- You can join the trend With sector indices, you can capitalize on popular stock market trading trends.

- Trading with one instrument Rather than cherry-picking for particular stocks, you will be able to spread out the potential profits or losses via a single instrument.

- More opportunities You’ll be able to invest on basket of shares for a particular sector by trading on these unique indices.

- US Biotech Giants (BUBIOG) The biggest 30 US biotechnology shares including Biogen, BioMarin Pharmaceutical, AbbVie and more.

- Lithium & Battery (BALITG) The 15 lithium and battery companies that are listed in North America such as Neo Lithium, Royal Nickel, Energy Fuels, FMC Corporation and more.

- China Internet Giants (BCINTG) The 30 leading internet companies in China such as Alibaba, Baidu, 500.com, Fanhua and more.

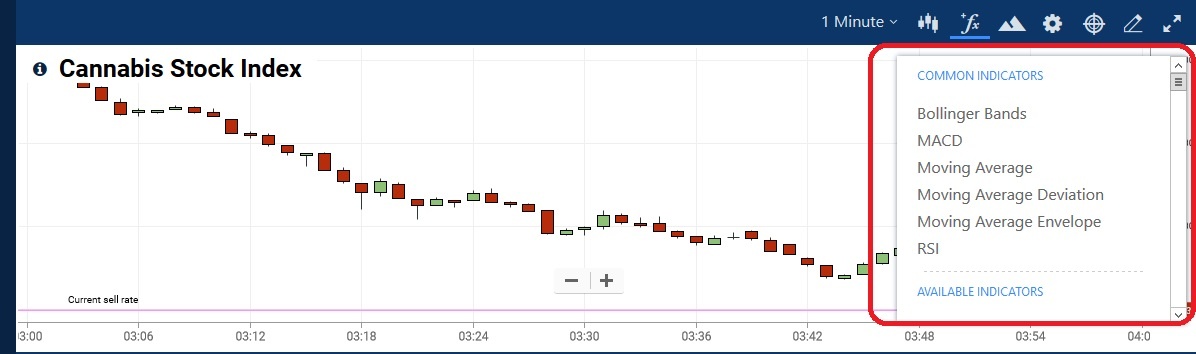

- Cannabis Stock (BGCANG) The 20 largest publicly listed companies in the world including Canopy Growth, Tilray, GW Pharmaceuticals, Cronos Group and more.

- NYSE FANG+ (FNG) The 10 next-generation technology companies like Facebook, Apple, Amazon, Netflix and more.

- Cybersecurity Giants (BUSCYG) [New] The 25 largest US publicly listed cybersecurity companies including Palo Alto Networks, Symantec, Forrtinet, Qualys and more.

- Gaming & E-sports Giants (BGAMGE) [New] The 20 leading gaming and E-sports companies such as NetEase, Weibo, NVIDIA, QUALCOMM and more.

- Company vs industry When we say “shares”, it represents the price of a stock based on the performance of the company. Among the most popular shares CFD are Facebook, Apple, Nintendo and Coca-Cola. A stock index on the other hand is the benchmark of a selected group of stock market shares. That means you’re it’s a number of companies rather than just one. These stock indices however have 2 groups:

- Specialised indices This tracks the performance of particular sectors and industries in the market.

- Regional/country-based indices This is comprised of large companies that are listed on a country’s stock exchanges. Examples include Germany 30, US-TECH 100, UK 100 and China A50.

- Maximum leverage ratio If you’re going to trade index CFDs at Plus500, the maximum leverage available is 1:30.

Why Plus500?

Listed on the London Stock Exchange’s main market for listed companies on the UK FTSE 250 and authorized and regulated by the Israel Securities Authority, Plus500 has offices throughout the globe.

Through their constant endeavors, they have managed to secure the top position in CFDs trading and offer not just sector indices but over 2000 instruments of other indices, forex, commodities and shares to trade.

What makes them stand out of the crowd is the many advanced features with new and innovative financial instruments together with their dedicated customer support team, who are rated as one of the best.

That’s not all…

In addition, they offer a free demo account with virtual money where you can explore the markets until you are comfortable with the trading platform before you invest your own money.

Exploring the markets

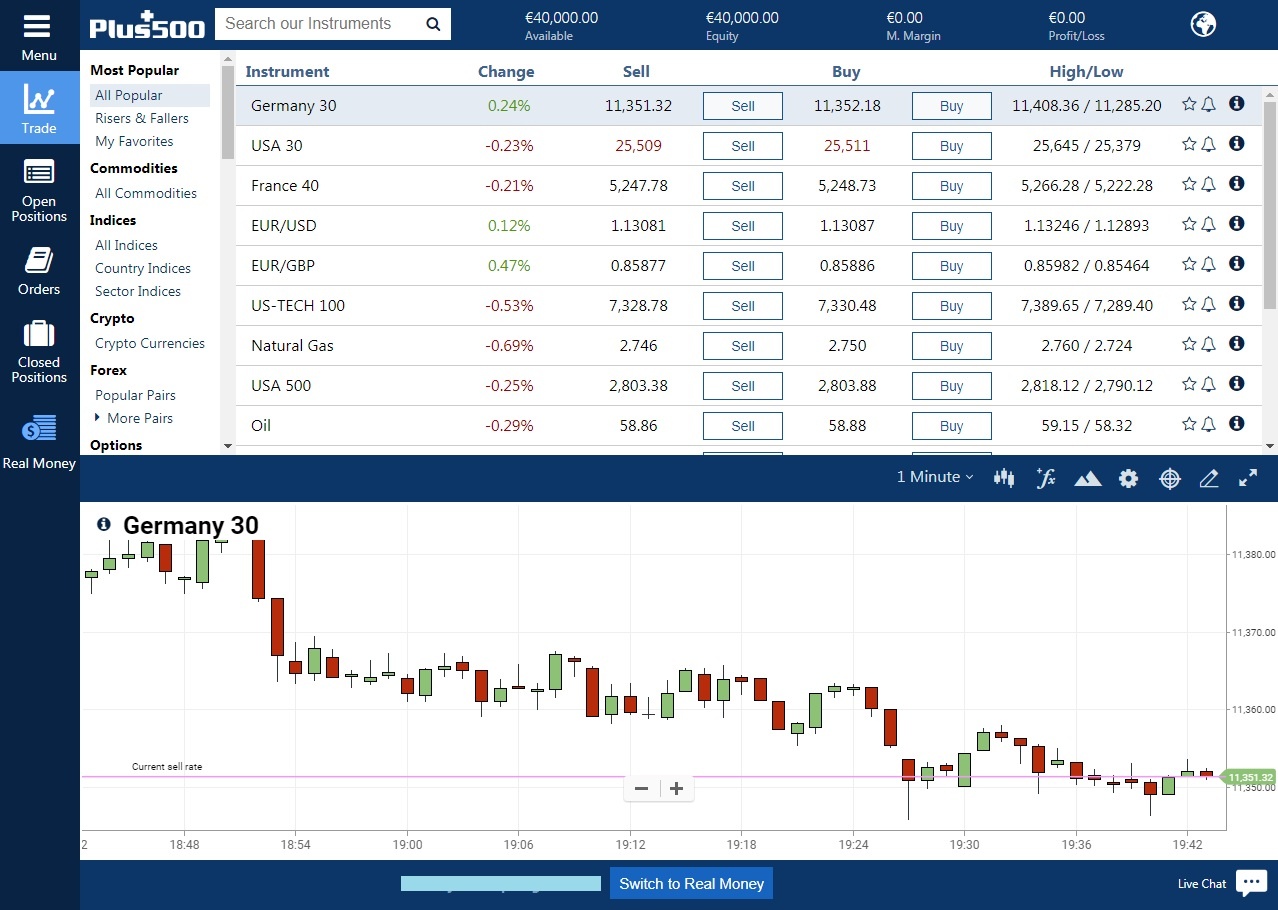

On the platform, you can search the instruments easily by name by most popular, forex, indices, shares, commodities and risers & fallers, all are free live time quotes.

Here’s the deal…

Get great perks like:

• No commissions

• Fast order execution

• Leverage of up to 1:30

• Very competitive spread rates

Bottom line?

Plus500’s sector indices is an interesting financial instrument to trade. So what are you waiting for? Trade now!

Get started with Plus500!

84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money