Introduction or Skip Content and Read the Bottom Line!

MTrading is a global forex and CFD broker that is based in Belize. They are regulated by the Belize International Financial Services Commission (IFSC) under the company ServiceCom Ltd.

| Founded | 2013 |

| Platform | MetaTrader 4, MT4 Supreme Edition, MetaTrader 4 WebTrader |

| Minimum account size | $100 |

| Minimum lot size | 0.01 |

| Tradable assets | 77 |

| Maximum margin | 1:1000 |

| Spread on EUR/USD | 2 pips |

| Payment methods | Local Banks, Credit Cards, Neteller |

| Demo account | Yes |

| Accepts Malaysian traders | Yes |

| Regulated | IFSC (Belize) |

| Support | Phone, E-mail, Live Chat |

| Website | www.mtrading.com |

Platforms 8.8/10

Like other brokers they also use MetaTrader 4 which has a downloadable version for trading forex and CFDs, an MT4 Supreme Edition which have additional plugins and a MetaTrader 4 WebTrader which is the web-based version for those who would like to trade using a web browser.

This earns a Platform score of 8/10.

Design 8/10

In terms of platform design, it was okay but improvements can be done to make it more interesting to use. Some optimization is also needed to make it faster and for this we are giving them a Design score of 4/10.

MTrading MT4 platform

Minimum Deposit 8/10

To be able to trade with this broker, you need to make an initial deposit of $100 on your account. This however is a little higher than the standard requirement in the market which is why they get a Minimum Deposit score of 8/10.

Minimum Lot Size 10/10

The allowed minimum lot size is 0.01 lowers down the risks. This earns a Minimum Trade Score of 10/10.

Tradable Assets 8.2/10

The have around 70+ assets comprising of currencies, spot metal CFDs, spot energy CFDs, spot index CFDs and stock CFDs. The choices are not that much though which is the they get a Tradable assets score of 8.2/10.

MTrading tradable assets

Spreads 8/10

MTrading offers fixed spreads from 2 pips on standard accounts and market spreads from 0 pips on pro accounts. The EUR/USD currency pair for example has a spread of 2 pips which is not that low since this is a major currency pair. This is the reason why we are giving MTrading a Spreads score of 8/10.

Withdrawal Time 9/10

Withdrawals get processed in just around 60 minutes during working hours. There were some instances however that it took a bit longer. Overall, it’s still fast so we are giving MTrading a Withdrawal Time score of 9/10.

Payment Methods 9/10

The supported payment methods for transferring funds include local banks, credit cards and Neteller. Though these are the common banking systems, it would have been better if they added more options. For this reason, they get a Deposit and Withdrawal Methods score of 9/10.

MTrading supported payment methods

Customer Support 7.5/10

Their customer service team is reachable via phone, email and live chat but are not available during weekends. Although their agents were able to provide the answers that we need, it took around 10 minutes before we were able to talk to one of their agents. This deserves a Support score of 7.5/10.

MTrading customer support

Quotes Accuracy 8/10

We’ve experienced a few re-quotes in some of our trades with this broker particularly when there were noticeable movements in the financial markets. It is the reason why we are giving them a Quotes Accuracy Score of 8/10.

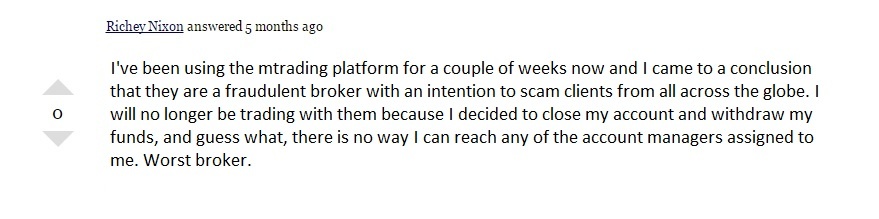

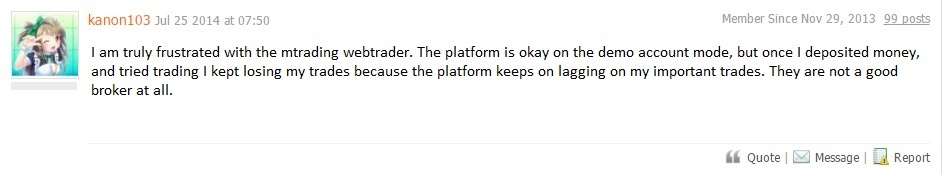

Credibility 7.4/10

MTrading has only been in the business for a few years but other than this concern that they are new, they don’t seem to have a reputation in the market based on the number of user comments that I’ve seen online. They do cater to Malaysian clients but there were only a few good comments that we’ve found. This is an indication that their credibility is not yet established which is why they are getting a Reputation score of 7.4/10.

MTrading client review

MTrading client review

MTrading client review

|

Conclusion 8/10

MTrading offers a set of state-of-the-art platforms but to be honest the conditions are not optimal for my trading needs. In most of the key factors that were weighed in, they were usually on the average side and if you’re a trader who’s looking for a broker that would surpass your expectations, it would be wise not considering them on your list. We highly recommend that you sign-up with a much a more stable and reliable brand like eToro as an alternative so you can continue with your trading activities.

|

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here https://etoro.tw/3PI44nZ

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.