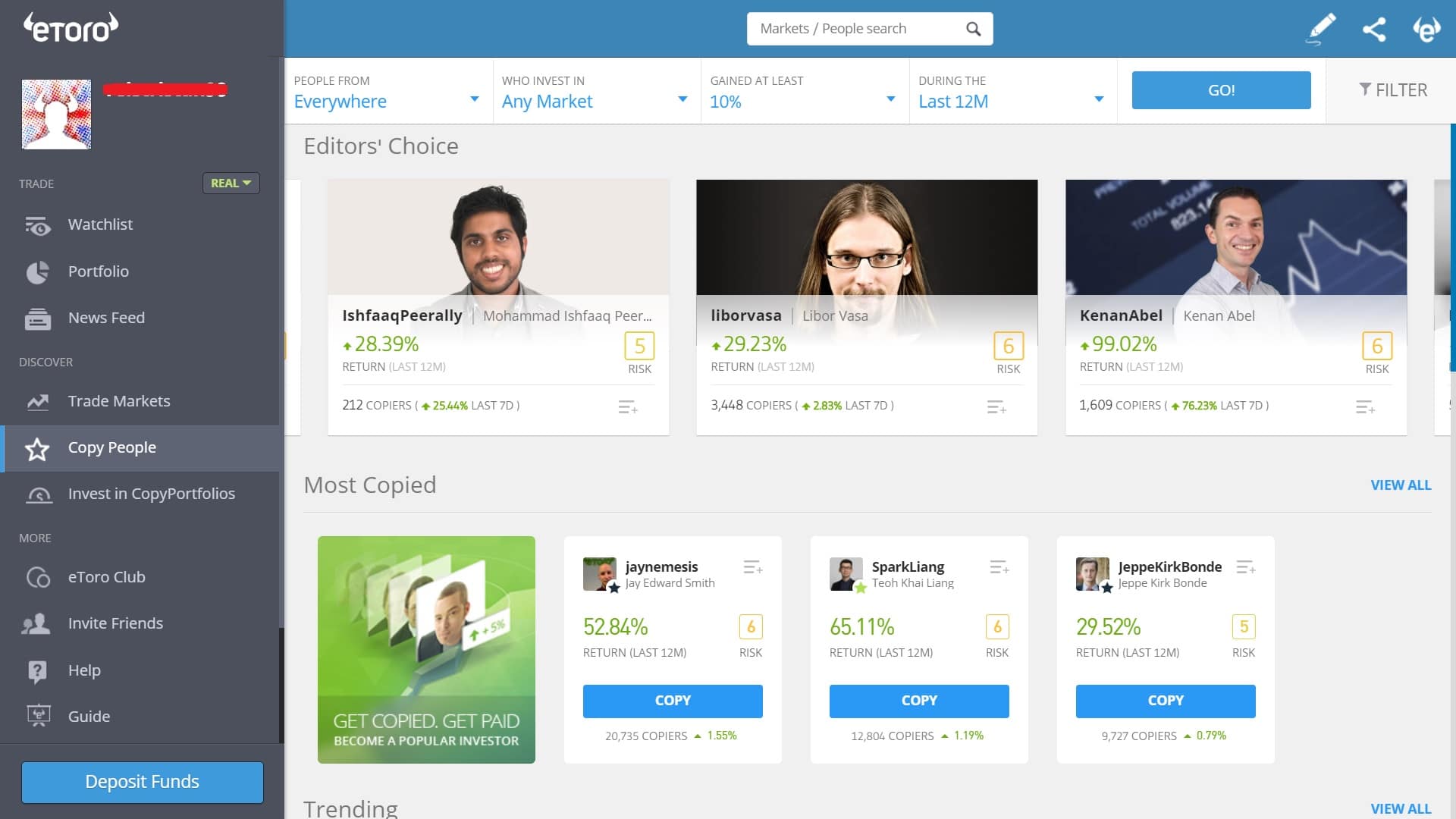

Being the ones who pioneered the social trading concept, eToro has this feature wherein you could copy the trades of other more experienced traders.

How can you actually use this?

You could find one whose trading fits yours; study the numbers; then copy their trades.

5. Write down your strategy

Trading is like any other business. The goal is to buy and then sell at a profit.

Or if selling short, sell at a higher price, then buy them back at a lower price – again for a profit.

Businesses have their own plans or strategies on how they will they be able to sell their products, create market share, and proceed on continuing their sales growth.

Trading should be like that as well.

Strategies and rules should be carefully planned so that the market decisions are informed, and not whimsical ones.

It’s a risk-reward game that’s full of uncertainties. Hence, writing down strategies should be able to help you prepare for whatever the outcome maybe.

I can’t emphasize enough…

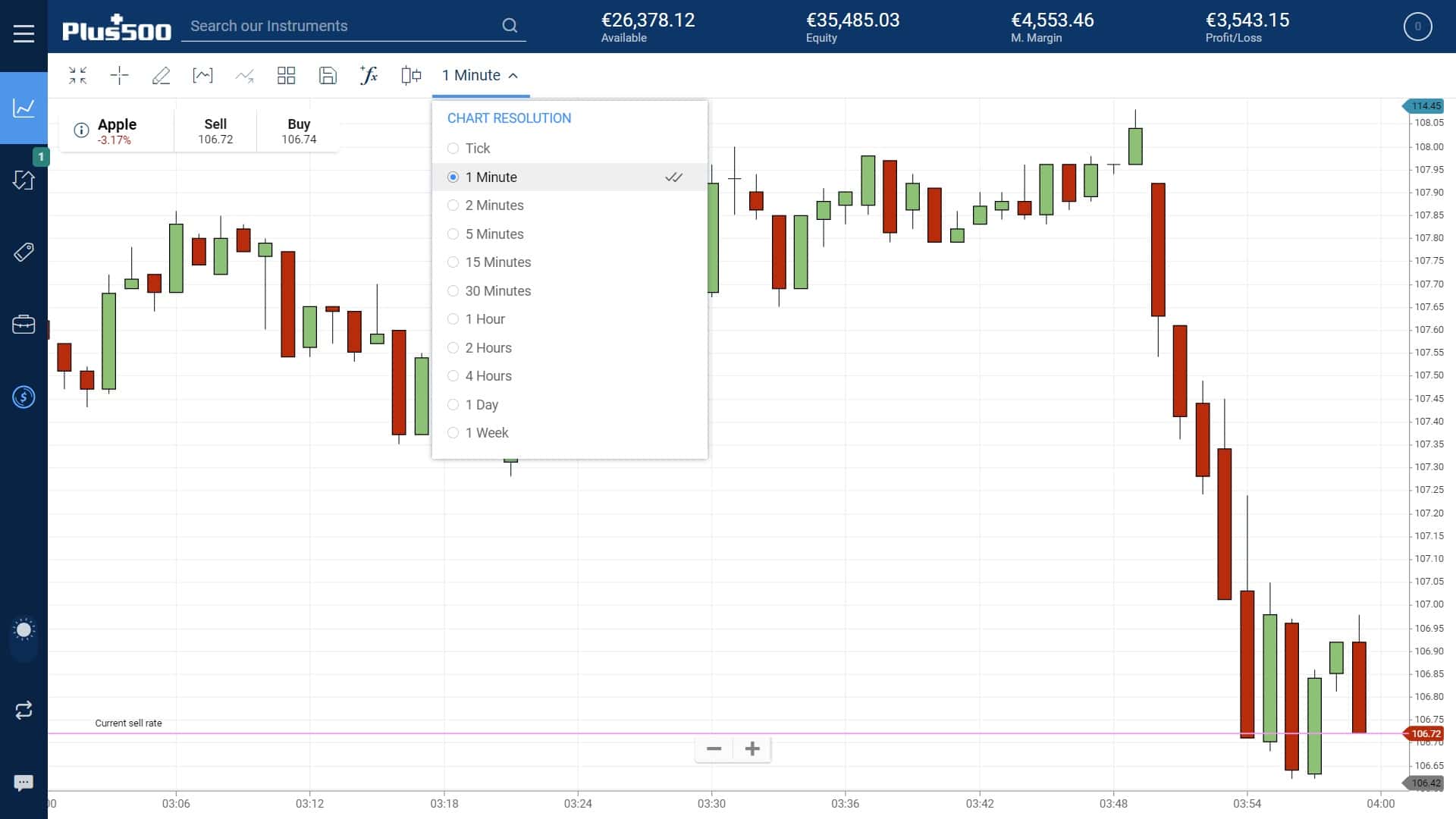

Industry leaders, such as Plus500, eToro, and AvaTrade have the data that you need in order to formulate a sound plan to prepare yourself for whatever eventuality the financial markets might end up with.

Their platforms contain data in different timeframes, to cater to the strategies of either short-term or longer-term traders.

Furthermore, they offer technical indicators, which are tools that are based on mathematical concepts, to help traders with their decisions.

To top it off…

Volatility has been a staple in the financial markets, and traders need to prepare for sharp movements of the financial markets in either direction.

We may not have any control on what the markets eventually decide to do. But we can focus on what we can control, and that is to manage our risk.

As industry leaders in providing CFD trading: eToro, Avatrade, and Plus500 offer us the tools that we need in managing our downside, as well as looking for opportunities to still profit – if the financial markets do indeed sell-off.

|

61% of retail CFD accounts lose money.

|

84% of retail CFD accounts lose money.

|

|

And here’s a final reminder on the importance of managing your risk.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.