You’ve probably seen those risk warnings regarding CFD trading. But how risky is it really and is there a way to avoid or at least lessen it?

Obviously, you need to be aware of what those risks are to make sure you understand them completely.

1. Overusing leverage

With CFDs, you get access to a lot of leverage, which means you only need a small amount of money in order to control a much larger position.

In fact sometimes, $500 will control a hundred thousand dollar worth of an index or a currency pair that is extremely high leverage. If you’re trading share on CFD, you might get access to 20 times leverage.

So you need 5% margin upfront. Still, that is unbelievably high leverage and you don’t need to use that all. The number one risk of trading CFDs is the access to the huge amount of leverage that you can actually trade with.

2. Short-selling without a stop

Now, as you could probably imagine, stocks can rise indefinitely. You just have to have a look at Berkshire Hathaway shares to see that they’re currently at sit like over $100,000 maybe even $200,000

Look: Some stocks can continue going up and up and up.

Now, if you’re short selling, it means you’re trying to make money as the market falls in value. If your position keeps going against you, you’re on the wrong side and you’re losing money.

If you do this without a stop and you get complacent and you let it slip, you can wipe out your account.

You can wipe out more than your account and wipe out everything. So short selling without a stop is a huge risk for poor traders everywhere.

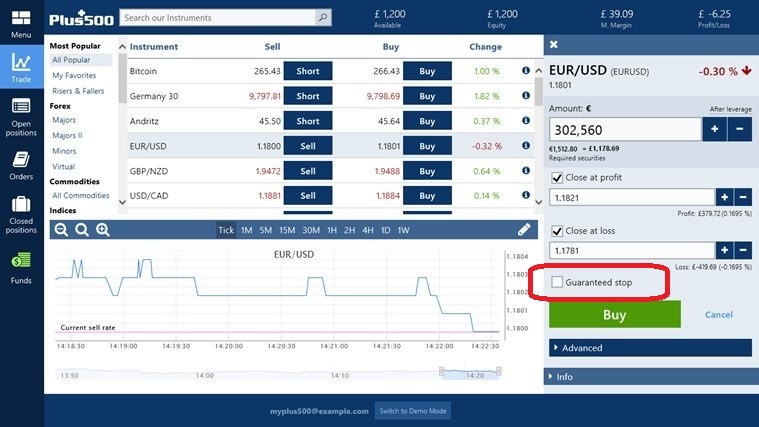

CFD service Plus500 features a Guaranteed Stop Order which will force the position to close at your desired price even if the market price surpasses it.

So once the underlying asset reaches your stated level, the position will then automatically close.

Plus500 Guaranteed Stop feature

3. Trading without a trading plan

It actually doesn’t matter what business you’re in. If you buy McDonald’s restaurant, if you start your own business, lawn-mowing or you run a bookstore or coffee shop.

You need to have a business plan and trading is no different. It is a profession and people take it very seriously.

In fact, what’s basically happening is that you’re betting against those other people out in the marketplace.

They’re professionals and their job is to try and take the money off you. So it’s better that you should have a business plan, a fully back-tested one, when it comes to trading.

Here’s the deal:

You want to know your entries, your exits, your risk management and all the strategies that it takes to build a profitable trading business. So make sure you go in with a trading plan.

4. Counterparty risk

Counterparty risk is a real issue. Over the last couple of years, there have been a couple of brokers that have gone bust just like MF Global’s case which took around two years for people to get their money back.

Here’s a fact:

Sometimes, you don’t get all your money back and sometimes, you get a hundred percent of it back. For brokerages that have definitely gone bust, this means that your money is tied up and it can be for several years if you choose an unstable or regulated brand.

So what’s the best action to take?

Inquire about your CFD broker a lot more and see what their financial position is. Try to get access to their financial statements and read plenty of online reviews about that broker especially when it comes to withdrawing funds just to make sure that it’s done in a fast and efficient manner.

But counterparty risk is definitely a concern among traders. One strategy that a lot of professional traders have done is that they’ve started to spread their capital base across several CFD brokers.

That’s something you might want to consider so you don’t have all your capital tied up with one CFD broker.

If you’re looking for established brokerages, be sure to checkout these brands that we have reviewed and sign-up with any of them:

• Plus500

• eToro

• Pepperstone

• AvaTrade

• XM

5. Trading against the trend

Now the fifth risk of trading is actually a trading risk that’s relative on any sort of market. You see when it comes to trading any financial product, if you trade against a trend, it’s very, very difficult to make money.

Remember:

Trends are very persistent and they can keep going for a lot longer than you have money in your account especially when you start using leverage. That is a real big concern.

If you trade against the trend, it’s not inevitable but there’s a high likelihood that you’ll actually lose large chunks of your money or significant amounts to actually wipe you out.

84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money