The COVID-19 pandemic has brought about many changes in how people live their lives. That behavioural change has also resulted in a shift in the business landscape.

As a result…

Different sectors of many economies were (and are still being) hit hard by the pandemic and the resulting change in spending behaviour of the collective, as people were instructed to stay inside their homes to mitigate the spread of the virus.

Industries such as tourism, hotels, airlines, etc. are still reeling from the effects of the events that happened this year.

However…

Since people tend to adapt to how things are, some industries also have benefited from the fact that people are encouraged to stay home.

Industries, such as technology providers and communications companies are among those who are likely to benefit from the concept of remote interaction, as businesses still need to continue – even with lesser human contact.

One of those that have generated increased interest is the online trading industry.

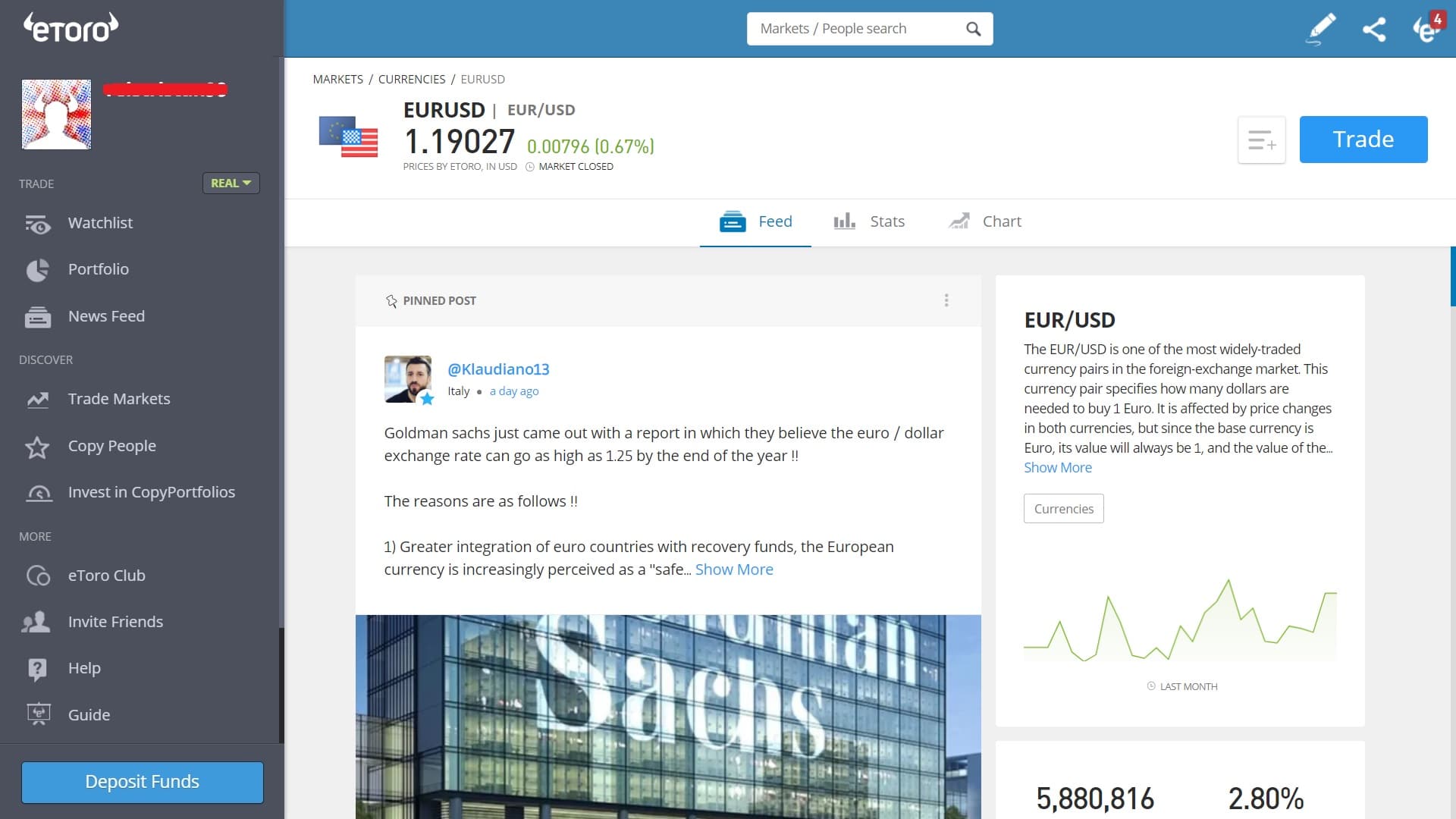

The financial markets (foreign exchange trading, commodities and equities markets, etc.) – since trading is mostly done online – could still thrive in this evolving economy.

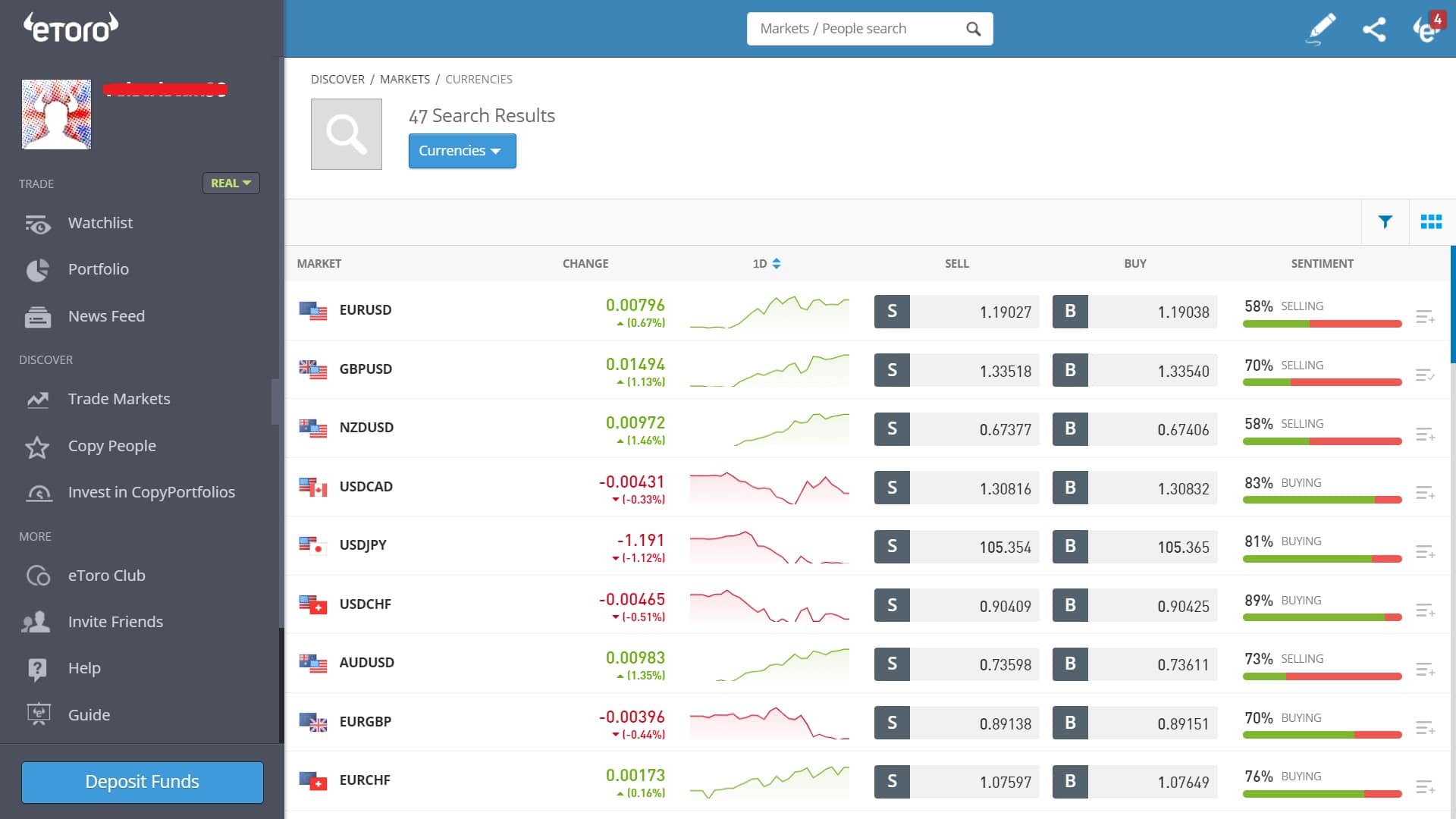

eToro, an online brokerage firm, has also adapted to this increased interest in the online space.

In fact…

It is already one of the leaders in this industry, and although they may not offer the lowest spreads in the market, they have now made the spreads for 10 major currency pairs even more competitive from what they were offering before.

How can traders benefit from this?

This will make the costs of trading the Forex market more affordable for their clients.

An example of the changes in the spread shows that the spread of USD/JPY pair has been lowered to 1 pip.

What are the advantages of lowering spreads?

Lowering the spreads tend to provide traders a competitive advantage over others.

This causes less slippage in their transactions as market participants are likely to look for the best possible prices to buy and sell currency pairs.

And when there is a sudden increase in volatility, or a sudden absence of liquidity, lower spreads enable market participants to find better prices to buy or sell their pairs – than those participants who are dealing with larger bid-ask spreads.

Better prices mean:

- more avenues for profits and;

- lesser avenues for losses

eToro’s change comes in three aspects:

The FIRST is the reduction of their spreads. They have scaled down the spreads of the top ten actively-traded currency pairs on eToro.

Please do note:

The new spreads that will be mentioned below are the expected and typical spreads, and will tend to fluctuate from time to time, hence may widen accordingly.

The changes are as follows:

The EUR/USD pair from a previous spread of 3 pips now has an expected and typical spread of 1 pip. USD/JPY from a spread of 2 pips now has a new spread of 1 pip; GBP/USD from 4 pips to 2 pips; USD/CHF from 3 to 1.5; NZD/USD from 5 to 2.5; USD/CAD from a previous spread of 3 pips now has an expected and typical spread of 1.5 pips; EUR/GBP from 4 to 1.5; EUR/JPY was reduced from 4 to 2; GBP/JPY from 6 pips to 3 pips; and AUD/JPY from 5 to 2 pips.

A SECOND aspect is the concept of variable spreads.

eToro has deemed that the case of allowing more flexibility to the structure of their bid-ask spreads will further add to the competitive advantage of their clients.

Why is it so?

These variable spreads will change in congruence with the change in volatility of the market conditions, thus market participants having variable spreads will be in a position to better take advantage of market volatility.

With this concept however, a reminder that the pip spreads may be wider than the values mentioned above when the markets are in a state of heightened volatility, but still more competitive than the other providers.

Finally, the THIRD aspect is that they introduced the pipette.

How can you actually use this?

The pipette is now the smallest decimal point for the listed price of a forex instrument in eToro.

This offers a more accurate depiction of the prices in the forex market.

Here’s the deal:

With the different sectors of the economy still in a state of flux, and the end result of this current state that the world is in is still uncertain, people have to adapt.

The previous consumer spending habits have already changed and nobody knows if this is temporary or permanent.

But one thing is certain…

Right now, people have to be comfortable with staying at home and learning to make profits from home.

And one way to generate profits is by trading the financial markets, specifically, the forex market.

And eToro, an industry leader, provides its clients with this advantage over other market participants, with these lowered spreads.

So, what are you waiting for?

Take advantage of that by opening an account with eToro now, and make them your partner in building your wealth.

It is important to manage your risk at all times.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto investments are risky and highly volatile. Tax may apply. Understand the risks here https://etoro.tw/3PI44nZ

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.