Even experienced traders can make silly mistakes when they’re trading. So what are these so-called “mistakes” that we’re talking about?

Here’s the list so you can avoid them in the future:

1. Emotional Trading

Also called impulsive trading, it is a kind of trading where you keep chasing a trade.

You know what these trades are and you keep on watching it. Then it goes away and you keep on chasing it and jumping on at a higher price.

This is the habit of chasing the market unnecessarily. In fact, you could just be jumping into a trade for the sake of it whether it’s for excitement or simply over-trading.

Trading too large in a position could also be detrimental to your results because doing so involves a lot of emotion.

Showing an impulsive attitude towards your trade executions will actually give you more setbacks than benefits so try to avoid it if you can.

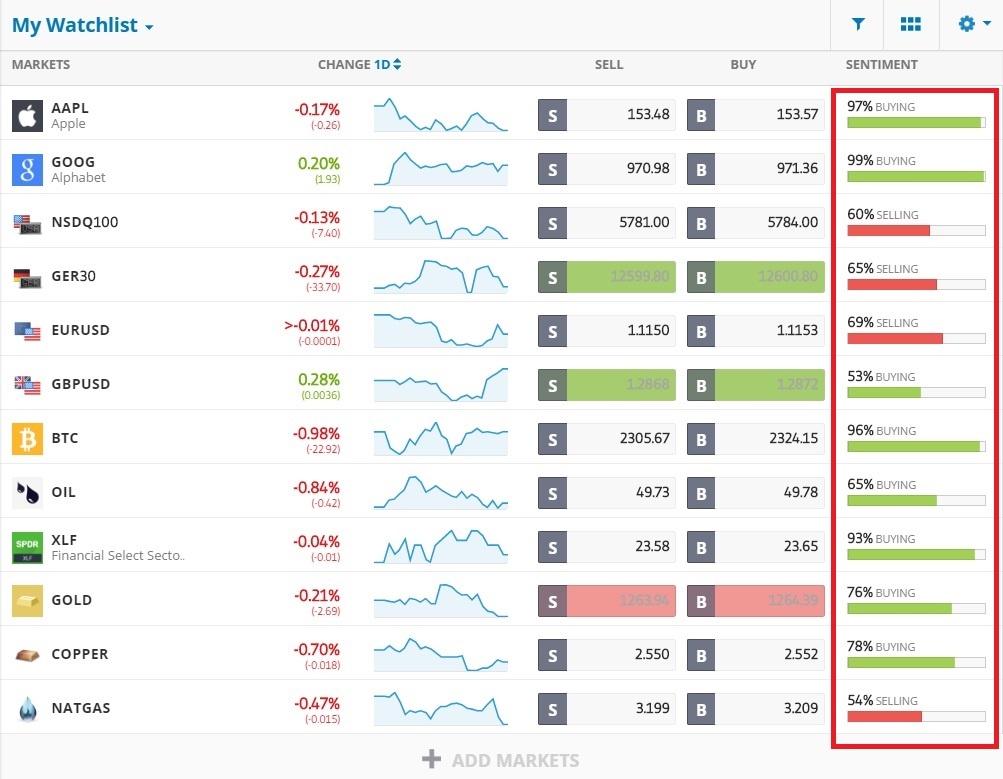

This feature shows the real-time sentiments of traders and the percentage of users who are either buying or selling.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. Buy or Sell

Hitting the Buy and Sell buttons incorrectly is a very common mistake for most traders. With CFDs, you can buy or sell very easily and there’s no distinction with the buy or sell.

You can go short or long, depending on which button you push and it is very common for some traders to execute a short position instead of exiting it and somehow ended up selling more.

Fact:

Most people have been trained to “buy” something to get in, and to “sell” something to get out.

So when they go to get out of their short position, they sell but instead of getting out, they end up pushing the button for the double quantity.

A simple habit to develop is that whenever you place a trade, go and check what that trade did and that way, you’ll never get caught by this silly mistake.

If you can pick it up quickly, it doesn’t cost a lot of money but if you forget about it, it can be disastrous.

3. Forgotten Orders

Oops! In a similar light, there are also times that you might forget to cancel an order.

So here, you’ve placed an order to exit the position but you forgot that stop-loss that you had sitting on the market. The stop-loss is still an active order!

And let’s say you bought the stock and you sold it at the market and you have push the sell button instead of stop-loss.

What can happen as the market can come down, hit your stop and then rebound from that stop level and hit higher.

This could happen anytime between closing your trading platform and the next time you open it. And it if does, the results could be disastrous.

So again, make sure that before you close your platform each day, recheck the open orders so you can be sure that the orders you have are the orders that you want in the market.

4. Pushing the Wrong Digits

Another little but huge mistake is that you can end up pushing the wrong digits or too many zeros.

Let’s say you that you decided to buy 10 contracts and accidentally added one more zero thus ending up with 100 contracts instead.

Another scenario is entering an 8 instead of 9.

Bottom line?

All of these can make a significant difference in your trading.

And we can’t emphasize enough…

When you place an order, develop the habit to check that the order has been placed and what you actually did was what you wanted to do.

By overcoming these simple mistakes, you can significantly improve the results of your trades.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto investments are risky and highly volatile. Tax may apply. Understand the risks here https://etoro.tw/3PI44nZ

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.