As a sign of progressive times, the world has seen a licensed cannabis producer expand market in Canada, South America and parts of Europe.

Do you want to invest on Aurora Cannabis? Now is the HIGH time and we’ll tell you how.

Overview

Status: Active

Sector: Healthcare

Industry: Drug Manufacturers—Specialty & Generic

Symbol: ACB

Exchange: NYSE

Employees: 2,779

Website: auroramj.com

Wait, there’s more…

Comprising of eight production facilities covering operations in twenty-five countries, Aurora Cannabis produces more than 630,000 kilograms of cannabis per year since it was founded in 2006.

That’s not all…

After Canada legalized the production of “cannabis 2.0” products in October 2019, Aurora Cannabis immediately cornered 27% of the market for its Cannabis Drift Oils products.

This resulted into a huge jump in its revenue.

Bear in mind…

The company also acquired Reliva, a company producing CBD—or cannabidiol, a non-psychoactive extract of cannabis—to get a large market share in the United States.

With the entry to the US market, forecasts put Aurora Cannabis to achieve a sale of more than $25 billion by 2025.

In this article…

We will explain to you the promising options that Aurora Cannabis present to investors, based on its current market performance and future business expansion and growth.

Please take note…

It is important to create a plan FIRST on what you want to achieve: like if you are aiming for a short-term or long-term investment before you start trading stocks.

Table of Contents

Why Trade Aurora Cannabis Stock?

Following the movement of cannabis legalization happening over North America—which includes 11 US states—expect Aurora Cannabis to expand its operation and cash-in on additional revenue.

At a current affordable value per share, analyst see a huge room for growth for Aurora Cannabis stocks, especially if it starts making correct partnership with other giant companies and improve its balance sheet in the coming year.

eToro

Features:

- Copy investment portfolios of top Aurora Cannabis traders

- Trade stocks commission-free

- Practice with a free demo account

- Risk management tools

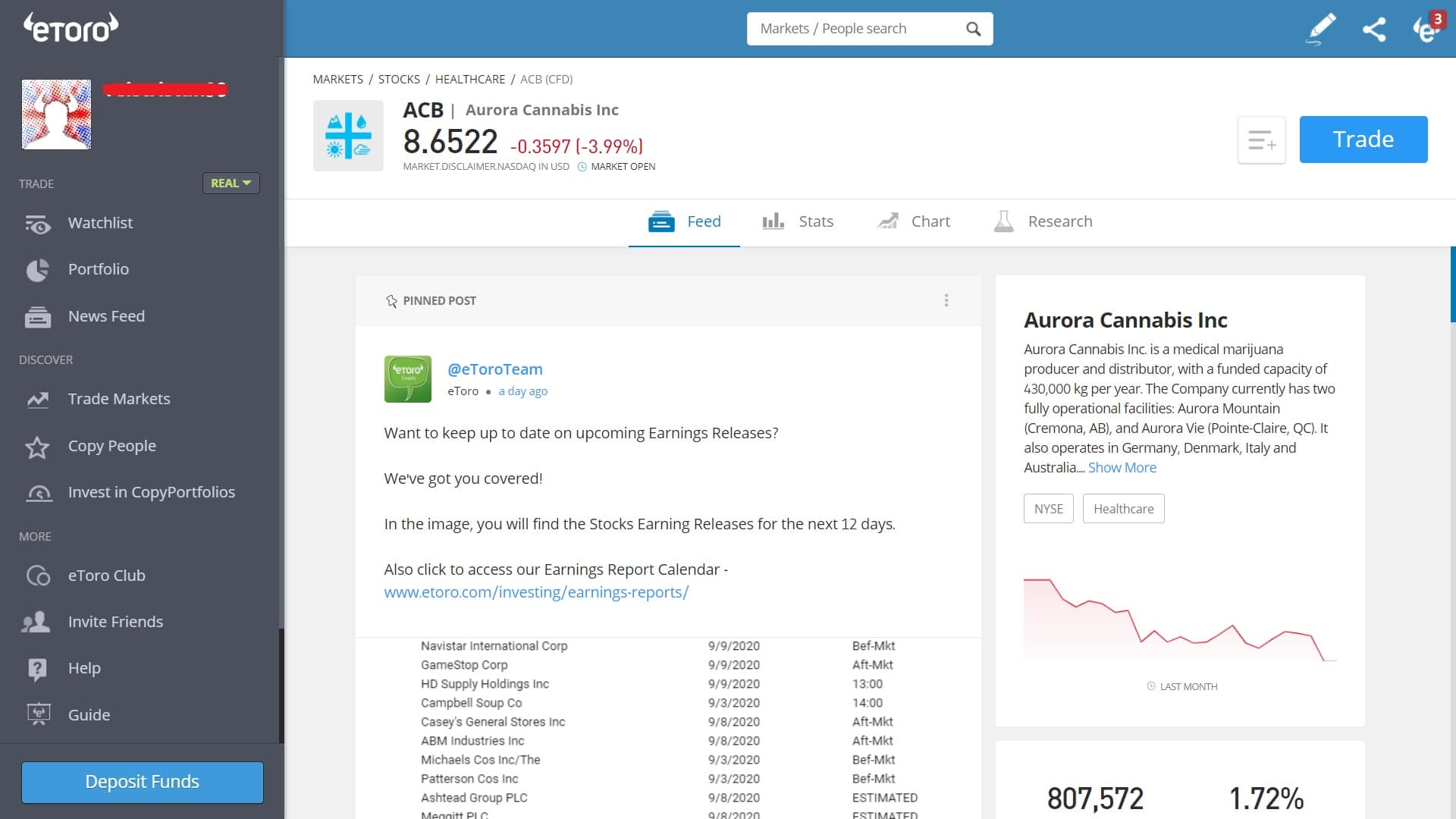

Patronized by a growing number of investors—now approaching 13 million users—eToro is a highly trusted e-trading platform perfect for both beginner and seasoned traders.

Want to know how to use eToro? We will tell you how:

- Create an account by inputting your information on the sign-in page.

- Verify your personal information for security purpose.

- Make your first deposit.

- And as easy as 1,2,3, you can now start trading!

eToro’s fantastic set of features include:

CopyTrading is a feature that allows users to search other successful traders and copy their strategies.

This feature provides a good learning curve for novice traders.

CopyPortfolios is another useful feature that guide traders on how to expand their portfolios while reducing risks on their investments.

And another thing:

The Analyst Coverage page is where loads of useful information about company stocks, forecasts and other data can be found.

This will help you reach your goals in the world of stock trading.

eToro is also regulated by different regulatory bodies including the following:

- CySEC – Cyprus Securities and Exchange Commission

- FCA – Financial Conduct Authority

- ASIC – Australian Securities and Investments Commission

Plus500

Features:

- Competitive spreads for Aurora Cannabis

- Trading with as little as $100

- Fast and reliable order execution

- Risk management tools

- Fully regulated by the FCA, CySEC and ASIC

Remember this:

The trademarked application of Plus500 is one of the most widely-used online trading platform for investing and managing portfolios.

Trading is made easier with Plus500

The integrated risk management tools of Plus500 help users sidestep investment risks while giving users total control of their investment.

One more thing…

Plus500’s online trading platforms follow all rules and guidelines set by financial governing bodies and is licensed by leading regulatory boards:

- Plus500CY Ltd authorized & regulated by CySEC (#250/14).

- Plus500UK Ltd authorised & regulated by the FCA (#509909).

- Plus500SG Pte Ltd, licensed by the MAS (#CMS100648-1) and IE Singapore (#PLUS/CBL/2018).

- Plus500AU Pty Ltd (ACN 153301681), licensed by:

ASIC in Australia, AFSL #417727, FMA in New Zealand, FSP #486026; Authorised Financial Services Provider in South Africa, FSP #47546. You do not own or have any rights to the underlying assets. Please refer to the Disclosure documents available on the website.

Aurora Cannabis Stock Performance

A low-risk stock with medium to high success

After experiencing some road bumps the last year due to regulatory issues, Aurora Cannabis is primed for a comeback after marijuana was declared as an “essential item” in many United States localities and in Canada, during the COVID-19 pandemic.

With a market cap of $1.1 billion, the stocks of Aurora Cannabis remained SOLID even after it went through a reverse split early this year.

Aurora Cannabis Stock Forecast

Below is the stock forecast of Aurora Cannabis based on current market value and the future of the company.

Please take note:

These are forecasts made based on the current stock and company performance of the company and is meant to guide you on your decision process.

Remember, that the final decision is still yours to make.

2020: Rebounding from a Crisis

Admittedly…

Aurora Cannabis owned up to some struggles in the market and in the whole cannabis industry due to regulatory issues and the effect of the COVID-19 pandemic.

But…

Under a new leadership of its recently-hired CEO, Aurora Cannabis is all set to rebound from the crisis of 2020 by planning a series of acquisitions and expanding markets to existing and new territories.

And so, we recommend….

While Aurora Cannabis is a safe bet right now, it will be also alright if you can wait a bit to see where the stock of Aurora Cannabis is headed.

2021: Riding the Strong Canadian Cannabis Retail Market

Take this:

Aurora Cannabis is expected to take advantage of the growing cannabis market in Canada and some regions in Europe in the coming years.

Basing it from the current situation, 2021 should be the year for Aurora Cannabis to experience HUGE revenue again.

How to Trade Aurora Cannabis Stock?

Simply follow the steps below and you’re good to go:

-

Open an account with an online broker.

For you to trade Aurora Cannabis stock and other company shares, first you need to open an account with a brokerage which offers a platform for trading.

Signing-up for an account only takes a few minutes to accomplish and after completing this process, you need to make a deposit so you can start investing.

-

Open your broker’s trading platform.

Let’s say you have opened an account with a specific brokerage and you have already funded it. The next step to do is to open their platform to start trading.

-

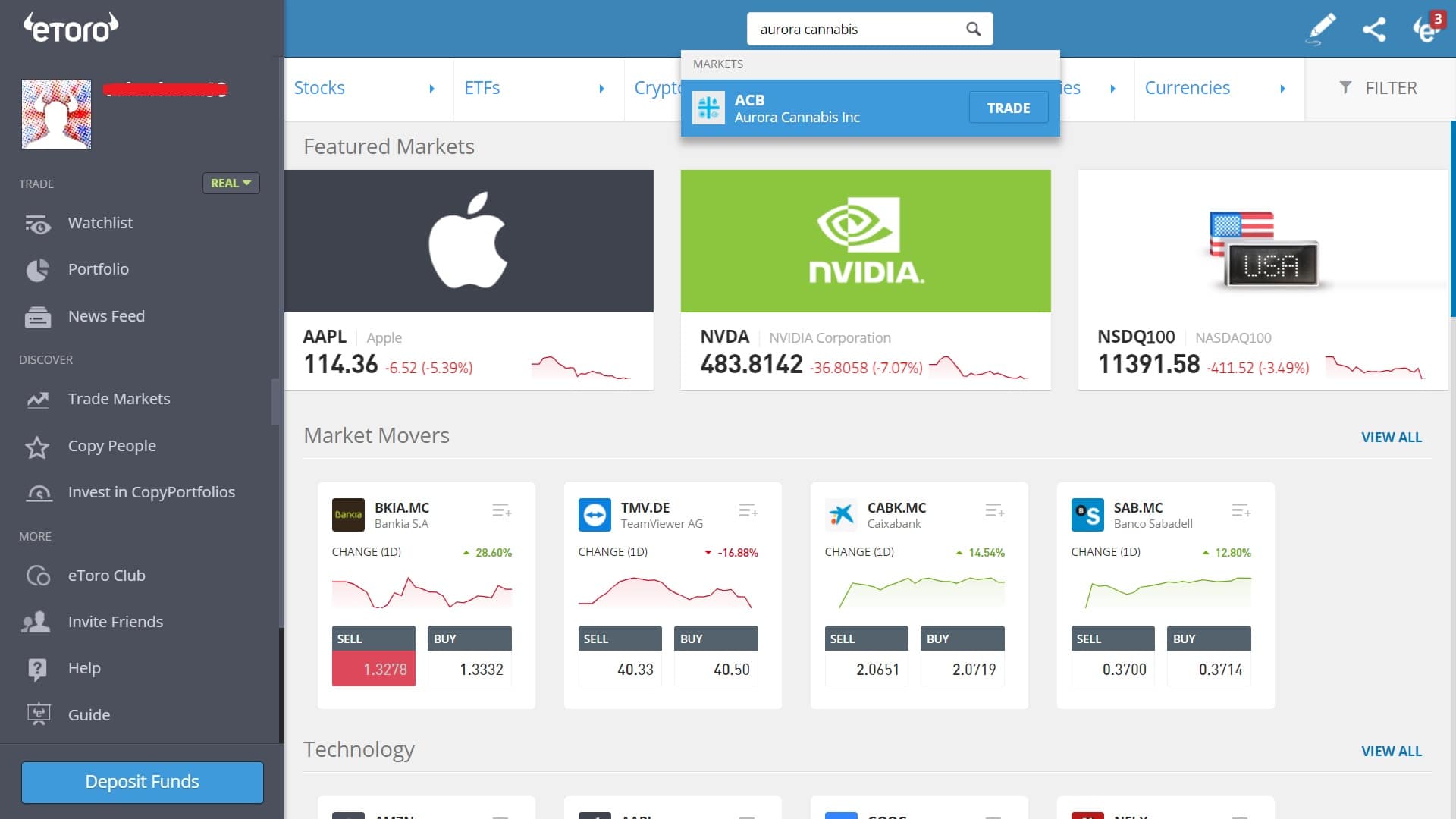

Look for the Aurora Cannabis stock (symbol: ACB).

After opening the platform, search for the Aurora Cannabis stock by using the search bar and entering either “Aurora Cannabis” or its stock symbol “ACB”.

-

Select Trade and set the amount.

Click on “Trade” and specify the amount that you wish to invest. You may also set several specific parameters depending the features that are offered to you by your broker.

-

Execute the order.

Initiate the trade by executing the order.

|

Should I trade Aurora Cannabis stock?Analysts foresee a bright future for Aurora Cannabis due to many factors such as wider legalization of cannabis in many regions in the world and lifting of regulations, that will create HUGE revenue stream not only to the company, but also to the whole industry of cannabis producers. Add to this rosy future, is the forecast that Aurora Cannabis will achieve more profitability in 2021 and 2022. With its affordable current stock value, investing on Aurora Cannabis share offers a low-risk and medium to high rewards. |

Frequently Asked Questions (FAQ)

How Much is the Aurora Cannabis Stock?

Here is the current stock market price of ( )

Who Owns the Most Shares of Aurora Cannabis?

The American investment advising firm the Vanguard Group, Inc. owns the largest number of Aurora Cannabis shares with 2,971,470 shares worth $26,743,000.

How Many Outstanding Shares Does Aurora Cannabis Have?

Based on latest figures, Aurora Cannabis’ outstanding shares is 112.89 million.

Where Can I Trade Aurora Cannabis Stock?

We recommend using the leading online stock trading platforms of Plus500 or eToro when trading and trading for Aurora Cannabis stock. These two leading CFD (contracts for difference) trading app are two of the most-trusted trading platforms in the world today.

Best Brokers for Trading Aurora Cannabis Stocks

Below are the most trusted and regulated brokers that we recommend for you to trade ACB stock CFDs.

Simply click on the Aurora Cannabis Page button of your chosen broker and we’ll take you straight to their stock trading page.

| Broker | Features | Rating | Official Site |

|---|---|---|---|

|

|

Min Deposit: $10-1000 (depends on country) Regulation: CYSEC, FCA

|

96 |

|

|

|

Min Deposit: $100 Regulation: FCA, ASIC, CySEC

|

95 |

|

|

|

Min Deposit: $100 Regulation: CBI, ASIC, FSC, FSA, FSB

|

94 |

|