Introduction

Gold has been deemed to be valuable for a very, very long time now.

You have encountered or maybe purchased gold products and are already aware of its prices.

And not only that…

It has been a widely-accepted concept in the world of financial markets that gold, the commodity, is being considered as a safe haven for traders when the other markets encounter bouts of extreme volatility.

With those statements, there are several ways to be able to profit from gold’s value.

That makes you interested now, don’t you think?

Then better read the rest of the article for you to also be able to profit from gold’s global value.

Generally…

Commodities are basically the raw materials that are being bought and sold in the marketplace. These materials are then being processed to create further end-products which are then distributed to consumers.

Since there is a constant demand for the finished goods and the raw materials (in this case, gold) in consumer-driven societies, then the price of the commodities tend to continuously fluctuate in the market as well.

This volatility is caused by the changing dynamics of supply and demand.

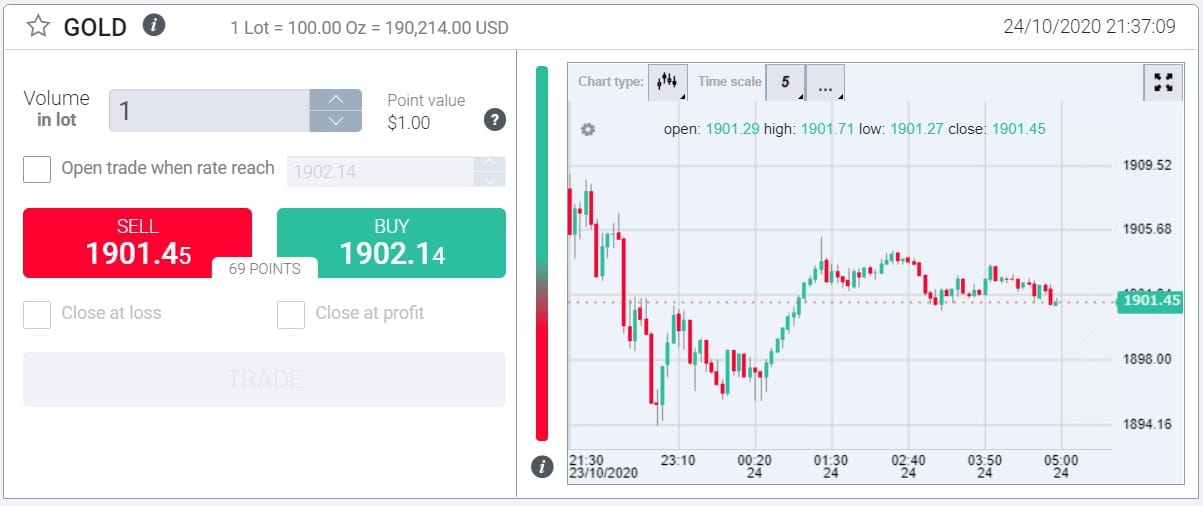

Via this updated graph, you can see how the gold market has been performing:

History has taught us that men and societies have valued gold throughout time.

Before the adoption of paper currency as we know today, coins made up of this metal were the primary means of exchange.

Because this commodity is being highly regarded by many, then this behavior provides more than enough activity and liquidity in the gold market.

Thus…

Gold traders are being provided their fair share of profit opportunities – notwithstanding whatever the general trend of the market maybe.

Fact is:

Gold traders could participate in this market by buying and selling either spot or futures contracts.

Spot contracts are those whose prices reflect the current market price of gold; whereas the price of a futures contract is the price that the buyer is willing to pay for the contract with a delivery date that is set in the future.

But do also note that:

The price of the futures contract is not an assurance that gold’s market price will be able to match that once the agreed-upon date has been reached.

Futures contracts are used as hedges instead (as tools to manage risk) or outlets for speculation.

Gold CFDs

CFDs or contracts for differences are derivatives. These derivatives are financial products as well, but whose prices are derived from the prices of their underlying assets (for example: price of gold).

CFD entails a procedure where the settlement between the opening and closing trade prices would be settled in cash.

A CFD is a transaction to exchange the difference in valuation between the price of the contract when it was opened and its price once it was closed.

Unlike in similar processes like stock trading wherein there’s a transfer of shares, or in some commodity transactions where there’s a transfer of physical goods; there’s nothing similar to that when trading CFDs, thus making the process quicker and more efficient.

In addition to that:

CFDs not only allow gold traders to speculate on the future price of gold, but also to diversify their gold exposure as well; hence CFDs enable them to manage their risk by hedging.

Why does this matter?

This matters because we are presenting information that you may find to be beneficial.

And if you’re still reading this part, then we could tell that you’ve digested that information and are looking for more.

Without any further ado…

We present InvestMarkets, a leading broker for CFDs and forex.

You might as well go ahead and see our full review here or even create an account with them right now for you to be able to explore their platform this instant.

What is InvestMarkets?

One of the industry leaders, InvestMarkets started out back in 2010 and their edge over their fellow providers is in the fact that they are continuously striving to provide you a solution that is custom-fit specifically for your trading needs.

This broker is regulated by the International Financial Services Commission of Belize with a license number of 000307/19.

It all boils down to this:

As it is regulated by a governing body, it is rest assured that InvestMarkets follows the most stringent of rules to provide you a service offered with integrity and fairness.

We will be now discussing the platform and its features in more detail.

So let’s begin!

Summary

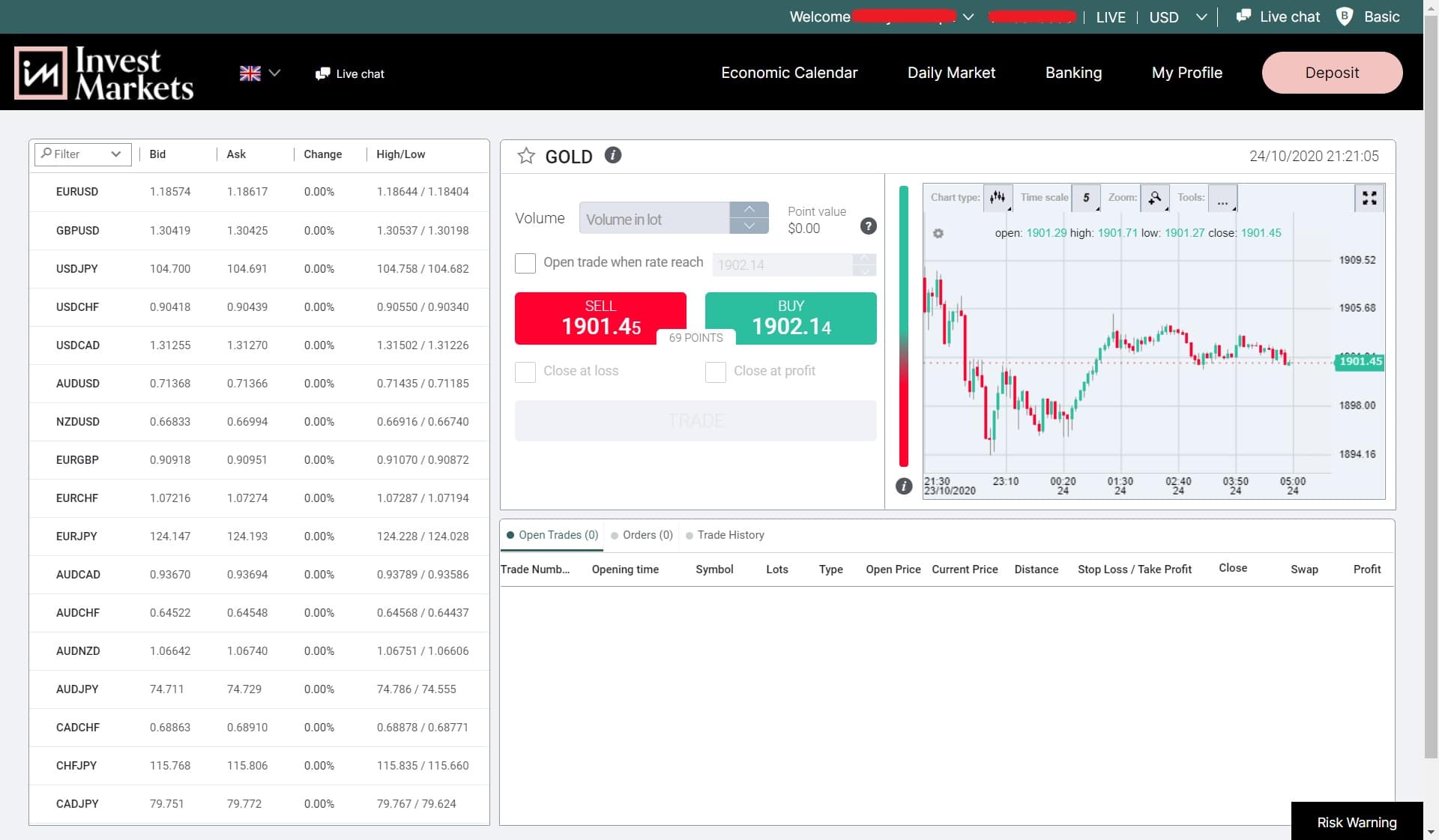

The platform of InvestMarkets features a layout whose design is direct, easy-to-navigate, and simple to use.

However…

The information that the platform holds is quite substantial.

It offers you solid data for you to execute on, but will not burden you with unnecessary complexities, thus allowing you to focus only on the important matters – such as analysis and trade execution.

The whole process – from creation of account, depositing of funds, and the subsequent withdrawal of funds – is quite simple to do.

Unlike other brokers, this platform does not offer the option of creating an account (or logging in) with your Facebook or Google account.

That could have its advantages if you’d look at it in the security perspective as that ensures that your trading account has its own log in credentials and not connected with your social media credentials which may also used for entertainment purposes.

The design layout of the platform could be termed as that of minimalist-like.

- Most information which pertains to your account (such as: verification center, account details, and change password option) is located on the top menu.

- The list of tradable financial instruments that could be found in the InvestMarkets platform is located on the left side. You may search for gold using the search bar, or look for the name (or other names) under their specific categories (i.e. gold could be found under commodity).

- The trading execution screen is located on the right side, and it has the biggest area in the platform’s layout. Once you have selected the asset of your choice (i.e. gold), the trading screen (main/right pane) will change to show the trading information pertaining to that asset.

Pros and Cons

Pros

- Minimalist and easy-to-navigate platform

- Education center covering a wide array of topics

- Can easily access gold instrument on platform

- Low floating bid-ask spreads

- Risk-management tools

Cons

- Price charts not on platform main page

- Restrictions on a few countries

Let’s first talk about the pros:

InvestMarkets puts an emphasis on education, as it ensures that you, as a client, are provided the necessary educational materials to properly guide you on how to make informed trading decisions before even risking your money in the financial markets.

There are different lessons being offered on a wide array of topics:

- Technical analysis – analyzing the past price movements in order to have a grasp of how human behaviour is like on certain price levels/characteristics.

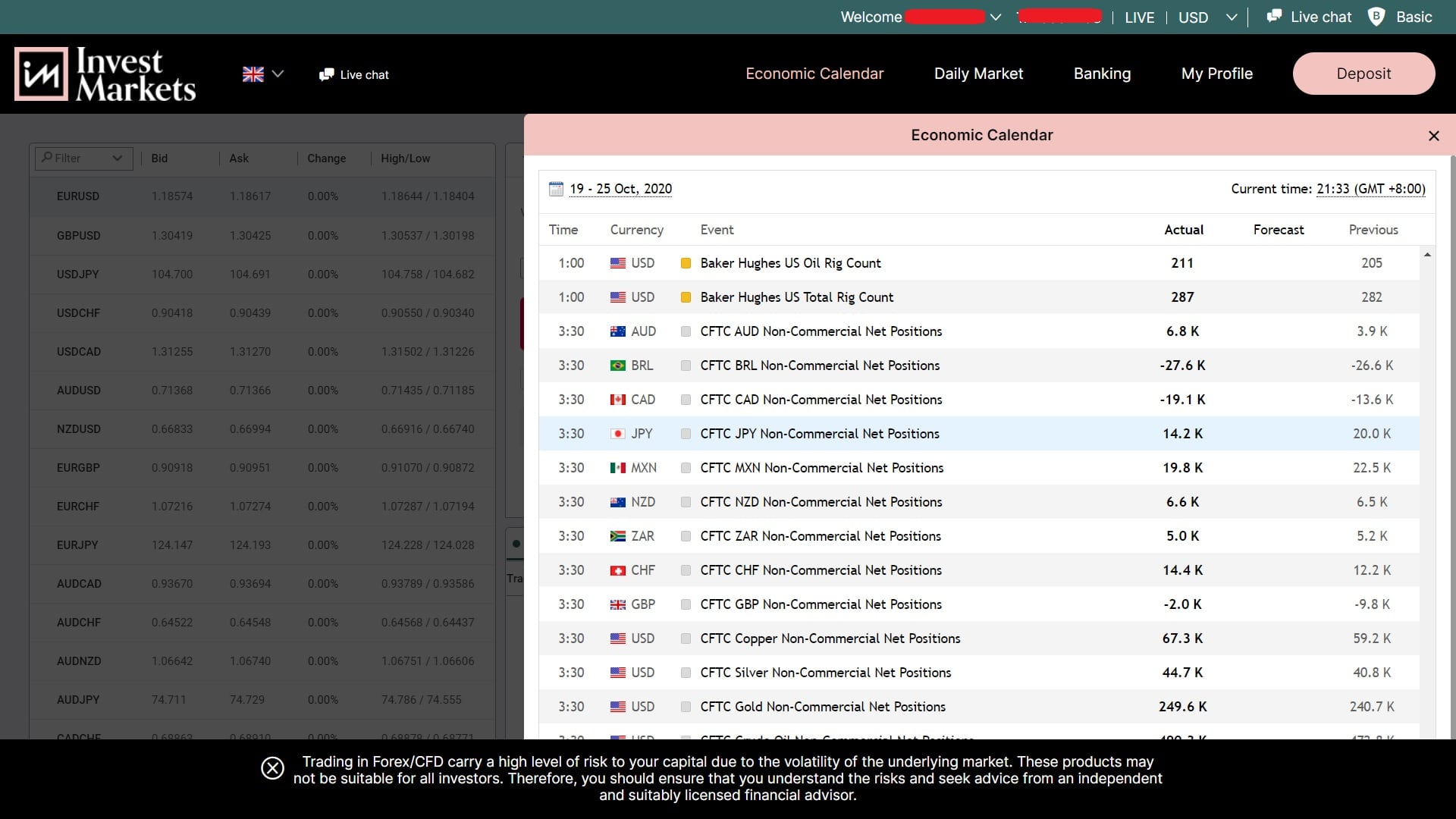

- Fundamental analysis – analyzing macro-economic information or events in order to have an idea how the supply and demand dynamics change on macroeconomic news or announcements.

- Trading psychology – How to handle your emotions and how to properly handle the constant information stream when you do the analysis.

- Videos – They provide tutorial videos on different trading topics, aside from the usual text-based tutorials. There’s a good chance that you will learn better watching videos than reading text-based tutorials.

- They also provide scheduled webinars.

InvestMarkets also provides you one of the lowest floating bid-ask spreads in the industry.

This is for you (and your account) to not be greatly affected by slippages when the volatility of the markets increases by a notch or two – which they are known to do every now and then.

Lastly…

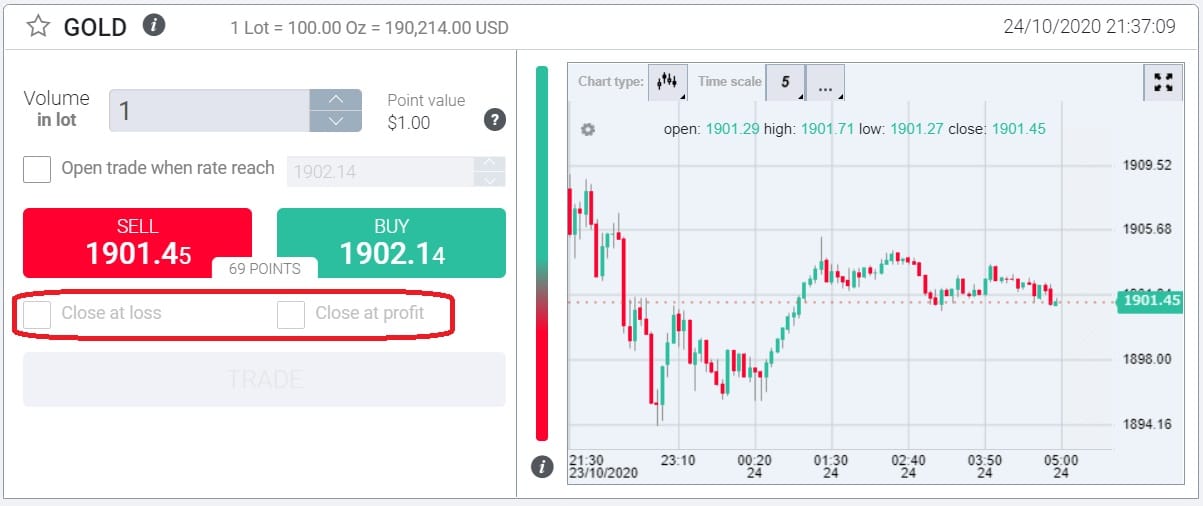

The platform also provides risk-management tools such as stop-loss orders and take-profit orders:

- Stop-loss orders will be triggered to close your open position in order to cut your losses should the price action did not go according to your initial plan.

- Take-profit orders will be triggered to close your open position in order if your trade is a certain percentage in the green (or profitable).

This ensures that you will be able to monetize your gains.

Now let’s talk about the cons:

The price charts are not being featured automatically on the main page of the platform.

Although you could access the charts by clicking another icon, this added step might cause a delay and might put you into a disadvantage if you are a technical analyst who uses the real-time information provided in the charts to make your informed trading decisions.

Moreover…

There are certain regional restrictions that limit InvestMarkets from offering their services to. These area restrictions include (but are not limited to) USA and Canada.

Education

The platform offers several tutorial videos to help you better in making informed trading decisions.

There are also text-based tutorials on topics ranging from technical analysis, fundamental analysis, trading psychology, etc.

And that’s not all…

There’s even an interactive e-book!

How to trade gold CFDs using InvestMarkets

InvestMarkets has all the essentials in its minimalist design.

Kindly do not forget to perform the necessary analysis before executing your gold trades (or any asset for that matter).

Select Gold from the list found on the left pane. And then on the main pane, you have to fill in:

- Volume of your order. The point value (per lot) is also displayed there.

- If you prefer a market order, click the Buy or Sell icon.

- If you prefer a limit order, click the Open trade when rate reach checkbox. Then put in the value that needs to be triggered to open your trade. Then click the buy or sell icon.

- Place the stop loss order.

- Place the take profit order.

|

Interested to Trade InvestMarkets?The best part? InvestMarkets has a platform that will immediately offer you an edge over your competition. It is a matter of using the tools that the platform has provided; and making informed trading decisions based on your studies and analysis. Let us not waste another second of your time! Register immediately and take advantage of the price movements in the global commodities market. Kindly do note that it is very important to manage your risk at all times.

|