Beyond Meat Inc., under the ticker symbol BYND, almost tripled climbing 163% at its IPO in their first day of trading on the New York Stock Exchange on Thursday.

The vegan products company is considered to be the best IPO so far in 2019 as its value soared to $3.8 billion.

That’s not all…

Traders will be able to trade BYND stock on eToro’s platform at the prevailing rate starting this week.

Shares priced ahead of the IPO debut on Wednesday were $25 a share. They climbed to $46 a share at the start of trading on the NASDAQ and rocketed to $65.75 at the close of the bell, hitting a record 163%. They continued to climb after hours adding another 4%.

Last Tuesday ahead of the IPO, they originally planned to offer 8.75 million shares at between $19 to $21 each. As it happened, Beyond Meat sold 9.63 million shares with the option of underwriters to sell an additional 1.44 million shares in the event of over-allotment.

The lead underwriters on the deal are JPMorgan, Goldman Sachs and Credit Suisse and the acting co-managers appointed are BofA Merrill Lynch, Jefferies and William Blair.

With a market cap of around $1.5 billion on Wednesday evening, it climbed to $3.8 billion on Thursday afternoon in its public debut boosting the company’s valuation.

According to the prospectus of Beyond Meat, to raise $250 million, Beyond Meat sold 9.5 million shares in the IPO. This will finance the expansion of existing manufacturing facilities in their plant-based meats and new ones, finance R&D, sales and marketing and be used for corporate purposes.

In their prospectus, the company said that in the foreseeable future they anticipate their operating expenses and capital expenditure to increase.

Due to continued investment in increasing their customer base, co-manufacturing partners, supplier network, investment in distribution and manufacturing facilities, hiring of additional employees and enhancing technology and production capabilities.

They observed that the expansion efforts may be more costly than anticipated and that they may not succeed to offset the higher expenses against the increasing revenues and margins sufficiently.

For the foreseeable future, Beyond Meat is not planning to pay a dividend which means that to generate returns investors will have to rely on stock gains.

Competition in the market

The fake meat market is becoming increasingly crowded. Money raised from the IPO will give Beyond Meat the muscle to compete with their rivals like Impossible Foods, a start-up in Silicon Valley.

According to news reports, Impossible Foods and Burger King started selling Impossible Whopper, a vegan burger in 59 stores in the St. Louis and Missouri area last month and expect to go nationwide by the end of the year.

Best performing first-day IPO in nearly 2 decades

According to Dealogic data, the last time a U.S. company that made an IPO with at least $200 million was in March 2000 during the dot-com boom with Palm Inc. and then in December 2010, Youku.com the Chinese internet company who at its debut on the NYSE shares climbed nearly 115%.

What’s the real story?

Beyond Meat, a Californian Company was founded in 2009 by vegan CEO Ethan Brown. The company substitutes meat by using proteins from peas, fava beans and soy with most of their revenue coming from their Beyond Burger patties, their flagship.

Today, Beyond Meat products, patties, imitations sausages and vegan ground beef are sold in over 11,000 stores throughout the U.S. and the first to have plant-based meat sold in the meat aisle at major grocery chains.

$37 million revenue was generated at restaurants and $50 million revenue came from retails sales in 2018 which included Amazon’s Whole Food Market and Kroger Co. supermarkets. Iceland saw a rise of 10% during the year in sales of their plant-based foods and more than 130 shops in Waitrose have a dedicated vegan section.

Expansion

Look:

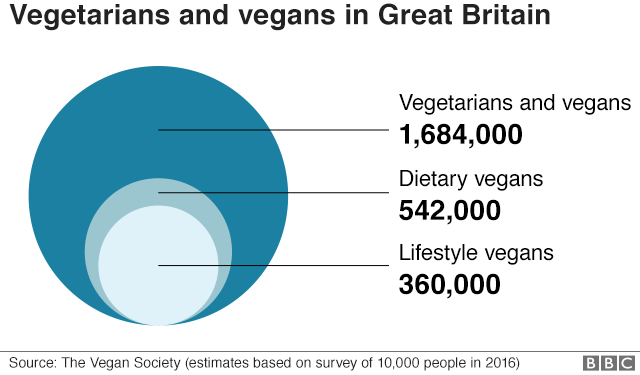

In 2016 there was around 540,000 vegans in the UK compared to 150,000 in 2006.

Now, vegans in the UK will soon be able to buy Beyond Meat products at one of the 350 Tesco stores. Supply issues have delayed the launch with estimates that the launch will take place in 3 months.

Beyond Meat plans to open manufacturing plants in Europe next year and already has secured a distributor in Hong Kong with the goal to expand into Asia.

Recently, Beyond Meat was recognized by Fast Company as one of the ‘most innovative companies’ for 2017.

At the launch of its IPO on the NASDAQ exchange, Ethan Brown said that there was an enormous opportunity for economic growth throughout American and the world for plant-based meat.

His ambitious plan is to take a good sized chunk of the $1.4 trillion global markets for meat.

A multi-billion dollar market

Now with big-name investors already at Beyond Meat like Leonardo DiCaprio and Microsoft founder Bill Gates, investors who are looking for the opportunity to make returns out of what is to become a multibillion-dollar market can trade Beyond Meats on eToro’s revolutionary platform.

How can you actually use this?

Initially, the total number of stocks will be limited and come on a ‘first come, first served basis with prices differing from the IPO price and available for long (BUY), non-leverage positions only.

However, more trading and investment options will be available after the market stabilizes.

The best part?

eToro’s CopyTrader feature allows you to copy the top portfolios of traders (CopyPortfolios) and with a network of over six million traders, there are plenty of options to choose from. In addition, you can copy and comment and discuss strategies.

The platform is easy to use and is suitable for new traders as well as more experienced professional traders. You have a big choice of the most popular assets to choose from, consisting of stocks, commodities, ETFs, fiat currencies and cryptocurrencies.

That’s not all…

It comes with powerful advanced financial tools where you can set limits with guaranteed stops, daily market analysis, live news feeds and more.

Take advantage of the free unlimited demo account that comes with virtual money to practice trades.

Look:

They have useful research data about this instrument but this is only available if you’re an active investor.

You also have access to eToro education program here you will have access to in-depth trading strategies for new stock.

Bottom line?

This is an exceptional opportunity for investors to turn a profit, remember ‘first-come’ ‘first-served’ the total number of stocks will be limited.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.