Savvy traders today know the importance of how a company’s quarterly earnings reports affect stock trading and use it as part of their trading strategy, it can be a great opportunity for traders.

Earnings reports, can affect the company’s stock, with better than expected figures sending the stock value up it shows that the company is on the right path and will provide investors with a solid return.

Lower than expected figures decreases the company’s value and can be an indication that there might be potential trouble ahead.

Analysts take a variety of data into account before the release of the company’s earnings reports:

Looking at the past performance of a company’s stock is not a guarantee on the future results of the actual earnings.

Stock prices of a company can fluctuate prior to the publication time of their earnings report driving the shares up or down depending on prior estimates by analysts.

Additional relevant data

When analysts forecast market predictions they take into account a number of factors with the company’s quarterly earnings report being the main factor.

A company’s earnings in relation to its market cap, earnings per share (EPS) is also a deciding factor. Other relevant data such as an increase in new subscriber numbers, budget allocated for new content as in the case of Netflix, all are taken into account.

Then, there is also Boeing, who has reported lower earnings since the tragic downing of their 737 Max 8 planes that left hundreds dead, all can affect the price of their shares and is relevant prior to the release of the earnings report.

Another factor to take into consideration that is likely to affect possible price changes, is when the report is expected, before or after the markets open or close.

The quarterly earnings reports from public listed companies kick off in April. The quarterly earnings season spans several weeks when U.S. Public traded companies report their quarterly earnings, which includes quarterly earnings, net income, sales numbers, earnings per share and more.

The first quarter January to February, 2nd quarter April to May, 3rd quarter July to August and the 4th quarter October to November. Public traded companies report their quarterly earnings, which includes quarterly earnings, net income, sales numbers, earnings per share and more.

During the next 6 weeks first quarterly results for Q1, 2019 will be released providing insights on how the company is performing.

Big Banks

The earnings season kicks off with big banks, with the two largest banks JP Morgan Chase and Wells Fargo due to release their reports.

2018 closed with positive results from the financial sector with the majority of banks showing an impressive performance.

Looking at past performance

Hitting new record highs, JPMorgan Chase closed 2018 with a steady total net revenue increase of 4% year after year for the last quarter and its annual net profit. (Even though their investment banking business saw a decline in revenues and profits).

In spite of multiple scandals for Wells Fargo in 2018, they posted solid gains and beat predictions from analysts even though their profits declined compared to 2017 Q4 results.

Bank of America, Goldman Sachs and Citigroup will also be sharing their earnings. Q4 earnings in 2018 for Bank of America saw their stocks jump 7% while Goldman Sachs beat analyst’s predictions with impressive results, saw their stock jump over 9%. Citigroup saw their stock jump 4%, after last time around posting weaker than expected results.

How can you actually use this?

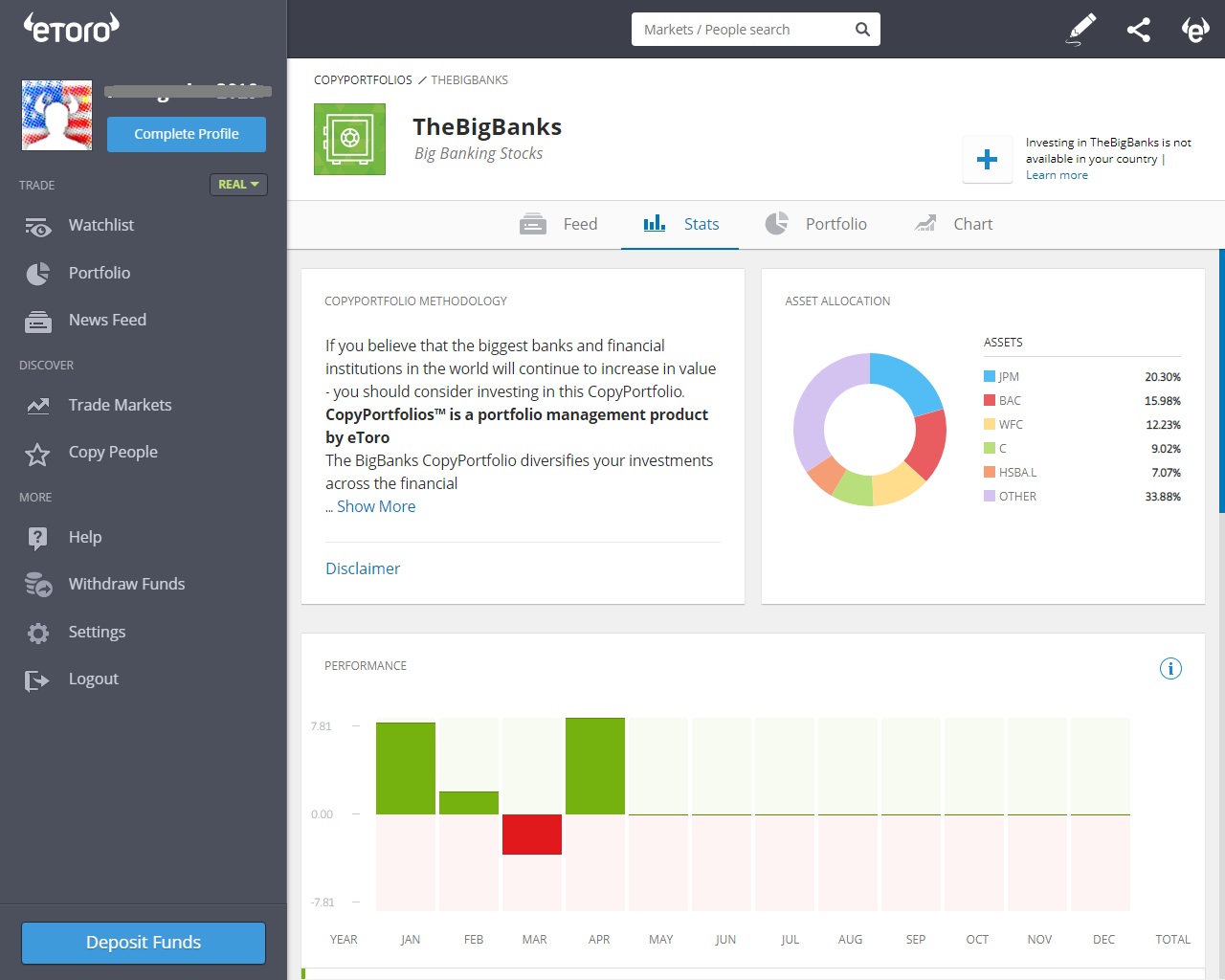

eToro offers investors and traders TheBigBanks CopyPortfolio so that they can plan and prepare for earnings seasons. This gives them an insight of what can be expected to happen to the stocks they are tracking.

The portfolio is comprised of the leading banks and financial institutions and to optimize performance is rebalanced periodically by the eToro Investment Committee.

Investors can track the markets and stay updated on recent and upcoming earnings reports with the eToro Earnings Reports Calendar.

Expectations

Analyst’s expectations, provide the trader with relevant information on how the stocks of the company is expected to perform. So when the earnings season begins there are expectations among traders on how the company will deliver overall.

The calendar is user-friendly

The earnings calendar has a listing of upcoming scheduled earnings reports that are due to be released by publicly traded companies.

Best of all…

Listed by market cap, it contains the financial instrument, sector and expected release date, it also details when the report is expected i.e. before market open or after closing.

Here’s a snapshot:

Predictions by analysts

Now, analysts are predicting that this earnings season may be tough for companies after a bull run on Wall Street which has run throughout the first quarter of 2019.

The consensus among most of the analysts is that there will be disappointing figures among the major companies with the financial sector seeing disappointing results.

Markets will also be watching the performance of ‘bellwethers’, companies like Apple and Microsoft, which is an indication of the health of the stock market and business activity in general.

Bottom line?

eToro the leading social network and investment broker offers traders over 1,500 different assets to choose from, which includes ETFs, stocks, commodities, fiat currencies, 13 cryptocurrencies and more.

That’s not all…

eToro’s platform is unique, using the ‘CopyTrader’ feature you can interact and mimic another top trader’s portfolio. The platform comes with advanced trading tools, but this does not mean you have to be a pro, it is especially user-friendly for beginners.

In addition, to which their education program encompasses everything you need to know about trading, from leverage, short-selling and more advanced trading strategies. Once you feel comfortable you are able to practice your knowledge without spending a dime of your own money, on their unlimited free demo account.

We can’t emphasize enough…

The release of this new quarter earnings reports, which will impact markets especially the banking sector, you can watch the upcoming scheduled earnings reports on eToro Earnings Reports Calendar.

Bottom line?Stay tuned on the latest developments so that you can plan and keep track for the earnings season on TheBigBanks CopyPortfolio.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto investments are risky and highly volatile. Tax may apply. Understand the risks here https://etoro.tw/3PI44nZ

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.