As a US-based biotechnology company, Moderna focuses on drug development and discovery, vaccine technology and its revolutionary messenger RNA (mRNA) technology comprising of a substance that help creates protein in the body.

Do you want to invest on Moderna? we’ll tell you how.

Overview

Status: Active

Sector: Healthcare

Industry: Biotechnology

Symbol: MRNA

Exchange: NASDAQ

Employees: 1,100+

Website: modernatx.com

Fact:

With a technology platform that make it possible to inject mRNA into human cells and help reprogram a human body to create immune security, Moderna has helped develop numerous vaccines such as the Covid-19 vaccine—therefore cementing a solid reputation in both the pharmaceutical and biotechnology industry.

And there’s more…

Moderna has a current value of $60 billion which is seen by financial observers as having a high odd of experiencing rapid increase, as the revenues from its Covid-19 vaccine enter the financial pipeline of the company. It is important to also note that Moderna’s Covid-19 vaccine is seen as the most promising among all the coronavirus vaccine developed today. Thanks to its minimum safekeeping requirements and high efficacy levels, Moderna’s Covid-19 vaccine is seen as the most in-demand inoculation in the market today.

Bear in mind….

In this article, we will study the option of investing on Moderna stocks by studying its stock performance history and analyst forecast of future share value.

If you’re ready, then let’s start learning about this good investment idea we have: investing on Moderna stock.

Table of Contents

Why Trade Moderna Stock?

Fact is:

Mirroring the 94.5% effectivity rate of the company’s Covid-19 vaccine, Moderna is also displaying effective performance on the stock market.

Thanks to an endorsement from the US Food and Drug Administration certifying Moderna’s experimental vaccine as ready to distribute, revenues are expected to further increase—as more than 200 million doses of Moderna’s vaccine becomes available.

Moderna Stock Performance

After going public in the latter part of 2018, Moderna has steadily built momentum by registering a 38% hike in 2019. Moderna’s stock has been on a rapid tear this 2020, seeing an almost seven-fold increase from last year.

After becoming the frontrunner in the Covid-19 vaccine race, Moderna’s stock further rose by hitting an all-time high on the opening day of December 2020.

eToro

Features:

- Copy investment portfolios of top Moderna traders

- Trade stocks commission-free

- Practice with a free demo account

- No overnight fees

- Risk management tools

Taking the online trading industry by storm, eToro has now garnered more than 13 million users since it was founded in 2006.

This highly-trusted e-trading application is the ideal investing tool for both seasoned and beginner traders.

Want to know how to use eToro? We will tell you how

- Sign up for an account by creating one at the sign-in page.

- Verify your personal information for security purposes.

- Make your first deposit.

- And as easy as 1,2,3, you can now start trading.

eToro’s fantastic set of features include:

CopyTrading – this is a robust feature that provides users a medium to search and copy successful traders for them to learn and invest properly.

CopyPortfolios – this is another valuable feature that teaches traders the proper way of expanding their portfolios without risking their investments by reducing the chances of experiencing losses through wise trading decisions.

And another thing:

The Analyst Coverage page is where users can find beneficial information about the industry, the market, company stocks, forecasts and other data you can use when making investment decisions.

eToro is also licensed by different regulatory bodies including the following:

- CySEC – Cyprus Securities and Exchange Commission

- FCA – Financial Conduct Authority

- ASIC – Australian Securities and Investments Commission

Plus500

Features:

- Competitive spreads for Moderna

- Trading with as little as $100

- Fast and reliable order execution

- Risk management tools

- Fully regulated by the FCA, CySEC and ASIC

Remember this:

The trademarked online trading platform of Plus500 is one of the most popular and highly-trusted tools used by investors for investing, trading and managing portfolios.

Trading made easier by Plus500

Plus500’s Integrated Risk Management Tools help users avoid investment risks by giving traders integrated control of their investment.

One more thing…

Plus500 online trading platform follows all rules and guidelines set by financial governing bodies and is regulated by leading regulatory boards:

- Plus500CY Ltd authorized & regulated by CySEC (#250/14).

- Plus500UK Ltd authorised & regulated by the FCA (#509909).

- Plus500SG Pte Ltd, licensed by the MAS (#CMS100648-1) and IE Singapore (#PLUS/CBL/2018).

- Plus500AU Pty Ltd (ACN 153301681), licensed by:

ASIC in Australia, AFSL #417727, FMA in New Zealand, FSP #486026; Authorised Financial Services Provider in South Africa, FSP #47546. You do not own or have any rights to the underlying assets. Please refer to the Disclosure documents available on the website.

Moderna Stock Forecast

Below is a summary of Moderna’s future and its relation to the potential value of its stocks.

These stock forecasts are based on current stock and company performance and is meant to guide your decision-making.

Remember, that the final decision is still yours to make.

2021: Post Covid-19 Innovative Drug Development

After the success of its Covid-19 vaccine, Moderna is looking ahead to the future with a multi-year plan of developing several innovative drugs passing clinical trials and becoming available to the public by 2025.

If this is realized—which the company is promising to do—investors will have more reasons to be bullish about Moderna’s long-term growth and success as a leading biotechnology company.

When these ground-breaking drugs starts generating sales, Moderna expect several to become blockbuster vaccines or therapeutic drugs that will help generate more than $3 billion to $5 billion in additional revenue per year.

Overall…

Our forecast for Moderna stock appears promising enough to reward stockholders with a return of investment and respectable profits ranging from low to medium.

2022: Developing a CMV Vaccine

After helping save the world from the 2020 pandemic, Moderna is still looking to save more lives by developing a CMV vaccine starting in 2021. Moderna has already earned “global commercial rights” to develop a vaccine for CMV (Cytomegalovirus)—a genus of viruses that a human body retains for life and affects one’s over-all health. As there are no existing vaccines yet available for CMV, Moderna hopes to be the first to develop one. If successful, then chalk up another $2-$3 billion of additional revenue for the company.

Our optimistic outlook for Moderna share value remains unchanged. Therefore, the chances of being rewarded for investing on Moderna stock ranges from medium to high.

How to Trade Moderna Stock?

Simply follow the steps below and you’re good to go:

-

-

Open an account with an online broker.

For you to trade Moderna stock and other company shares, first you need to open an account with a brokerage which offers a platform for trading.

Signing-up for an account only takes a few minutes to accomplish and after completing this process, you need to make a deposit so you can start investing.

-

-

-

Open your broker’s trading platform.

Let’s say you have opened an account with a specific brokerage and you have already funded it. The next step to do is to open their platform to start trading.

-

-

-

Look for the Moderna stock (symbol: MRNA).

After opening the platform, search for the Moderna stock by using the search bar and entering either “Moderna” or its stock symbol “PFE”.

-

-

-

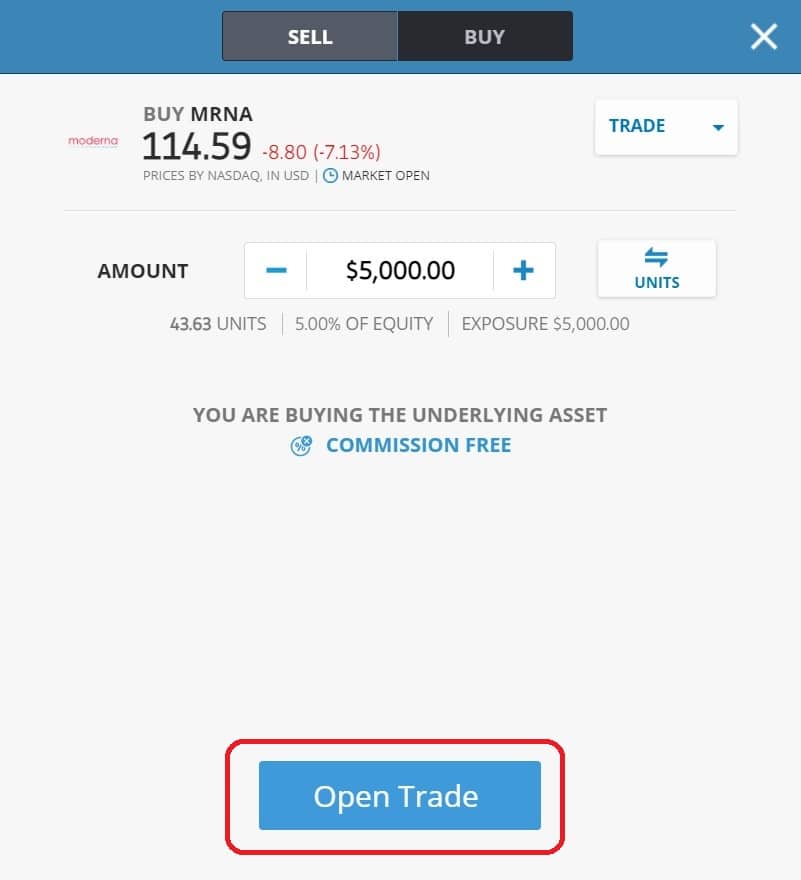

Select Trade and set the amount.

Click on “Trade” and specify the amount that you wish to invest. You may also set several specific parameters depending the features that are offered to you by your broker.

-

-

Execute the order.

Initiate the trade by executing the order.

|

Should I trade Moderna stock?Yes. As Moderna leads the pack of the Covid-19 vaccine race, analysts are seeing a bright future ahead for this biotechnology company with revenues hitting an average of $2-3 billion a year. Aside from its coronavirus vaccine, Moderna is also banking on its major plans to acquire several profitable smaller drug companies, to add on to its profit. Given the many creative ways Moderna is undertaking to inject more earnings, shareholders also stand to gain in the future success of the company—even after the Covid-19 pandemic. So, are you are ready to trade Moderna shares? If you are now sold on trading and trading Moderna stocks, then we highly encourage you to look for a highly trusted and regulated brokerage firm that can promise you appropriate management and control of your investments, and also provide you with a peace of mind.

|

Frequently Asked Questions (FAQ)

How Much is the Moderna Stock?

Here is the current stock market price of ( )

Who Owns the Most Shares of Moderna?

FMR, LLC owns the most number of Moderna shares with 34,221,324 stocks valued at $2,421,158,673.

How Many Outstanding Shares Does Moderna Have?

Based on latest figures, Moderna’s outstanding shares is 395.71 million.

Where Can I Trade Moderna Stock?

When trading Moderna stocks, we highly recommend the two leading online trading platforms used by many traders today. These are the Plus500 and eToro, two popular CFD (contracts for difference) trading applications trusted by investors all over the world.

Best Brokers for Trading Moderna Stocks

We’ve prepared a table of the most trusted and regulated brokers that offers Moderna stock CFD trading services.

All you have to do is click on the Moderna Page button of your preferred broker and you will be taken straight to their stock trading page.

| Broker | Features | Rating | Official Site |

|---|---|---|---|

|

|

Min Deposit: $200 Regulation: CYSEC, FCA

|

96 |

|

|

|

Min Deposit: $100 Regulation: FCA, ASIC, CySEC

|

95 |

|

|

|

Min Deposit: $100 Regulation: CBI, ASIC, FSC, FSA, FSB

|

94 |

|