Introduction or Skip Content and Read the Bottom Line!

Markets.com was founded in 2008 and is authorised and licensed by several financial regulators including the Australian Securities and Investments Commission, the Cyprus Securities and Exchange Commission and the Financial Sector Conduct Authority in South Africa.

This online trading broker is operated by a group of regulated entities and claims to be one of the world’s fastest growing Forex and CFD providers.

The question is..

Can they really prove this statement? And the bigger question:

Is Markets.com safe?

Let’s find out the truth with our in-depth and detailed review.

| Founded | 2008 |

| Platform | Marketsx, Marketsi, MT4, MT5, Mobile |

| Minimum account size | $250 |

| Minimum lot size | 0.01 |

| Tradable assets | 2,200+ |

| Maximum margin | 1:30 |

| Spread on EUR/USD | 1.80 pips |

| Payment methods | Credit Card, Wire Transfer, Skrill/Neteller, PayPal, Local Bank Transfer, Ideal, Sofort |

| Demo account | Yes |

| Accepts US traders | No |

| Regulated | CySEC (Cyprus), FSC, (BVI), ASIC (Australia), FCA (UK), FSCA (South Africa) |

| Support | Phone, Email, Live Chat |

| Website | www.markets.com |

Registration 10/10

The initial stage of the registration via their website is very basic and won’t require you a lot of details.

You only need to enter your email and your desired password, and set your preferred account currency (USD, EUR, DKK, GBP, NOK, JPY, AUD, CAD, SKK or ZAR).

Alternatively…

You may also easily sign-up if you have an account from the following:

- Apple

Look:

This process won’t even take you more than a minute to accomplish so it’s a great advantage as compared to other brokerages that would be asking for a lot of information before you can open an account with them.

Kudos to Markets.com for making it a lot simpler.

But of course…

You need to complete the registration process in order to deposit funds and start live trading but you can do this later should you just want to explore the demo account and test out its features.

Should you decide to continue and finalize the registration, the following are the forms and sections that you need to complete:

- Personal Information

- Tax Information

- Financial Information

- Trading Experience

- Financial Knowledge

Here’s the thing:

This entire process won’t take you all day.

In fact, we only spent around 5 minutes in total so it’s really not time-consuming at all.

Account Types 10/10

Generally, there are 2 types of accounts that are offered by Markets.com:

- Retail – The standard account that are usually availed by most users.

- Professional – This is ideal for experienced traders that have a capital of $500,000 or higher.

In addition…

They also offer Islamic accounts and this was created especially for traders who are strictly following the Sharia principle of interest-free trading.

So if you want to avail of this account type, then be sure to get in touch with your account manager or contact the customer support.

Open an account with Markets.com!

Demo Account 10/10

Don’t forget:

A demo account is your best option to explore the trading platform and see how it works.

What makes this feature very useful is because you can even do trades in practice mode so you won’t have to use the real funds from your live account.

It’s risk-free and best of all, free to use.

When you use the Markets.com demo account, you’ll be able to experience the live trading environment with real market prices and market conditions but of course, your access will be limited to practice mode.

You will be credited with a $10,000 virtual fund which is ample enough for you to explore and make practice trades risk-free.

It’s important to remember:

Using a demo account is a great way to experience the platform but eventually, you need to build your confidence and transition yourself to live trading.

How to access the Markets.com demo account?

Switching between the demo and real account on the Marketsx platform can be done by accessing the menu (the three lines) at the top right corner of the interface.

Look for the “Switch to Demo” button to access the platform in demo mode.

If you wish to go back to live mode then simply access the menu again and click on the “Switch to Real” button.

It’s as simple as that.

Payment Methods 10/10

As of press time, Markets.com broker accepts the following deposit methods:

- Credit card

- Wire transfer

- Skrill/Neteller

- PayPal

- Local bank transfer

- Ideal

- Sofort

It’s good to know that they cover these common payment methods because this makes it convenient to transfer funds into the account since there are a lot of options.

We can’t emphasize enough…

The more payment gateways that they support, the better because it gives you the flexibility to top-up your account in a variety of ways.

How can you actually use this?

Picture this: Your credit card, which is the primary payment method that you’re using to fund your trading account, is suddenly not working.

Oh no! What to do now?

Since you have a PayPal account and Markets.com also accepts this option, you won’t have to worry about adding more funds because there are plenty of alternatives.

Minimum Deposit 7/10

The minimum initial amount that you can deposit into your account after the registration is $250.

So how does it compare with the others?

It’s an acceptable capital size which is not that low but definitely not that high as well.

Reality check:

Let’s say they do accept a minimum deposit of $1, the practical question is are you really going start with that small capital to trade?

With just $1 or $5??? We don’t think so.

And that is why we believe that Markets.com’s $250 minimum deposit requirement is reasonable.

Platforms 9/10

Markets.com has diversified their platform offerings and this is definitely good news for traders because there are now more options to choose from:

- Marketsx

- Marketsi

- MT4

- MT5

- Mobile

What we liked about these platforms is that they were tailored for easy access since trading can be done not just with a PC, but also with other devices such as laptops, browsers, mobile phones and tablets.

That means you can just tap on your mobile device and instantly access your trading account.

Knowing that this is already integrated with MetaTrader 4 and 5 gives us an assurance regarding its stability.

There’s more…

The newly launched Marketsi will allow you to invest on real stocks from around the globe with the opportunity to create and manage your own dynamic stock portfolio.

Just to be clear:

Marketsi offers real stocks while MarketsX offers CFDs.

Here’s a preview of their platforms:

Design 10/10

The Marketsx layout is more visually appealing compared to the other platforms that we’ve tested in the market.

The interface doesn’t take up a lot of system resources which makes it very light to browse even if you have live graphs and rapidly changing market prices.

It’s also worth mentioning that:

They were able to integrate all the essential functions and services on the platform so you won’t have to jump to different pages.

You can access positions, orders, alerts, events, signals, financial news, financial commentaries and even their XRay live-streaming service direct from the main screen.

How cool is that?

In addition…

The Marketsx has a dark theme which is a really nice feature to use if your eyes prefer a less bright interface.

This is a great advantage since the white background can cause eyestrain especially if you’ll be using the trading platform for hours.

Tradable Assets 9.7/10

With Markets.com, it’s easy to find a good number of instruments to invest on as it has over 2,200 choices and this gives traders better opportunities to make a profit since there are lots of assets to choose from.

And did you know?

They are among the top brokerages that we have reviewed to offer such variety and number of instruments.

With such an array of choices, it’s definitely worth giving them a notably high score.

Below are the financial instrument categories that you can invest on with this online brokerage firm:

Currencies

This will give you access to plenty of FX pairs including the most popular ones like EUR/USD, GBP/USD, EUR/GBP, USD/JPY, EUR/CHF, AUD/USD, EUR/JPY, GBP/JPY, USD/CAD, USD/CHF and others.

Commodities

Metals and energy sectors are available under this category. That includes gold, silver, copper, natural gas, spot Brent oil and spot crude oil.

Indices

You’ll find a good selection of global indices such as Germany 30, USA 30, UK 100, Europe 50, US Tech 100, USA 500, VIXX, Australia 200, Hong Kong 45 and even the Dollar index.

Stocks

There are a lot of shares CFDs available and this includes the big names in stock market like Alphabet (Google), Netflix, Apple, Deutsche Bank, GlaxoSmithKline, Tilray, Tesco and plenty of other popular companies.

Cryptocurrencies

Crypto CFD trading is now possible with Markets.com. You can invest in Bitcoin futures, Ethereum, Bitcoin Cash, Dash, Litecoin and Ripple.

Let’s not forget:

Buying/selling cryptocurrencies from a digital exchange is not similar to trading crypto CFDs.

Minimum Lot Size 10/10

Similar to other brokers, you can place a minimum lot of 0.01 so if you’re used to this size then this won’t be a problem when you trade with Markets.com.

Look:

For newbies or those that have no trading experience, a lower lot size is the better and safer option.

Spreads 8.4/10

One of the most important factors to consider when choosing a broker to sign-up with is the spread.

Why is it so?

Because this will measure the possible profits or losses that can result out of a trade.

Let’s accept the fact that:

People trade on forex for the purpose of making money and which is why a good spread is highly important.

The good news is this:

Markets.com offers very tight spreads and in fact they have narrowed it down further for as low 0.6 pips for the EUR/USD pair which is competitive and promising.

Even spreads for other interesting sectors are also very attractive: 0.3 pips for gold, 0.8 pips for Germany 30 and 1 pip for UK100.

Alongside is their Marketsx brand which continues to offer trading across their WebTrader, MT4 & MT5, offering very competitively low spreads.

Quotes Accuracy 9.5/10

Re-quotes are not that common even when the markets are shaken up.

There were no discrepancies between the prices at the time we placed the order and the time that it was executed and this merits Markets.com a Quote Accuracy Score of 9.5.

Withdrawal Time 8/10

Delayed withdrawals is one of the major factors that traders are concerned about when choosing a brokerage.

At Markets.com, the processing time only takes 2 days for most payment methods.

But do take note that:

There’s an additional 5 to 7 days more for you to wait for the funds to reflect on your banking account and this is already handled by your chosen payment method.

This means this brokerage is able to do their job faster than their competition and this deserves a Withdrawal Time score of 8.

Customer Support 9/10

Always remember:

Good customer service is important especially if you’re looking for a broker that you can count on.

Never settle for a company that won’t even have the time to answer even the most basic questions because you need to feel that they treat you as a valued client.

And that’s what we tried to determine when we tested Markets.com’s customer service quality.

Get this:

Their Knowledge Centre has a lot of information about their services and it’s more than just a regular FAQ page.

It also has the latest financial news, in-depth market analysis and even features their highly informative Xray live-stream service.

So how do you contact Markets.com?

This broker can be reached via phone, email and live chat.

Our first test was done through their 24-hour phone support and surprisingly, the waiting time was just around 5 seconds before we were able to get in touch with one of their agents.

We threw a lot of questions and in general, they were very accommodating and were able to provide the most precise answers.

Next…

We sent the same questions to their email support and the answers that we received were basically the same as what they provided to us over the phone.

It’s also notable that we were able to get a response from the email support team in less than 30 minutes which is quite fast as compared to other brokerages that usually take more than a day to answer such queries.

And finally…

We also tested the live chat support which is integrated on their platforms.

This feature is easily accessible via the menu at the top right corner of the interface.

Their answers to our questions were also consistent to the ones that we received via phone and email and in terms of speed, they answer really fast.

To sum it all up:

Our customer service experience with Markets.com went above and beyond what we expected.

Regulation and License 10/10

Markets.com is operated by a group of entities and every entity has a license from relevant authorities in their jurisdiction:

- Cyprus Securities and Exchange Commission (CySEC) – operated by Safecap investments Ltd under license # 092/08.

- Financial Conduct Authority (FCA) – operated by TradeTech Alpha Ltd with registration # 607305.

- Financial Sector Conduct Authority (FSCA) – operated by TradeTech Markets under license no. 43906 as a Financial Services Provider in South Africa.

- Australian Securities and Investments Commission (ASIC) – operated by Tradetech Markets (Australia) Pty Ltd with ACN 158 641 064 under license # 424008.

- B.V.I Financial Services Commission (FSC) – operated by TradeTech Markets (BVI) Limited under the Securities and Investment Business Act, 2010 with license # SIBA/L/14/1067.

We checked all these licenses and registration numbers and were able to verify that all of them are active.

Here’s the deal:

The fact that they are able to get licenses from these trusted financial authorities means that they are abiding by their strict regulatory guidelines.

Credibility 9.1/10

As previously stated, Markets.com is licensed by several financial regulatory bodies.

To be specific under their CySEC license, they are also providing the new brand Marketsi for investment in real stocks.

Here’s the deal:

They are under a company that is operated by a FTSE 250 subsidiary.

These are notable advantages because it gives traders peace of mind because their broker is monitored by regulatory regimes for investment services.

Their reputation in the business is also quite good.

In addition to that…

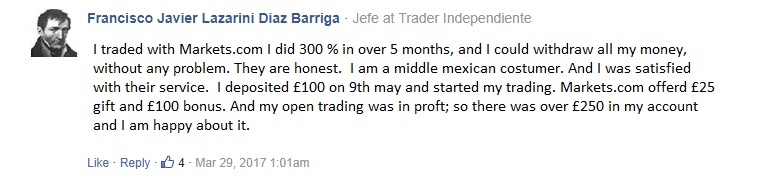

After an intensive online research, we found that the majority of the reviews and comments were positive while the negative comments were at a marginal range.

This warrants Markets.com a high Reputation score of 9.1.

|

Conclusion 9/10

What sets Markets.com apart from the rest is that they provide a more individual approach to the world of trading and investing. And the added advantage is that it has a lot of notable features like their extensive platform offerings, impressive platform design and the wide range of assets. Most especially… Their credibility in the business is exemplary and this is proven by the good number of positive comments from forex traders and the existing licenses that they have from various financial regulators. So if you’re in search of a forex and CFD broker that is credible, safe and offers top-notch features then Markets.com is no doubt among the best options to consider.

|

Thanks for this updated review. I highly agree that their service has improved a lot. I’ve been with Markets since 2015 and I’m very much satisfied. 👍

Check if you can make a demo account with them and see the spreads and leverage they offer. They have a really good offer lately.

They offer trading with cryptocurrencies, but am not so sure if they do offer spread betting on their platform

Do they offer spread betting on cryptocurrencies?

If I wasn’t able to connect with them via live chat, I was able to send them message of inquiry via email and I immediately got a response.

I have been with this broker for quite sometimes now, and I think that you can easliy reach or contact their support staff if you need them.

Can you help me check how reliable is this broker? I like the spreads they offer, I just wanted a broker that I can reach easily when I have to.

Can I use Paypal as my payment method for markets.com?

Yes. I’m always using Paypal to fund my account. It’s safe and easy.

Was the 1:200 leverage offer from this broker as profitable as I think?

I think the answer depends on how much profit percentage we are talking about.

What if the traders are expecting like up to 200% profit, what are some of the useful ways to do that?

Is it easy to register for a demo account with this broker?

I just used my valid email for the registration and presto I was able to use the platform through my demo account. If you wish to make it into a real money account, just follow the instructions on how to deposit and trade.

You need to have a valid email address to get a confirmation link for your demo, so I may say that setting up a demo account with markets.com is easy.

What is more exciting about markets.com is that they are always finding ways to improve themselves. They upgraded to web-based platform aside from MT4 and MT5.

Do they have the MT4 and MT5 webtrader or they have a separate webtrader platform?

I think that they have a separate webtrader platform. You can try it by signing-up for a demo account.

They have this new webtrader and I was able to experience it first hand on my trades. Now, it is more easier to trade forex and other stuff because the platform is very user friendly.

I sign-up for the demo account in the webtrader and I fully enjoyed the platform and I end up enlisting for the real money account. I really had a great experience with them.

The web-based trading screen has improved a lot as compared to last year. The social stream is indeed a nice feature.

I find trading with Markets to be much more opportune than with the other brokers I have signed-up with. Their tight spreads are one of their best advantages.

I like the social trading on Markets.com, very impressive

They always answer me promptly at customer service

Good broker, I have had an amazing time trading with Markets.com, made some pretty good trades and handsome profits

trading through markets.com platform allows me a better leverage.

Very professional broker they everything I could wish for from a great platform to lots of assets and they are safe and regulated. Customer service is good too!